Instructions for Schedule CT 1041FA 2023-2026

What is the Instructions For Schedule CT 1041FA

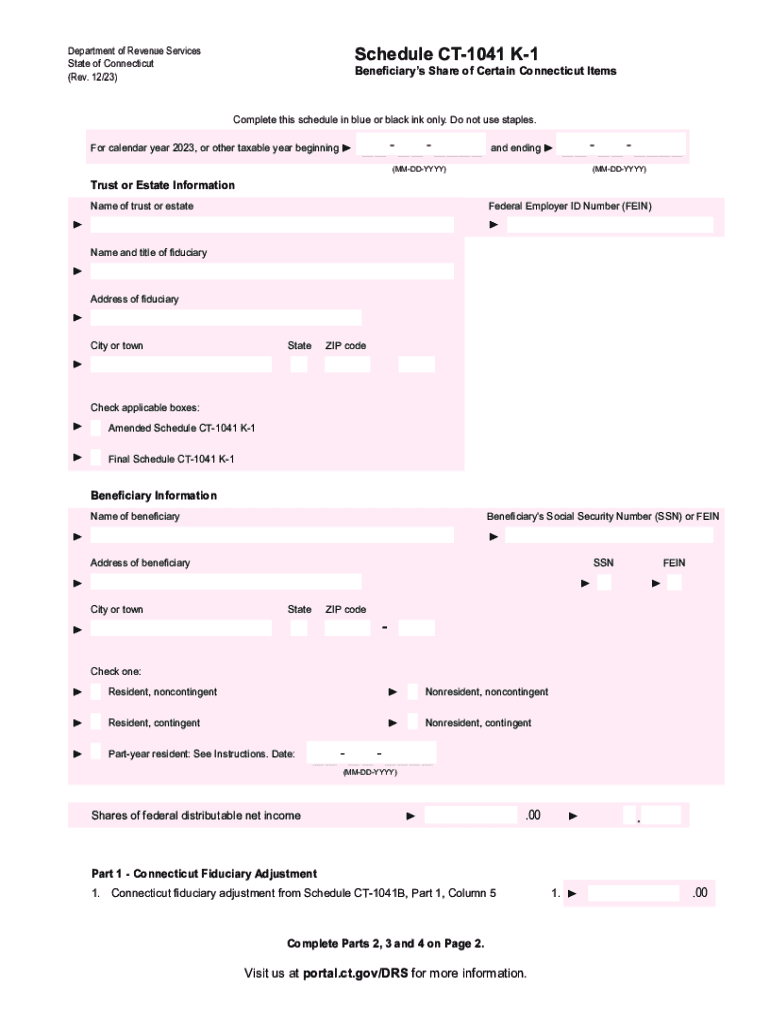

The Instructions For Schedule CT 1041FA provide detailed guidance for completing the Connecticut Form CT-1041, which is used by fiduciaries to report income for estates and trusts. This schedule is crucial for ensuring compliance with state tax regulations. It outlines the necessary steps to accurately report income, deductions, and credits associated with the estate or trust, ensuring that fiduciaries meet their tax obligations in Connecticut.

Steps to complete the Instructions For Schedule CT 1041FA

Completing the Instructions For Schedule CT 1041FA involves several key steps. First, gather all relevant financial documents related to the estate or trust, including income statements and expense records. Next, carefully read through the instructions to understand the specific requirements for reporting different types of income and deductions. Fill out the form by entering the required information in the designated fields, ensuring accuracy to avoid potential penalties. Finally, review the completed form against the instructions to confirm that all necessary information has been included before submission.

Filing Deadlines / Important Dates

Filing deadlines for Schedule CT 1041FA are critical for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the estate or trust's taxable year. For estates and trusts operating on a calendar year basis, this typically means an April 15 deadline. It is essential to stay informed about any changes to these dates, as failure to file on time can result in penalties and interest on unpaid taxes.

Required Documents

To complete Schedule CT 1041FA, several documents are required. These typically include:

- Income statements for the estate or trust

- Records of expenses and deductions

- Prior year tax returns, if applicable

- Any supporting documentation for credits claimed

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Legal use of the Instructions For Schedule CT 1041FA

The Instructions For Schedule CT 1041FA are legally binding guidelines that fiduciaries must follow when reporting income for estates and trusts in Connecticut. Adhering to these instructions is essential for compliance with state tax laws. Failure to follow the guidelines can result in legal consequences, including penalties and fines. It is advisable for fiduciaries to consult with a tax professional if they have questions about the legal implications of their filings.

Who Issues the Form

The Connecticut Department of Revenue Services is responsible for issuing Schedule CT 1041FA. This state agency oversees tax administration and ensures that fiduciaries have the necessary resources to comply with tax laws. The department regularly updates the instructions and forms to reflect changes in legislation and tax policy, making it important for filers to use the most current version available.

Quick guide on how to complete instructions for schedule ct 1041fa

Easily Prepare Instructions For Schedule CT 1041FA on Any Device

Managing documents online has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow furnishes you with all the tools necessary to create, amend, and electronically sign your documents swiftly and without issues. Handle Instructions For Schedule CT 1041FA on any device with the airSlate SignNow applications available for Android or iOS and streamline any document-based procedure today.

How to Amend and Electronically Sign Instructions For Schedule CT 1041FA with Ease

- Locate Instructions For Schedule CT 1041FA and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Select your preferred method for sending your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Instructions For Schedule CT 1041FA to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule ct 1041fa

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule ct 1041fa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct 1041 k and how does it relate to document signing?

The ct 1041 k is a specific tax form used in Connecticut for reporting income. Using airSlate SignNow, businesses can easily eSign and send this document, ensuring compliance and streamlining their tax reporting process.

-

How can airSlate SignNow help me with filling out the ct 1041 k?

airSlate SignNow provides templates and tools that simplify the process of filling out the ct 1041 k. Users can input their data, save frequently used information, and electronically sign the document for submission.

-

What are the pricing options for using airSlate SignNow for the ct 1041 k?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on the plan you choose, you can access advanced features to manage documents like the ct 1041 k more effectively and efficiently.

-

Are there any integrations available with airSlate SignNow for completing the ct 1041 k?

Yes, airSlate SignNow seamlessly integrates with various applications, including accounting and tax software, making it easier to manage the ct 1041 k. These integrations enhance workflow efficiency and data accuracy across platforms.

-

What security features does airSlate SignNow offer for the ct 1041 k?

airSlate SignNow prioritizes document security by offering features like encryption and secure access controls. This is especially important for sensitive tax documents like the ct 1041 k, ensuring your data remains private and protected.

-

Can I track the status of my ct 1041 k once it's sent for eSignature?

Absolutely! With airSlate SignNow, you can easily track the status of your ct 1041 k after sending it for eSignature. You'll receive notifications regarding when the document is viewed, signed, or completed.

-

How does airSlate SignNow improve the efficiency of processing the ct 1041 k?

Using airSlate SignNow, businesses can automate the workflow associated with the ct 1041 k, reducing the time spent on manual processes. This streamlining allows for quicker completion and submission of tax documents.

Get more for Instructions For Schedule CT 1041FA

- Business declaration form ab0705e complete this form when you need to make a business declaration for a client ab0705e

- Temporary on premises sign application city of edmonton edmonton form

- Cl489n occupational therapy discharge report occupational therapy discharge report form

- Statement of authorship form

- Kindness gram fhhrca form

- Corrections canada visitor application form

- D claration des biens personnels form

- Cra t183 fillable form

Find out other Instructions For Schedule CT 1041FA

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors