05 Version of Ifta Missouri Form

What is the 05 Version Of Ifta Missouri Form

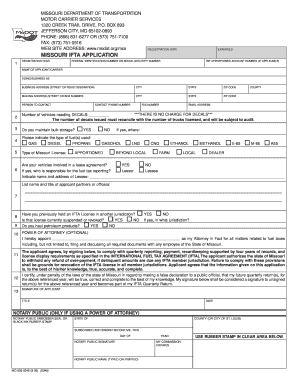

The 05 version of IFTA Missouri form is a crucial document used by motor carriers for reporting fuel usage and miles traveled in various jurisdictions. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel taxes for carriers operating in multiple states. By using this form, carriers can ensure compliance with state regulations and accurately calculate their fuel tax obligations.

How to use the 05 Version Of Ifta Missouri Form

To effectively use the 05 version of IFTA Missouri form, a carrier must gather all necessary data regarding fuel purchases and mileage traveled in each jurisdiction. This includes tracking fuel receipts and maintaining accurate mileage logs. Once the data is compiled, the carrier can fill out the form, detailing fuel consumption and distance traveled in each state. After completing the form, it must be submitted to the appropriate state agency for processing.

Steps to complete the 05 Version Of Ifta Missouri Form

Completing the 05 version of IFTA Missouri form involves several key steps:

- Collect all fuel purchase receipts and mileage records for the reporting period.

- Fill in the carrier's information, including name, address, and IFTA account number.

- Report the total miles traveled and fuel consumed in each jurisdiction.

- Calculate the total tax due based on the reported fuel usage and applicable rates.

- Review the form for accuracy and completeness before submission.

Legal use of the 05 Version Of Ifta Missouri Form

The legal use of the 05 version of IFTA Missouri form is essential for compliance with tax regulations. Carriers must ensure that all information provided is accurate and truthful to avoid penalties. The form serves as an official record of fuel consumption and mileage, which may be subject to audits by state authorities. Proper completion and submission of this form help maintain good standing with regulatory agencies.

Filing Deadlines / Important Dates

Filing deadlines for the 05 version of IFTA Missouri form are typically set quarterly. Carriers must submit their reports by the last day of the month following the end of each quarter. Important dates to remember include:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31

Form Submission Methods (Online / Mail / In-Person)

The 05 version of IFTA Missouri form can be submitted through various methods to accommodate different preferences. Carriers may choose to file online via the state’s tax portal, which offers a streamlined process. Alternatively, the form can be mailed to the designated state agency or submitted in person at local offices. Each method has its own advantages, and carriers should select the one that best fits their needs.

Quick guide on how to complete 05 version of ifta missouri form

Complete 05 Version Of Ifta Missouri Form effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 05 Version Of Ifta Missouri Form across any platform with airSlate SignNow Android or iOS applications and simplify any document-centered task today.

The simplest way to modify and eSign 05 Version Of Ifta Missouri Form without hassle

- Obtain 05 Version Of Ifta Missouri Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 05 Version Of Ifta Missouri Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 version of ifta missouri form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 05 Version Of Ifta Missouri Form?

The 05 Version Of Ifta Missouri Form is a specific document used for reporting International Fuel Tax Agreement (IFTA) fuel usage across different jurisdictions. It is essential for commercial vehicle operators to comply with state regulations and accurately report fuel tax liabilities.

-

How can airSlate SignNow help with the 05 Version Of Ifta Missouri Form?

AirSlate SignNow provides an easy-to-use platform that streamlines the signing and submission process for the 05 Version Of Ifta Missouri Form. Users can securely eSign the document, reducing processing times and improving efficiency for businesses.

-

Is there a cost associated with using airSlate SignNow for the 05 Version Of Ifta Missouri Form?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses seeking to manage documents such as the 05 Version Of Ifta Missouri Form. Pricing varies depending on features and number of users, ensuring a cost-effective solution for your organization.

-

What features does airSlate SignNow offer for managing the 05 Version Of Ifta Missouri Form?

AirSlate SignNow includes features like customizable templates, secure eSignatures, and real-time document tracking specifically for the 05 Version Of Ifta Missouri Form. These features enhance document management and help ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for the 05 Version Of Ifta Missouri Form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage documents, including the 05 Version Of Ifta Missouri Form. Connect it with your existing systems for a seamless workflow.

-

What are the benefits of using airSlate SignNow for the 05 Version Of Ifta Missouri Form?

Using airSlate SignNow for the 05 Version Of Ifta Missouri Form enhances your workflow with efficient eSigning, increased security, and reduced paper usage. These benefits translate into cost savings and faster processing times for your business.

-

Is it easy to use airSlate SignNow for the 05 Version Of Ifta Missouri Form?

Yes, airSlate SignNow is designed to be user-friendly, allowing anyone to navigate easily and complete the 05 Version Of Ifta Missouri Form without prior training. The intuitive interface provides a smooth experience, even for first-time users.

Get more for 05 Version Of Ifta Missouri Form

- City of punta gorda building department 22999831 form

- Site www pdffiller com 429841787 form

- Sh 900 1 fillable form 100086512

- Georgia form a certificate of postgraduate training

- Third party affidavit for insurance claim form

- Celebrity appearance agreement template form

- Celebrity endorsement agreement template form

- Celebrity confidentiality agreement template form

Find out other 05 Version Of Ifta Missouri Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors