Keystone Bank Agric Loan Form

What is the Keystone Bank Agric Loan

The Keystone Bank Agric Loan is a financial product designed specifically for individuals and businesses involved in agricultural activities. This loan aims to support farmers and agribusinesses by providing them with the necessary funds to enhance productivity, invest in equipment, and expand their operations. The loan can cover various agricultural needs, including purchasing seeds, fertilizers, and livestock, as well as funding infrastructure improvements.

How to use the Keystone Bank Agric Loan

Utilizing the Keystone Bank Agric Loan involves several steps. First, applicants must assess their financial needs and determine how much funding is required for their agricultural projects. Next, they will need to gather necessary documentation, which may include proof of identity, business registration documents, and a detailed business plan outlining how the funds will be used. Once the application is submitted, the bank will review it, and if approved, funds will be disbursed to the borrower’s account.

Eligibility Criteria

To qualify for the Keystone Bank Agric Loan, applicants typically need to meet specific criteria. This may include being a registered farmer or agribusiness, demonstrating a viable agricultural project, and having a good credit history. Additionally, applicants may need to provide collateral to secure the loan. It is essential for potential borrowers to check the exact eligibility requirements with Keystone Bank, as these may vary based on the loan amount and purpose.

Application Process & Approval Time

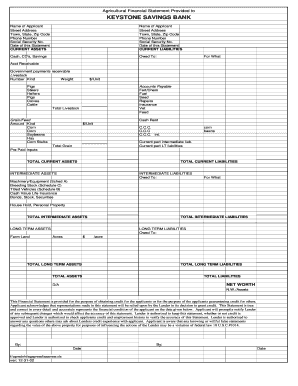

The application process for the Keystone Bank Agric Loan generally involves several key steps. Applicants start by filling out a loan application form, which can often be completed online or in person. After submitting the application, the bank will conduct a thorough review, which may include assessing the applicant's creditworthiness and the viability of the proposed agricultural project. The approval time can vary but typically ranges from a few days to a couple of weeks, depending on the complexity of the application and the bank's workload.

Key elements of the Keystone Bank Agric Loan

Several key elements define the Keystone Bank Agric Loan. These include the loan amount, which can vary based on the applicant's needs and the bank's policies. Interest rates are another critical aspect, as they determine the overall cost of borrowing. Loan terms, including repayment schedules and durations, are also essential, as they outline how long borrowers have to repay the loan. Additionally, any fees associated with the loan, such as processing fees, should be clearly understood by the borrower before proceeding.

Required Documents

When applying for the Keystone Bank Agric Loan, applicants must prepare a set of required documents. These typically include:

- Proof of identity (such as a government-issued ID)

- Business registration documents

- A detailed business plan outlining the agricultural project

- Financial statements or records of previous agricultural activities

- Collateral documentation, if applicable

Ensuring that all documents are complete and accurate can help streamline the application process and improve the chances of approval.

Quick guide on how to complete keystone bank agric loan

Complete Keystone Bank Agric Loan effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly and efficiently. Manage Keystone Bank Agric Loan on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Keystone Bank Agric Loan without hassle

- Find Keystone Bank Agric Loan and select Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Keystone Bank Agric Loan and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the keystone bank agric loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the USSD code to borrow money from Keystone Bank?

The USSD code to borrow money from Keystone Bank is a simple numeric code that customers can dial on their mobile phones to access loan services. This allows you to apply for a loan quickly and without the need for extensive paperwork. Simply follow the prompts after dialing the USSD code to borrow money from Keystone Bank.

-

How do I use the USSD code to borrow money from Keystone Bank?

To use the USSD code to borrow money from Keystone Bank, dial the specified code on your mobile device and follow the instructions that appear on your screen. Make sure you have a Keystone Bank account and meet any eligibility criteria to qualify for the loan. This process is designed to be fast and user-friendly.

-

What are the eligibility requirements for using the USSD code to borrow money from Keystone Bank?

To be eligible to use the USSD code to borrow money from Keystone Bank, you must have an active account with the bank and a good transaction history. Additionally, the bank may require you to meet a minimum salary threshold. Always check with Keystone Bank for the latest eligibility requirements.

-

Are there any fees associated with using the USSD code to borrow money from Keystone Bank?

Using the USSD code to borrow money from Keystone Bank may involve certain fees, including service charges or interest rates on the borrowed amount. It's essential to review these charges before proceeding with the loan application. Always read the terms and conditions provided by the bank for transparency.

-

What loan amounts can I access through the USSD code to borrow money from Keystone Bank?

The loan amounts available through the USSD code to borrow money from Keystone Bank vary based on your account status and creditworthiness. Generally, customers can borrow amounts ranging from a minimum threshold to a set maximum limit. Contact Keystone Bank for detailed information regarding specific loan limits.

-

How long does it take to receive funds after using the USSD code to borrow money from Keystone Bank?

Once you successfully use the USSD code to borrow money from Keystone Bank, funds are typically disbursed within a few minutes if you meet all eligibility criteria. However, processing times may vary depending on the bank's operational hours and your account status. Always check with the bank for the most accurate time frame.

-

Can I repay the loan obtained through the USSD code to borrow money from Keystone Bank through the app?

Yes, you can repay your loan obtained through the USSD code to borrow money from Keystone Bank using the bank's mobile application or other payment options provided. This makes it convenient to manage repayments without needing to visit a bank branch. Always ensure you make payments on time to avoid penalties.

Get more for Keystone Bank Agric Loan

Find out other Keystone Bank Agric Loan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors