2015rpie Filing Form

What is the 2015rpie Filing Form

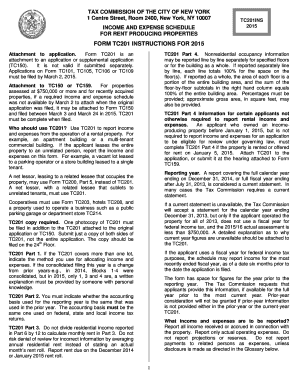

The 2015rpie filing form is a specific document used in the United States for reporting certain financial information. This form is essential for individuals and businesses to comply with federal regulations, particularly in the context of tax filings. It serves as a means to disclose income, deductions, and other relevant financial data to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is crucial for accurate and timely submissions.

Steps to complete the 2015rpie Filing Form

Completing the 2015rpie filing form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand the required information. Fill out the form methodically, ensuring that all fields are completed accurately. Once the form is filled, review it thoroughly for any errors or omissions before submission. This careful approach helps prevent delays or issues with the IRS.

Legal use of the 2015rpie Filing Form

The legal use of the 2015rpie filing form is governed by federal tax laws. To be considered valid, the form must be completed accurately and submitted within the designated time frame. It is important to adhere to the guidelines set forth by the IRS to avoid penalties. Additionally, the form must be signed by the individual or authorized representative, ensuring that the information provided is truthful and complete. Failure to comply with these legal requirements can result in serious consequences, including fines or audits.

Form Submission Methods

There are several methods available for submitting the 2015rpie filing form. Individuals can choose to file electronically using approved e-filing software, which is often the most efficient method. Alternatively, the form can be printed and mailed to the appropriate IRS address. For those who prefer in-person submissions, visiting a local IRS office is also an option. Each method has its own advantages, and the choice may depend on personal preference or specific circumstances.

Filing Deadlines / Important Dates

Filing deadlines for the 2015rpie filing form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these deadlines, as late submissions can incur penalties and interest on unpaid taxes.

Required Documents

To successfully complete the 2015rpie filing form, certain documents are required. These include income statements, such as W-2s or 1099s, which report earnings for the year. Additionally, documentation for deductions, such as receipts for business expenses or charitable contributions, should be gathered. Having these documents ready will facilitate a smoother filing process and help ensure that all relevant information is accurately reported.

Examples of using the 2015rpie Filing Form

Understanding practical examples of how to use the 2015rpie filing form can enhance clarity. For instance, self-employed individuals may use this form to report income earned from freelance work, detailing both earnings and allowable expenses. Similarly, businesses may utilize the form to report revenue and deductions associated with operations. These examples illustrate the form's versatility in various financial contexts, aiding users in accurately reporting their financial activities.

Quick guide on how to complete 2015rpie filing form

Complete 2015rpie Filing Form effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage 2015rpie Filing Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The most efficient way to modify and eSign 2015rpie Filing Form with ease

- Find 2015rpie Filing Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign 2015rpie Filing Form and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015rpie filing form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015rpie Filing Form and why is it important?

The 2015rpie Filing Form is a crucial document for reporting income from certain types of partnerships. It ensures compliance with tax regulations, helping businesses avoid fines and penalties. Understanding how to use the 2015rpie Filing Form can streamline your tax filing process and keep your finances in order.

-

How does airSlate SignNow facilitate the 2015rpie Filing Form submission?

airSlate SignNow provides an intuitive platform that allows users to easily fill out the 2015rpie Filing Form digitally. You can add signatures, dates, and other required information with a few clicks, ensuring a smooth submission process. This simplifies your workflow and saves valuable time.

-

What are the pricing options for using airSlate SignNow for eSigning the 2015rpie Filing Form?

airSlate SignNow offers various pricing plans to fit different business needs. Each plan includes features that simplify the eSigning process for documents like the 2015rpie Filing Form. You can choose a plan based on your document volume and desired features, ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with other tools for filing the 2015rpie Filing Form?

Yes, airSlate SignNow seamlessly integrates with various applications and services, making it easy to manage documents related to the 2015rpie Filing Form. Whether you use accounting software or CRM applications, these integrations enhance your operational efficiency. This flexibility helps ensure that all your documentation and processes are interconnected.

-

What are the benefits of using airSlate SignNow for the 2015rpie Filing Form?

Using airSlate SignNow for the 2015rpie Filing Form enhances security, speed, and user-friendliness. You can track documents, automate reminders, and ensure that signatures are collected promptly. This efficient process leads to faster filing and reduces the chances of errors or omissions.

-

Is airSlate SignNow easy to use for filling out the 2015rpie Filing Form?

Absolutely! airSlate SignNow is designed for users of all skill levels, making it easy to fill out the 2015rpie Filing Form. The user-friendly interface guides you through the steps, allowing you to complete your tasks quickly with minimal learning curve.

-

How secure is airSlate SignNow for signing the 2015rpie Filing Form?

airSlate SignNow prioritizes security, ensuring that all documents, including the 2015rpie Filing Form, are kept safe with encryption technologies. Your data is protected against unauthorized access, allowing you to sign and send sensitive documents with peace of mind. Trust in our security measures to keep your information confidential.

Get more for 2015rpie Filing Form

- Application for indiana timber buyers license form

- Micro wine wholesaler indiana form

- Business card printing request state of indiana in form

- Printing request form this area for print shop use only

- Instructions for form uic 29 production waste dnr louisiana

- Form7106r05noc 1final 06 30 2017

- Louisiana deq form noc 1

- State of ga rescission form

Find out other 2015rpie Filing Form

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document