CT Earned Income Tax Credit 2023-2026

What is the CT Earned Income Tax Credit

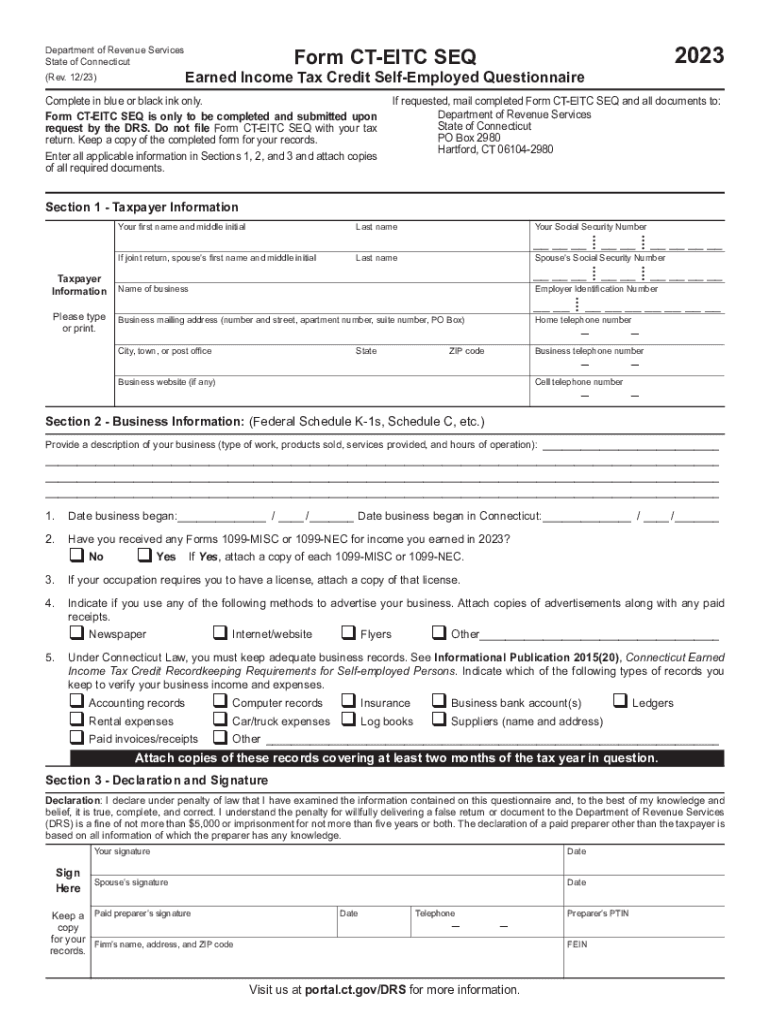

The Connecticut Earned Income Tax Credit (CT EITC) is a state-level tax benefit designed to assist low- to moderate-income working individuals and families. This credit is based on the federal Earned Income Tax Credit and aims to reduce poverty and encourage employment. Eligible taxpayers can receive a percentage of their federal EITC, which can significantly lower their tax liability and potentially result in a refund.

Eligibility Criteria

To qualify for the CT EITC, taxpayers must meet specific income and filing requirements. Generally, eligibility is determined by the taxpayer's income level, filing status, and the number of qualifying children. For the 2019 tax year, the income thresholds vary based on the number of dependents. It is essential for applicants to review these criteria carefully to ensure they meet the requirements before applying.

Steps to complete the CT Earned Income Tax Credit

Completing the CT EITC involves several steps. First, gather necessary documentation, including income statements and identification. Next, fill out the 2019 CT EITC form accurately, ensuring all information is complete. After completing the form, review it for any errors and submit it either online or by mail. Keeping a copy of the submitted form and all supporting documents is advisable for future reference.

Required Documents

When applying for the CT EITC, taxpayers need to provide specific documents to support their application. Required documents typically include proof of income, such as W-2 forms or 1099s, identification documents, and any relevant tax returns. Having these documents ready can streamline the application process and help ensure that all eligibility criteria are met.

Form Submission Methods

Taxpayers can submit the CT EITC form through various methods. The form can be completed and submitted online using approved tax software, which often includes built-in checks for accuracy. Alternatively, individuals can print the form and mail it to the appropriate state tax office. In-person submissions may also be possible at designated tax assistance centers, depending on local resources.

Key elements of the CT Earned Income Tax Credit

Understanding the key elements of the CT EITC is crucial for maximizing benefits. The credit amount is determined based on income level and the number of qualifying children. Additionally, the credit is refundable, meaning that if the credit exceeds the taxpayer's liability, they may receive the difference as a refund. Familiarity with these elements can help taxpayers effectively navigate the application process.

Examples of using the CT Earned Income Tax Credit

Utilizing the CT EITC can provide significant financial relief for eligible taxpayers. For instance, a single parent with two children earning a modest income may qualify for a substantial credit, reducing their overall tax bill. Another example includes a married couple filing jointly with one child, where the credit can help offset childcare costs. These scenarios illustrate how the CT EITC can positively impact families and individuals financially.

Quick guide on how to complete ct earned income tax credit

Effortlessly Prepare CT Earned Income Tax Credit on Any Device

Digital document management has become increasingly favored by both companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, since you can locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle CT Earned Income Tax Credit on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign CT Earned Income Tax Credit with Ease

- Locate CT Earned Income Tax Credit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your preferred device. Edit and eSign CT Earned Income Tax Credit and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct earned income tax credit

Create this form in 5 minutes!

How to create an eSignature for the ct earned income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 ct eitc seq and how does it relate to airSlate SignNow?

The 2019 ct eitc seq is a provision related to the Earned Income Tax Credit in Connecticut. Understanding this sequence can help you navigate through tax documentation processes more efficiently. With airSlate SignNow, businesses can easily prepare and sign any necessary documents, ensuring compliance with the 2019 ct eitc seq efficiently.

-

How does airSlate SignNow support the 2019 ct eitc seq documentation process?

airSlate SignNow simplifies the process of preparing and eSigning documents related to the 2019 ct eitc seq. Our platform offers templates and document workflows specifically designed for tax-related filings, making it easy and intuitive for users to ensure their documents are compliant and void of errors.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to the needs of different users, including those who need to handle the 2019 ct eitc seq documentation. You can choose from a free trial, monthly subscriptions, or custom solutions that fit your business size and document management needs.

-

Are there features in airSlate SignNow specifically for tax documents like the 2019 ct eitc seq?

Yes, airSlate SignNow includes features tailored for tax documentation, such as customizable templates and easy sharing options. These features allow users to manage the paperwork efficiently, helping to reduce the risk of errors in the 2019 ct eitc seq process.

-

What benefits does airSlate SignNow offer for managing 2019 ct eitc seq forms?

Using airSlate SignNow for managing your 2019 ct eitc seq forms comes with multiple benefits. These include enhanced security features, real-time tracking of document status, and the ability to store and retrieve documents easily, ensuring your tax-related affairs are documented in a streamlined manner.

-

Can airSlate SignNow integrate with other tax software for the 2019 ct eitc seq?

Absolutely! airSlate SignNow can integrate seamlessly with various tax software applications, allowing for efficient handling of the 2019 ct eitc seq. These integrations enable users to synchronize their data and workflows, ensuring that all tax documents are managed in one cohesive platform.

-

How does airSlate SignNow ensure compliance with regulations regarding the 2019 ct eitc seq?

AirSlate SignNow ensures compliance with the regulations pertaining to the 2019 ct eitc seq by providing legally binding eSignatures and secure document storage. Our platform is designed to be updated in accordance with the latest tax laws and guidelines, ensuring your documents stay compliant.

Get more for CT Earned Income Tax Credit

Find out other CT Earned Income Tax Credit

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word