Maryland Deed of Trust Form

What is the Maryland Deed of Trust

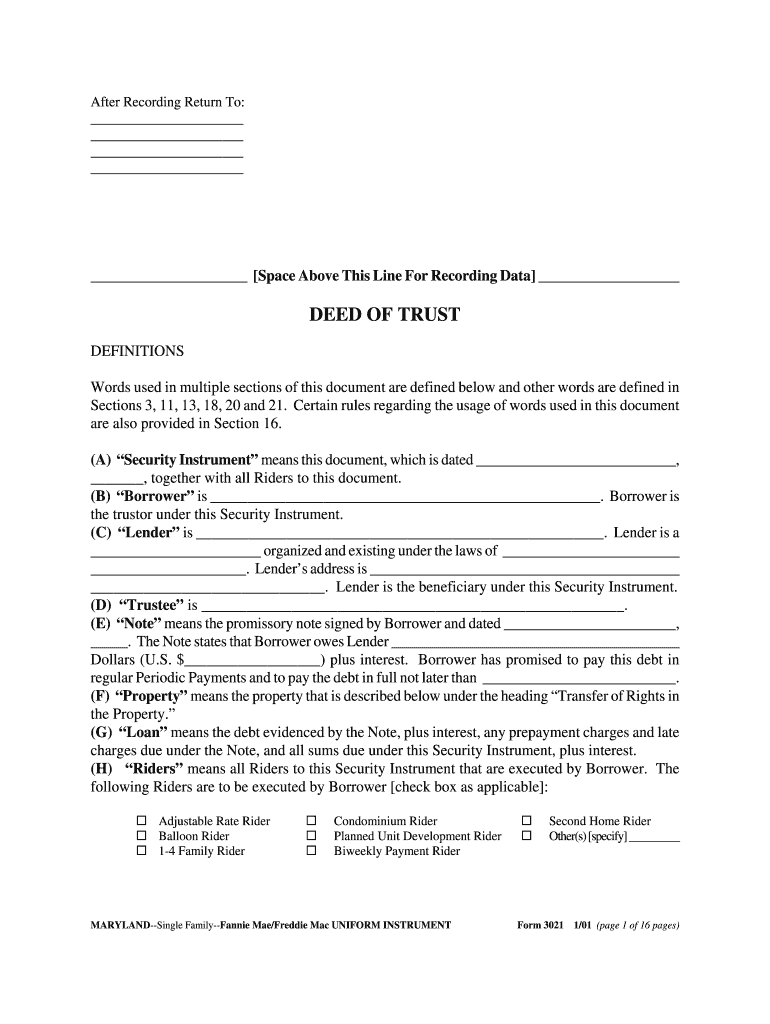

The Maryland deed of trust is a legal document used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property to the trustee, who holds it as security for the loan until it is paid off. This document outlines the terms of the loan and the rights of each party. In Maryland, the deed of trust serves a similar purpose to a mortgage but offers some unique advantages, such as the ability to expedite foreclosure processes if necessary.

Key elements of the Maryland Deed of Trust

A Maryland deed of trust typically includes several critical components:

- Parties Involved: Identification of the borrower, lender, and trustee.

- Property Description: A detailed description of the property being secured.

- Loan Amount: The total amount of the loan being secured by the deed of trust.

- Terms of the Loan: Interest rates, payment schedules, and any other relevant terms.

- Default Provisions: Conditions under which the lender can initiate foreclosure.

Steps to complete the Maryland Deed of Trust

Completing a Maryland deed of trust involves several essential steps:

- Gather necessary information about the property, borrower, and lender.

- Draft the deed of trust, ensuring all required elements are included.

- Have all parties review and agree to the terms outlined in the document.

- Sign the deed of trust in the presence of a notary public.

- Record the deed of trust with the local land records office to ensure public notice.

How to obtain the Maryland Deed of Trust

Obtaining a Maryland deed of trust can be done through various means. Many legal forms are available online, including templates that can be customized to fit specific needs. Additionally, legal professionals can assist in drafting a deed of trust to ensure compliance with Maryland laws. It is essential to ensure that the form used is up-to-date and meets all legal requirements.

Legal use of the Maryland Deed of Trust

The Maryland deed of trust is legally binding when executed correctly. It must comply with state laws, including proper notarization and recording. This document is used primarily in real estate transactions, allowing lenders to secure their interests in the property. Understanding the legal implications of this document is crucial for all parties involved to avoid potential disputes or issues in the future.

State-specific rules for the Maryland Deed of Trust

Maryland has specific regulations governing the use of deeds of trust. For instance, the deed must be recorded within a certain timeframe to be enforceable against third parties. Additionally, Maryland law outlines the foreclosure process for deeds of trust, which differs from traditional mortgages. Familiarity with these state-specific rules is vital for anyone involved in real estate transactions within Maryland.

