Pa40es Form

What is the PA40ES?

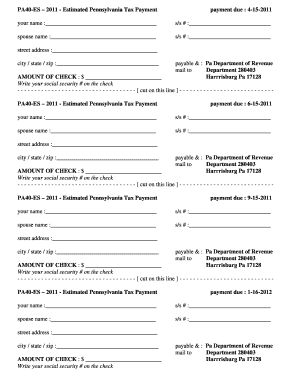

The PA40ES is a specific form used for estimated tax payments in the state of Pennsylvania. This form is essential for individuals and businesses who expect to owe tax of $500 or more when filing their annual tax return. The PA40ES allows taxpayers to make quarterly estimated payments to ensure they meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the year.

How to use the PA40ES

Using the PA40ES involves a straightforward process. Taxpayers need to calculate their estimated tax liability for the year and determine the amount to be paid quarterly. The form requires basic information such as the taxpayer's name, address, and Social Security number. Once the estimated amounts are calculated, payments can be made either online or via mail, ensuring that they are submitted by the due dates to avoid penalties.

Steps to complete the PA40ES

Completing the PA40ES involves several key steps:

- Determine your estimated tax liability: Assess your expected income and deductions for the year.

- Calculate your quarterly payments: Divide your total estimated tax liability by four to find the amount due each quarter.

- Fill out the PA40ES form: Provide all necessary information, including personal details and payment amounts.

- Submit the form: Choose your submission method, either online or by mailing the completed form to the appropriate address.

Legal use of the PA40ES

The PA40ES is legally recognized for making estimated tax payments in Pennsylvania. To ensure compliance, it is important to adhere to the guidelines set forth by the Pennsylvania Department of Revenue. This includes making timely payments and accurately reporting income to avoid potential penalties for underpayment or late submission.

Filing Deadlines / Important Dates

Filing deadlines for the PA40ES are crucial for taxpayers to remember. Payments are typically due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on the unpaid amounts. It is advisable to mark these dates on your calendar to ensure timely payments.

Required Documents

When preparing to complete the PA40ES, taxpayers should gather the following documents:

- Previous year’s tax return: This can help estimate current year income and deductions.

- Income statements: Such as W-2s or 1099s, to accurately report earnings.

- Documentation of deductions: Any receipts or records that support claimed deductions should be organized.

Who Issues the Form

The PA40ES form is issued by the Pennsylvania Department of Revenue. This state agency is responsible for tax collection and ensuring compliance with state tax laws. Taxpayers can access the form and related resources directly through the Department of Revenue's official website or through authorized tax professionals.

Quick guide on how to complete pa40es

Effortlessly Prepare Pa40es on Any Device

Digital document management has become increasingly favored by companies and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the features required to generate, modify, and eSign your documents quickly without any holdups. Manage Pa40es on any device through airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Modify and eSign Pa40es Effortlessly

- Locate Pa40es and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Pa40es and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa40es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pa40es and how does it benefit my business?

Pa40es is a powerful electronic signature solution offered by airSlate SignNow that enables businesses to streamline their document management. With pa40es, you can easily send, sign, and manage documents from anywhere, drastically reducing turnaround times and improving workflow efficiency. It's designed to cater to various industries, ensuring that you stay compliant while enhancing productivity.

-

How much does the pa40es solution cost?

The pricing for pa40es varies depending on the features and the number of users you require. airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective solution. You can also take advantage of a free trial to evaluate the platform before making a commitment.

-

What features does pa40es include?

Pa40es includes a variety of features such as customizable templates, bulk sending, and real-time tracking of document statuses. Additionally, it provides secure storage and compliance with industry regulations, ensuring that your sensitive information is well-protected. These features make pa40es a comprehensive tool for modern businesses.

-

Can I integrate pa40es with other software tools?

Yes, pa40es is designed to integrate seamlessly with a wide range of software applications, including CRMs, document management systems, and cloud storage services. This flexibility allows you to enhance your existing workflows and maintain your current processes. This makes pa40es a versatile addition to your technology stack.

-

Is pa40es secure for sensitive documents?

Absolutely, pa40es prioritizes the security of your documents by employing industry-leading encryption and security protocols. This means that your sensitive data is protected during transmission and storage, ensuring compliance with regulations like GDPR and HIPAA. Trusting pa40es means you can safeguard your business's valuable information.

-

How does pa40es improve document turnaround times?

Pa40es signNowly improves document turnaround times by allowing users to send, sign, and receive documents electronically without the delays associated with traditional paper methods. With its intuitive interface, users can quickly complete transactions, ensuring that important agreements are finalized faster. This efficiency translates to better productivity for your business.

-

What support options are available for pa40es users?

airSlate SignNow provides extensive support for pa40es users, including a knowledge base with tutorials, webinars, and customer service representatives available for assistance. Whether you need help getting started or have questions about specific features, our team is here to support you. Our commitment to customer success is a key benefit of using pa40es.

Get more for Pa40es

- Dbs change of account mandate form

- Immigration act chapter 133 section 55 1 form

- District of columbia student support team sst request form dcsig

- Individual financial statement form

- Application for home loan bank of baroda form

- Ds11 form

- New social work referral formpdf lincoln park public schools

- Daycare registration form open arms lutheran church

Find out other Pa40es

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself