IRA One Time Distribution Form Lord Abbett and Co

What is the IRA One Time Distribution Form Lord Abbett And Co

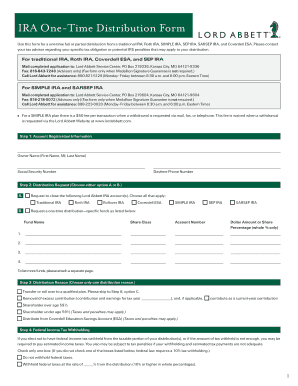

The IRA One Time Distribution Form from Lord Abbett And Co is a specific document used by individuals to request a one-time distribution from their Individual Retirement Account (IRA). This form is essential for managing funds within an IRA, allowing account holders to withdraw a specified amount without the need for ongoing distributions. The form ensures that the withdrawal complies with IRS regulations and the policies of Lord Abbett And Co, facilitating a smooth transaction for the account holder.

How to use the IRA One Time Distribution Form Lord Abbett And Co

Using the IRA One Time Distribution Form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from Lord Abbett And Co's website or customer service. Next, fill out the required fields, including personal information, account details, and the amount you wish to withdraw. Once completed, you can submit the form electronically or via mail, depending on your preference and the options provided by Lord Abbett And Co.

Steps to complete the IRA One Time Distribution Form Lord Abbett And Co

Completing the IRA One Time Distribution Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from Lord Abbett And Co's official resources.

- Provide your personal information, including your name, address, and Social Security number.

- Fill in your IRA account number to ensure the request is processed correctly.

- Specify the amount you wish to withdraw and select the distribution method, such as check or electronic transfer.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your request.

- Submit the form according to the submission methods outlined by Lord Abbett And Co.

Legal use of the IRA One Time Distribution Form Lord Abbett And Co

The legal use of the IRA One Time Distribution Form is governed by IRS regulations and the policies of Lord Abbett And Co. To ensure the form is legally binding, it must be completed accurately and submitted in compliance with applicable laws. Electronic signatures are generally accepted, provided they meet the requirements set forth by the ESIGN Act and UETA. This legal framework supports the validity of eDocuments, ensuring that your distribution request is recognized by financial institutions and courts.

Key elements of the IRA One Time Distribution Form Lord Abbett And Co

Several key elements are essential for the IRA One Time Distribution Form to be effective:

- Personal Information: Accurate identification details, including your name and Social Security number.

- Account Information: The specific IRA account number from which funds are being withdrawn.

- Distribution Amount: The exact amount you wish to withdraw, which must adhere to IRS guidelines.

- Signature: A valid signature is required to authorize the distribution.

- Date: The date of submission is crucial for processing and compliance.

Form Submission Methods

The IRA One Time Distribution Form can be submitted through various methods, depending on the options provided by Lord Abbett And Co. Common submission methods include:

- Online Submission: Many users prefer to submit the form electronically through Lord Abbett And Co's secure platform.

- Mail: You can also print the completed form and send it via postal mail to the address specified by Lord Abbett And Co.

- In-Person: If preferred, you may visit a local branch or office to submit the form directly.

Quick guide on how to complete ira one time distribution form lord abbett and co

Complete IRA One Time Distribution Form Lord Abbett And Co effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents rapidly without delays. Manage IRA One Time Distribution Form Lord Abbett And Co on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign IRA One Time Distribution Form Lord Abbett And Co with ease

- Locate IRA One Time Distribution Form Lord Abbett And Co and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign IRA One Time Distribution Form Lord Abbett And Co and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira one time distribution form lord abbett and co

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRA One Time Distribution Form from Lord Abbett And Co.?

The IRA One Time Distribution Form from Lord Abbett And Co. is a streamlined document designed to facilitate a single withdrawal from your Individual Retirement Account (IRA). By using this form, you ensure compliance with IRS regulations while efficiently managing your retirement funds.

-

How do I obtain the IRA One Time Distribution Form from Lord Abbett And Co.?

You can easily obtain the IRA One Time Distribution Form from Lord Abbett And Co. by visiting their official website or by contacting their customer support. Additionally, airSlate SignNow can provide you with access to this form, enabling you to eSign it seamlessly.

-

What are the benefits of using the airSlate SignNow for the IRA One Time Distribution Form from Lord Abbett And Co.?

airSlate SignNow offers a user-friendly interface that simplifies the process of signing and managing the IRA One Time Distribution Form from Lord Abbett And Co. It allows for quick eSigning, saving you time and reducing paperwork hassle.

-

Is there a fee to use the IRA One Time Distribution Form from Lord Abbett And Co. with airSlate SignNow?

While accessing the IRA One Time Distribution Form from Lord Abbett And Co. is typically free, using airSlate SignNow may involve subscription fees for additional features like eSigning and document management. However, the platform is known for its cost-effective solutions.

-

Can I save and edit my IRA One Time Distribution Form from Lord Abbett And Co. on airSlate SignNow?

Yes, airSlate SignNow allows you to save and edit your IRA One Time Distribution Form from Lord Abbett And Co. at your convenience. Its robust editing features enable you to make necessary adjustments before finalizing the eSignature process.

-

Is the IRA One Time Distribution Form from Lord Abbett And Co. compliant with IRS regulations?

Yes, the IRA One Time Distribution Form from Lord Abbett And Co. is designed to meet IRS requirements for distributing funds from your IRA. Utilizing this form through airSlate SignNow helps ensure your compliance while streamlining the process.

-

What integrations does airSlate SignNow offer for handling the IRA One Time Distribution Form from Lord Abbett And Co.?

airSlate SignNow offers various integrations with popular applications, allowing you to manage the IRA One Time Distribution Form from Lord Abbett And Co. effectively. You can easily connect it with your favorite CRM tools or document storage solutions for a more cohesive workflow.

Get more for IRA One Time Distribution Form Lord Abbett And Co

Find out other IRA One Time Distribution Form Lord Abbett And Co

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form