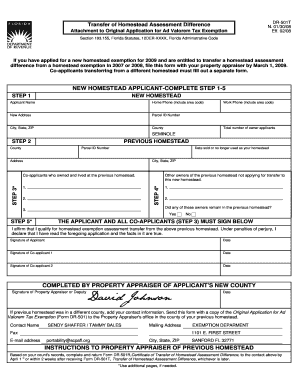

Homestead Exemption Seminole County Form

What is the Homestead Exemption Seminole County

The Seminole County homestead exemption is a property tax benefit designed to reduce the taxable value of a homeowner's primary residence. This exemption can significantly lower property taxes for eligible homeowners by providing a reduction in the assessed value of their property. In Seminole County, Florida, the homestead exemption is available to permanent residents who occupy their property as their primary home. The exemption amount can vary based on specific criteria, including the property's assessed value and the homeowner's eligibility status.

Eligibility Criteria for the Homestead Exemption Seminole County

To qualify for the homestead exemption in Seminole County, applicants must meet several criteria:

- The property must be the applicant's primary residence.

- The applicant must be a permanent resident of Florida.

- The applicant must have legal or equitable title to the property.

- The application must be filed by March first of the year for which the exemption is requested.

Additional requirements may apply, depending on specific circumstances, such as age or disability status. Homeowners are encouraged to check with the Seminole County Property Appraiser for detailed eligibility guidelines.

Steps to Complete the Homestead Exemption Seminole County

Completing the homestead exemption application in Seminole County involves several key steps:

- Gather necessary documentation, including proof of residency and ownership.

- Obtain the homestead exemption application form from the Seminole County Property Appraiser's office or their website.

- Fill out the application form accurately, providing all required information.

- Submit the completed application by the March first deadline, either online, by mail, or in person.

It is important to ensure that all information is correct to avoid delays or denial of the exemption.

Required Documents for the Homestead Exemption Seminole County

When applying for the homestead exemption in Seminole County, homeowners must provide specific documents to verify their eligibility. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Documentation showing ownership of the property, such as a deed.

- Evidence of residency, such as utility bills or bank statements with the applicant's name and address.

Homeowners should ensure that all documents are current and clearly show the necessary information to facilitate the approval process.

Form Submission Methods for the Homestead Exemption Seminole County

Homeowners in Seminole County can submit their homestead exemption application through various methods:

- Online: Applications can be completed and submitted electronically through the Seminole County Property Appraiser's website.

- By Mail: Homeowners can print the application form, fill it out, and send it to the Property Appraiser's office via postal mail.

- In-Person: Applicants may also visit the Property Appraiser's office to submit their application directly.

Choosing the most convenient submission method can help ensure timely processing of the application.

Legal Use of the Homestead Exemption Seminole County

The legal framework governing the homestead exemption in Seminole County is established by Florida state law. Homeowners must adhere to these regulations to maintain their exemption status. Misuse of the exemption, such as claiming it on multiple properties or failing to meet residency requirements, can result in penalties, including the loss of the exemption and potential fines. It is essential for homeowners to understand their legal obligations and ensure compliance to benefit from the homestead exemption.

Quick guide on how to complete homestead exemption seminole county

Complete Homestead Exemption Seminole County effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to create, alter, and electronically sign your documents quickly and without delays. Handle Homestead Exemption Seminole County on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Homestead Exemption Seminole County effortlessly

- Locate Homestead Exemption Seminole County and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about missing or lost documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Homestead Exemption Seminole County while ensuring stellar communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homestead exemption seminole county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Seminole County homestead exemption?

The Seminole County homestead exemption is a tax benefit designed to reduce the taxable value of a primary residence. Homeowners in Seminole County can apply for this exemption to save on property taxes, making homeownership more affordable.

-

How do I apply for the Seminole County homestead exemption?

To apply for the Seminole County homestead exemption, homeowners need to complete an application form available through the Seminole County Property Appraiser's office. Ensure you have the necessary documentation, such as proof of residency and ownership, to qualify for the exemption.

-

What are the eligibility requirements for the Seminole County homestead exemption?

Eligibility for the Seminole County homestead exemption typically requires that the property be a primary residence and that the owner has legal or equitable title. Additional criteria may include age, disability status, or income, so it's essential to review specific requirements based on your situation.

-

What are the benefits of the Seminole County homestead exemption?

The primary benefit of the Seminole County homestead exemption is the reduction in property taxes, which can lead to signNow savings for homeowners. Additionally, it provides some degree of protection against creditors and may qualify homeowners for other tax-related benefits.

-

Can I have multiple properties qualify for the Seminole County homestead exemption?

No, the Seminole County homestead exemption is only available for your primary residence. Homeowners cannot claim this exemption for multiple properties, as it is intended to support residents living in their primary home.

-

How does the Seminole County homestead exemption impact property values?

The Seminole County homestead exemption can positively impact property values by making homeownership more affordable, thereby increasing demand. As more homeowners take advantage of this exemption, it may lead to a stable housing market in the area.

-

What happens if I sell my home with a Seminole County homestead exemption?

If you sell your home that has a Seminole County homestead exemption, you will need to remove the exemption upon the sale. The new owner will have to apply for their own exemption if they meet the eligibility requirements.

Get more for Homestead Exemption Seminole County

- Annual diabetic foot exam form

- Pens e6 e unjspf unjspf form

- Remit instruction sheet form

- Barmer bonusprogramm pdf form

- Fillable online immunization worksheet for pre kday care for form

- Hhc 2844 restoration form 1 4 16

- Medicaid offers electronic funds transfer for provider form

- Lincoln public schools department of student services form

Find out other Homestead Exemption Seminole County

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple