Form 8283

What is the Form 8283

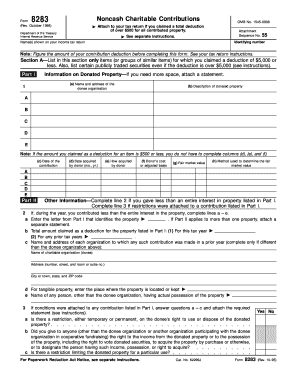

The Form 8283, officially known as the "Noncash Charitable Contributions" form, is a tax document used by individuals and organizations in the United States to report noncash donations made to qualified charities. This form is particularly important for taxpayers who wish to claim a deduction for items such as clothing, household goods, or other property donated to charitable organizations. The IRS requires this form to ensure that the value of the donated items is accurately reported and that the contributions meet the necessary guidelines for tax deductions.

Steps to complete the Form 8283

Completing the Form 8283 involves several key steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all necessary information regarding the donated items, including descriptions, fair market values, and the date of the donation. Next, fill out the form by providing your personal information, details about the charity, and specifics about the items donated. It is essential to ensure that the values assigned to the items reflect their fair market value at the time of donation. Finally, if the total value of noncash contributions exceeds $500, you must obtain a qualified appraisal and include that information on the form.

How to obtain the Form 8283

The Form 8283 can be easily obtained through the IRS website. It is available in PDF format, allowing you to download and print it for completion. Additionally, many tax software programs include the Form 8283 as part of their offerings, enabling users to fill it out digitally. If you prefer a physical copy, you can also request one by contacting the IRS directly or visiting a local IRS office.

Legal use of the Form 8283

The legal use of the Form 8283 requires adherence to specific IRS guidelines. Taxpayers must ensure that the form is completed accurately and submitted with their tax return if claiming a deduction for noncash contributions. The IRS mandates that all noncash donations valued over $500 require a qualified appraisal, and the details of this appraisal must be included on the form. Failure to comply with these requirements could result in penalties or disallowance of the deduction.

IRS Guidelines

The IRS has established guidelines for the use of Form 8283 to ensure proper reporting of noncash charitable contributions. Taxpayers must maintain records of the donated items, including receipts from the charity and appraisals where applicable. The IRS also stipulates that donations must be made to qualified organizations to be deductible. It is important to review the latest IRS publications related to charitable contributions for any updates or changes to the guidelines.

Required Documents

When completing the Form 8283, certain documents are required to substantiate the noncash contributions. These include receipts from the charitable organization, a qualified appraisal for items valued over $500, and any additional documentation that supports the fair market value of the donated items. Keeping thorough records is crucial, as the IRS may request these documents for verification purposes during an audit.

Quick guide on how to complete form 8283

Easily Prepare Form 8283 on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without any holdups. Manage Form 8283 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Form 8283

- Obtain Form 8283 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your alterations.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8283 to ensure seamless communication at any point of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8283

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8283 and why is it important?

Form 8283 is a tax form used by taxpayers to report non-cash charitable contributions. It's important for ensuring that valuable donations are documented and potentially eligible for tax deductions. With airSlate SignNow, you can easily eSign and manage your Form 8283 for a seamless filing process.

-

How can airSlate SignNow help me with Form 8283?

airSlate SignNow offers an easy-to-use platform that allows you to send, eSign, and manage your Form 8283 digitally. This enhances accuracy and speeds up the submission process, ensuring that your contributions are reported in a timely manner. Plus, you can access your documents from anywhere, making it convenient.

-

What are the pricing options for using airSlate SignNow for Form 8283?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. You can choose from various subscription models that fit your budget while allowing unlimited document signing, including Form 8283. This cost-effective solution ensures you can manage your documents without breaking the bank.

-

Is airSlate SignNow secure for signing Form 8283?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption and authentication methods to protect your data. Signing Form 8283 through our platform ensures that your sensitive information remains confidential and secure. You can confidently handle your charitable contribution records with peace of mind.

-

Can I integrate airSlate SignNow with other software for managing Form 8283?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and many more. This allows you to easily import and manage your Form 8283 alongside other important documents, streamlining your workflow and improving efficiency.

-

What features does airSlate SignNow offer specifically for Form 8283?

airSlate SignNow provides features that simplify the completion of Form 8283, including customizable templates, automated reminders, and real-time tracking of document status. These tools are designed to help you efficiently manage your charitable contributions and ensure proper filing with tax authorities.

-

How can I track the status of my signed Form 8283 in airSlate SignNow?

With airSlate SignNow, tracking the status of your signed Form 8283 is simple. Our platform offers real-time notifications and a comprehensive dashboard, allowing you to monitor when documents are viewed, signed, and completed. This ensures you stay updated throughout the entire process.

Get more for Form 8283

Find out other Form 8283

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself