Minnesota Tax Clearance Form

What is the income tax clearance certificate?

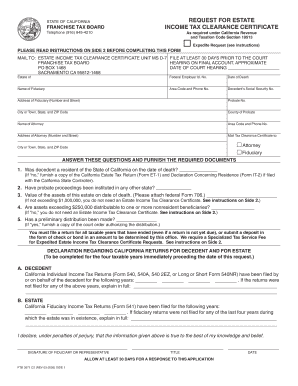

The income tax clearance certificate is an official document issued by the tax authority, indicating that an individual or business has fulfilled their tax obligations. This certificate serves as proof that all income taxes have been paid and that there are no outstanding liabilities. It is often required for various purposes, including loan applications, business transactions, and government contracts. In the United States, this document may be referred to differently depending on the state, but its primary function remains consistent across jurisdictions.

How to obtain the income tax clearance certificate

To obtain an income tax clearance certificate, individuals or businesses typically need to follow a specific process. This process may vary by state, but generally includes the following steps:

- Gather necessary documentation, such as tax returns, payment receipts, and identification.

- Contact the local tax authority or visit their website to find the application form for the certificate.

- Complete the application form, ensuring all required information is accurate.

- Submit the application along with any required documentation and fees, if applicable.

After submission, the tax authority will review the application and issue the certificate if all tax obligations are met.

Key elements of the income tax clearance certificate

The income tax clearance certificate contains several key elements that validate its authenticity and purpose. These elements typically include:

- The name and address of the taxpayer.

- The tax identification number (TIN) or Social Security number (SSN).

- The period for which the clearance is granted.

- A statement confirming that all taxes have been paid.

- The signature and seal of the issuing authority.

These details ensure that the certificate can be used effectively for its intended purposes, such as securing loans or completing business transactions.

Steps to complete the income tax clearance certificate

Completing the income tax clearance certificate involves several important steps to ensure accuracy and compliance. These steps generally include:

- Reviewing your tax records to confirm that all taxes have been filed and paid.

- Collecting any supporting documents that may be required by the tax authority.

- Filling out the application form accurately, paying close attention to details.

- Submitting the application through the appropriate channels, whether online, by mail, or in person.

Following these steps carefully can help streamline the process and reduce the likelihood of delays or issues.

Legal use of the income tax clearance certificate

The income tax clearance certificate is legally recognized and can be used in various situations where proof of tax compliance is required. Common legal uses include:

- Applying for loans or credit from financial institutions.

- Participating in government contracts or grants.

- Transferring ownership of property or business assets.

- Meeting regulatory requirements for certain licenses and permits.

Understanding the legal implications of this certificate can help individuals and businesses navigate their financial and operational responsibilities effectively.

Filing deadlines / Important dates

Filing deadlines for obtaining an income tax clearance certificate can vary by state and depend on specific circumstances. It is important to be aware of key dates, such as:

- The annual tax filing deadline, typically April 15 for individuals.

- State-specific deadlines for business tax filings.

- Deadlines related to specific applications requiring the certificate.

Staying informed about these deadlines can help ensure timely compliance and avoid potential penalties.

Quick guide on how to complete minnesota tax clearance

Effortlessly Prepare Minnesota Tax Clearance on Any Device

The management of online documents has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle Minnesota Tax Clearance on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Easily Modify and eSign Minnesota Tax Clearance

- Find Minnesota Tax Clearance and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that task.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Minnesota Tax Clearance and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota tax clearance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax clearance certificate?

An income tax clearance certificate is an official document issued by tax authorities confirming that an individual or business has paid all due income taxes. Having this certificate is essential for various financial transactions, including securing loans and participating in government tenders.

-

Why do I need an income tax clearance certificate?

You need an income tax clearance certificate to prove your tax compliance when applying for financial products or participating in government contracts. It assures stakeholders that you have settled all your income tax obligations, which can enhance your credibility and trustworthiness.

-

How can airSlate SignNow help me obtain an income tax clearance certificate?

airSlate SignNow streamlines the process of documenting your income tax compliance by allowing you to eSign and send necessary documents quickly. Our platform can help you gather required tax documents and ensure they are filed correctly, making it easier to obtain your income tax clearance certificate.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including templates for tax-related documents and secure eSigning capabilities. These features allow for efficient handling of documents required for your income tax clearance certificate, simplifying the overall process.

-

What is the pricing for using airSlate SignNow?

airSlate SignNow offers cost-effective pricing plans tailored to different business needs. Our plans are designed to provide excellent value, ensuring that you can manage your documents and obtain your income tax clearance certificate without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for tax management?

Yes, airSlate SignNow can be easily integrated with a variety of third-party tools that facilitate tax management. Integrating your income tax clearance certificate processes with other applications can enhance workflow efficiency and ensure compliance.

-

What benefits does airSlate SignNow offer when handling income tax clearance certificates?

With airSlate SignNow, you benefit from a user-friendly interface and a secure platform for handling your income tax clearance certificate documentation. Our service enhances productivity by reducing processing times and ensuring that your documents are compliant and easily accessible.

Get more for Minnesota Tax Clearance

- Hba form

- Djb new connection status form

- Riverside rehnonline com form

- Fdlic death claim form

- N9a response pack form

- Community based residential facility cbrf residents rights dhs wisconsin form

- Tmj health questionnaire dr joseph sarkissian d d s form

- Protected b when completed page of treaty annuit form

Find out other Minnesota Tax Clearance

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document