Form 1001

What is the Form 1001

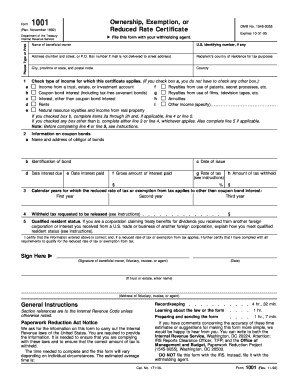

The Form 1001 is an important document used primarily for tax purposes in the United States. It is often referred to as the IRS Form 1001 and is utilized by individuals and businesses to report certain types of income. This form is essential for ensuring compliance with federal tax regulations and is particularly relevant for foreign individuals and entities claiming a reduced rate of withholding tax on income received from U.S. sources.

How to use the Form 1001

Using the Form 1001 involves several key steps. First, you must gather all necessary information regarding your income and the applicable tax treaty benefits. Next, fill out the form accurately, ensuring that all details align with your tax situation. Once completed, submit the form to the appropriate withholding agent or financial institution to ensure that the correct withholding tax rate is applied to your income. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Form 1001

Completing the Form 1001 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Indicate your residency status and the specific income type you are reporting.

- Provide information on any applicable tax treaties that may reduce your withholding tax rate.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form 1001

The legal use of the Form 1001 is governed by IRS regulations. It serves as a declaration that you are eligible for reduced withholding tax rates based on tax treaties between the U.S. and your country of residence. To ensure the form's validity, it must be filled out correctly and submitted on time. Any discrepancies or inaccuracies may lead to penalties or increased withholding tax rates.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1001 can vary depending on the type of income and the specific circumstances of the taxpayer. Generally, it is advisable to submit the form before the payment is made to ensure that the correct withholding tax rate is applied. Be aware of any specific deadlines related to your income type, as late submissions may result in higher withholding taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 1001 can be submitted through various methods, depending on the requirements of the withholding agent. Common submission methods include:

- Online submission via secure portals provided by financial institutions.

- Mailing the completed form to the appropriate address specified by the withholding agent.

- In-person submission at designated offices or financial institutions.

Quick guide on how to complete form 1001

Effortlessly Prepare Form 1001 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form 1001 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign Form 1001 with Ease

- Obtain Form 1001 and click Get Form to initiate.

- Utilize the tools available to fill out your form.

- Mark important sections of your documents or hide sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1001 to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1001 and why is it important for businesses?

Form 1001 is a crucial document for efficiently collecting necessary tax information from clients and vendors. Using airSlate SignNow to manage form 1001 ensures compliance and helps streamline your document handling process, saving time and reducing errors.

-

How can I electronically sign form 1001 using airSlate SignNow?

You can easily eSign form 1001 with airSlate SignNow by uploading your document to our platform and following the user-friendly prompts. Our solution allows for fast and secure electronic signatures, ensuring your form 1001 is signed and filed quickly.

-

Is there a cost associated with using airSlate SignNow for form 1001?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Depending on your requirements, you can choose a plan that allows you to manage form 1001 and other documents without breaking your budget.

-

What features does airSlate SignNow offer for managing form 1001?

airSlate SignNow provides a range of features for form 1001, including document templates, automation options, and audit trails. These features not only enhance productivity but also guarantee that your form 1001 is handled securely and efficiently.

-

Can I integrate airSlate SignNow with other tools to manage form 1001?

Absolutely! airSlate SignNow offers integrations with various business applications, allowing you to streamline your workflow involving form 1001. By connecting with tools like CRM and invoicing software, you can simplify document management further.

-

What are the benefits of using airSlate SignNow for form 1001 in my business?

By utilizing airSlate SignNow for form 1001, businesses can enhance their operational efficiency and reduce turnaround times. The platform provides a secure and legally binding way to manage signatures, ensuring that your form 1001 processes are both accurate and compliant.

-

Can multiple users access form 1001 through airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 1001 seamlessly. This feature enhances teamwork by facilitating real-time access and editing, ensuring everyone involved can contribute to the document efficiently.

Get more for Form 1001

Find out other Form 1001

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form