Quick guide on how to complete maryland credit line deed of trust form

Effortlessly Prepare Maryland Deed Of Trust on Any Device

Managing documents online has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Maryland Deed Of Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Modify and Electronically Sign Maryland Deed Of Trust with Ease

- Obtain Maryland Deed Of Trust and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select pertinent sections of the documents or redact sensitive data with the tools that airSlate SignNow offers specifically for that function.

- Generate your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your adjustments.

- Choose how you wish to distribute your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Maryland Deed Of Trust to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Does the IRS require unused sheets of a form to be submitted? Can I just leave out the section of a form whose lines are not filled out?

This is what a schedule C I submitted earlier looks like :http://onemoredime.com/wp-conten... So I did not submit page 2 of the schedule C - all the lines on page 2 (33 through 48) were blank.

-

How long after you purchase a home and rent it out can you take a line of credit out on it to purchase another property?

It normally takes 2 years of proven rental income (shown on your tax returns) before you can count that income towards the purchase of another property. To borrow against any equity you have in a property (cash out refinance, line of credit etc.) you would need to have at least 20% equity available (loan to value ratio of under 80% but preferably lower). How long you’ve had the property isn’t as important as how much equity you have available if you are trying to borrow against it and you’re ability to pay back the loan or credit. Each lending institution has their own ways of dealing with risk and you’d have to shop around to get a concrete number.

Create this form in 5 minutes!

How to create an eSignature for the maryland credit line deed of trust form

How to generate an electronic signature for your Maryland Credit Line Deed Of Trust Form in the online mode

How to create an eSignature for your Maryland Credit Line Deed Of Trust Form in Chrome

How to generate an electronic signature for signing the Maryland Credit Line Deed Of Trust Form in Gmail

How to make an electronic signature for the Maryland Credit Line Deed Of Trust Form straight from your smart phone

How to create an eSignature for the Maryland Credit Line Deed Of Trust Form on iOS devices

How to generate an electronic signature for the Maryland Credit Line Deed Of Trust Form on Android OS

People also ask

-

What is a deed of trust and how is it used?

A deed of trust is a legal document that secures a loan by transferring the property title to a trustee until the loan obligation is fulfilled. It's commonly used in real estate transactions to ensure that the lender has a claim against the property in case of default. airSlate SignNow simplifies the process of creating and eSigning a deed of trust, making it easier for both lenders and borrowers.

-

How does airSlate SignNow ensure the security of my deed of trust?

AirSlate SignNow prioritizes the security of your documents, including deeds of trust, with industry-standard encryption and secure cloud storage. Our platform features authentication methods to ensure that only authorized parties can access and sign the document. You can confidently manage your deed of trust knowing that your information is well protected.

-

What are the pricing options for using airSlate SignNow for a deed of trust?

AirSlate SignNow offers several pricing tiers to cater to different business needs, including options for single users and teams. You will find that our pricing is cost-effective, allowing businesses to manage documents like a deed of trust without breaking the bank. For detailed pricing, visit our website to find a plan that suits your requirements.

-

Can I customize my deed of trust using airSlate SignNow?

Yes, airSlate SignNow allows users to customize their deed of trust templates to fit specific transaction requirements. You can add fields for signatures, dates, and any other pertinent information directly within the platform. This feature ensures that your deed of trust meets all legal and transactional needs seamlessly.

-

What are the benefits of using airSlate SignNow for a deed of trust?

Using airSlate SignNow for a deed of trust offers numerous benefits, including improved efficiency, reduced turnaround time, and enhanced collaboration between parties. The digital signing process streamlines the entire workflow, making it simple to manage multiple documents. Additionally, you can track the status of your deed of trust in real time.

-

Does airSlate SignNow integrate with other software for managing a deed of trust?

Absolutely! AirSlate SignNow integrates with a variety of popular software, including CRM and document management systems, to facilitate efficient handling of a deed of trust. By connecting these tools, you can enhance your workflow and ensure that your documents are in sync across platforms. Explore our integrations to see how we can fit into your existing ecosystem.

-

How long does it take to complete a deed of trust using airSlate SignNow?

Completing a deed of trust using airSlate SignNow can be done in minutes, thanks to our user-friendly interface that streamlines the eSigning process. Once all parties have signed, the completed document is instantly available for download or further distribution. This efficiency allows you to move quickly in securing your real estate transactions.

Get more for Maryland Deed Of Trust

- Z103 form

- Massdot aeronautics aircraft registration form

- Form 4311 industrial security approval

- Hot tub addendum rental agreement form

- City of raleigh change of contractor form

- Use this form for personal injuries or other non injury

- Council asphalt work record city of townsville eplanning townsville qld gov form

- Whs induction checklist form

Find out other Maryland Deed Of Trust

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA