Sc 1120s Instructions Form

What is the SC 1120S Instructions?

The SC 1120S instructions provide guidance for South Carolina S corporations on how to complete and file their state tax returns. This form is specifically designed for S corporations, which are unique business entities that pass income, losses, deductions, and credits through to their shareholders for federal tax purposes. Understanding the SC 1120S instructions is crucial for ensuring compliance with state tax laws and for accurately reporting financial information to the South Carolina Department of Revenue.

Steps to Complete the SC 1120S Instructions

Completing the SC 1120S instructions involves several key steps. First, gather all necessary financial documents, including income statements, expense reports, and previous tax returns. Next, follow the instructions carefully, filling out each section of the form accurately. Pay special attention to the calculations for income, deductions, and credits, as these will affect the overall tax liability. After completing the form, review it for any errors or omissions, and ensure that all signatures are included before submission.

Legal Use of the SC 1120S Instructions

The SC 1120S instructions are legally binding documents that must be completed in accordance with South Carolina tax laws. To ensure legal compliance, it is important to adhere to the guidelines provided within the instructions. This includes maintaining accurate records, filing on time, and ensuring that all information reported is truthful and complete. Failure to comply with these legal requirements can result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the SC 1120S are critical for maintaining compliance with South Carolina tax regulations. Generally, the form must be filed on or before the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this typically means a due date of March 15. It is important to mark these dates on your calendar to avoid late filing penalties.

Required Documents

When preparing to file the SC 1120S, certain documents are required to ensure that the form is completed accurately. These documents typically include:

- Income statements and balance sheets for the tax year.

- Records of any deductions or credits claimed.

- Shareholder information, including their respective ownership percentages.

- Any previous year tax returns for reference.

Having these documents ready will streamline the filing process and help ensure compliance with state regulations.

Form Submission Methods

The SC 1120S can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for quicker processing times and immediate confirmation of receipt. For those choosing to mail the form, it is advisable to use certified mail to ensure that the submission is tracked and received by the tax authorities.

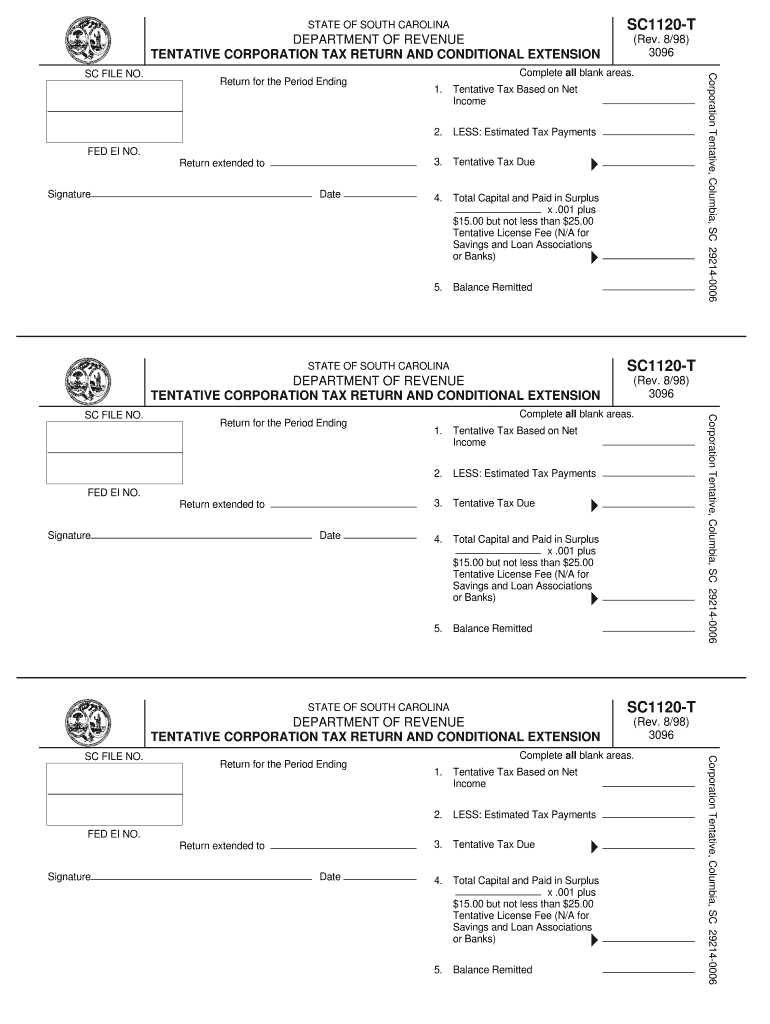

Quick guide on how to complete sc1120 ctd 3094

Prepare sc1120 ctd 3094 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage sc1120 instructions on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign south carolina 1120 instructions effortlessly

- Obtain sc 1120 instructions and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive details using tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign sc 1120 instructions 2017 and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to south carolina 1120 instructions

Create this form in 5 minutes!

How to create an eSignature for the sc 1120 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask sc1120 ctd 3094

-

What are the South Carolina 1120 instructions for filing taxes?

The South Carolina 1120 instructions provide detailed guidance for corporations on how to file their income tax returns. These instructions include essential information on eligibility, forms needed, and filing deadlines to ensure compliance with state regulations.

-

How can airSlate SignNow help with South Carolina 1120 instructions?

airSlate SignNow offers a streamlined solution that allows businesses to easily send, sign, and manage the necessary documents related to South Carolina 1120 instructions. Our platform simplifies the process of handling tax documents by providing a user-friendly interface and secure eSignature capabilities.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as document templates, automated reminders, and secure storage, all of which are beneficial when dealing with South Carolina 1120 instructions. These tools help ensure that important tax documents are completed accurately and filed on time.

-

How much does airSlate SignNow cost for businesses needing South Carolina 1120 instructions?

airSlate SignNow provides various pricing plans to accommodate different business needs. Each plan is designed to be cost-effective, offering features that cater to managing documentation, including those pertaining to South Carolina 1120 instructions.

-

Are there any integrations available to facilitate the handling of South Carolina 1120 instructions?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software tools, simplifying the handling of South Carolina 1120 instructions. These integrations help ensure that all relevant data is accurately captured and transferred, enhancing the overall efficiency of your tax filing process.

-

Can I customize documents related to South Carolina 1120 instructions in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their documents, including forms related to South Carolina 1120 instructions, ensuring that all necessary information is included and tailored to meet specific needs. This flexibility helps streamline the documentation process for tax filings.

-

Is airSlate SignNow secure for eSigning documents related to South Carolina 1120 instructions?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption methods to protect your documents and eSignatures, including those tied to South Carolina 1120 instructions. Our platform also complies with industry standards, giving you peace of mind when handling sensitive tax-related documents.

Get more for sc1120 t

- Approval field trip form

- Home equity notice concerning extensions of credit home equity notice concerning extensions of credit ig libertyonline form

- Application hoa form

- Pre application conference request form clackamas county clackamas

- Indiana declaration form

- Petition to seal records of nolle prosequi dismissals and acic form

- Sample of how to fill out the automobile proof of loss form

- Bill of lading application guideline target intermodal form

Find out other sc 1120s instructions

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now