Nycers Org Forms 266 2011

What is the Nycers Org Forms 266?

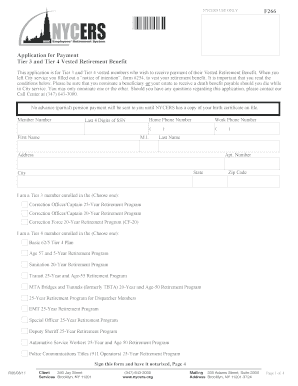

The Nycers Org Forms 266 is a crucial document used by members of the New York City Employees' Retirement System (NYCERS) to apply for retirement benefits. This form is essential for individuals seeking to initiate their retirement process and ensures that the necessary information is collected to facilitate the calculation and distribution of benefits. The form typically requires personal details, employment history, and beneficiary information, making it vital for accurate processing.

How to use the Nycers Org Forms 266

Using the Nycers Org Forms 266 involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation, including proof of employment and identification. Next, fill out the form completely, ensuring that all sections are addressed. It is important to review the form for accuracy before submission, as errors can lead to delays in processing. Once completed, the form can be submitted through the designated channels, whether online or via mail.

Steps to complete the Nycers Org Forms 266

Completing the Nycers Org Forms 266 requires careful attention to detail. Follow these steps:

- Gather required documents, including your employment history and identification.

- Fill out personal information accurately, including your name, address, and Social Security number.

- Provide details about your employment, including the dates of service and job titles.

- Designate beneficiaries by including their names and contact information.

- Review the form for any errors or omissions before submission.

- Submit the completed form as directed, either online or by mailing it to the appropriate office.

Legal use of the Nycers Org Forms 266

The Nycers Org Forms 266 is legally binding when properly completed and submitted. It adheres to the regulations set forth by the NYCERS, ensuring that the information provided is used solely for the purpose of processing retirement benefits. It is important to understand that providing false information on this form can lead to penalties, including denial of benefits or legal repercussions. Therefore, accuracy and honesty are paramount when filling out the form.

Key elements of the Nycers Org Forms 266

The Nycers Org Forms 266 includes several key elements that are essential for processing retirement benefits. These elements typically include:

- Personal Information: Name, address, and Social Security number.

- Employment History: Detailed information about your employment with NYC, including dates and positions held.

- Beneficiary Designation: Names and contact information for individuals designated to receive benefits.

- Signature: A signature is required to validate the form and confirm the accuracy of the information provided.

Form Submission Methods

The Nycers Org Forms 266 can be submitted through various methods to accommodate different preferences. The primary submission methods include:

- Online Submission: Users can complete and submit the form digitally through the NYCERS online portal, which offers a streamlined process.

- Mail Submission: The completed form can be printed and sent via postal mail to the designated NYCERS office.

- In-Person Submission: Individuals may also choose to submit the form in person at a NYCERS office for assistance and immediate confirmation.

Quick guide on how to complete nycers org forms 266

Effortlessly Prepare Nycers Org Forms 266 on Any Device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Nycers Org Forms 266 across all platforms with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and Electronically Sign Nycers Org Forms 266 with Ease

- Find Nycers Org Forms 266 and click Get Form to initiate.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form hunting, or the need to print new copies due to errors. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nycers Org Forms 266 while ensuring exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nycers org forms 266

Create this form in 5 minutes!

How to create an eSignature for the nycers org forms 266

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 266 266a and how is it used?

Form 266 266a is a crucial document utilized in various business processes. It allows users to efficiently collect and manage signatures for important transactions. With airSlate SignNow, you can easily prepare and send this form digitally, streamlining the signing process.

-

How does airSlate SignNow simplify the signing of form 266 266a?

airSlate SignNow simplifies the signing of form 266 266a by providing an intuitive platform for document creation and electronic signatures. Users can easily upload the form, add necessary fields, and send it out for signatures in just a few clicks. This reduces the time spent on paperwork signNowly.

-

What are the pricing options for using airSlate SignNow to manage form 266 266a?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Users can choose from subscription options that fit their needs while managing documents like form 266 266a. Each plan includes features designed to enhance document workflow and eSigning capabilities.

-

Can I integrate other tools with airSlate SignNow to handle form 266 266a?

Yes, airSlate SignNow provides seamless integrations with various applications including CRM systems and cloud storage services. This allows you to manage form 266 266a workflows more efficiently by connecting it with your existing tools, enhancing productivity.

-

What are the security measures in place for form 266 266a on airSlate SignNow?

airSlate SignNow prioritizes security with robust measures to protect sensitive documents like form 266 266a. These include data encryption, secure servers, and compliance with industry standards. This ensures that your documents are safe during storage and transmission.

-

Are there templates available for form 266 266a on airSlate SignNow?

Yes, airSlate SignNow offers a variety of templates including pre-made designs for form 266 266a. This feature helps users get started quickly and ensures that the forms meet industry standards. You can customize these templates to suit your specific business needs.

-

What benefits does airSlate SignNow provide for businesses using form 266 266a?

By using airSlate SignNow for form 266 266a, businesses can enjoy faster turnaround times and improved efficiency in document processing. The ability to track document status and send reminders contributes to enhanced workflow. Additionally, it promotes a greener approach by reducing paper usage.

Get more for Nycers Org Forms 266

- Eureka math lesson 19 homework answers form

- City of oviedo permitting form

- Noaa form 42 28 rev 05 07 corporateservices noaa

- Tmj screening questionnaire form tmjsq patient information

- Or rtg 41 oregon form

- Bccsb early in special education preschool program parent eipp ccs k12 nc form

- Dani johnson gems form

- Sisseton wahpeton oyate enrollment form

Find out other Nycers Org Forms 266

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online