Form CT K 1T, Transmittal of Schedule CT K 1 2023-2026

What is the Form CT K-1T, Transmittal of Schedule CT K-1

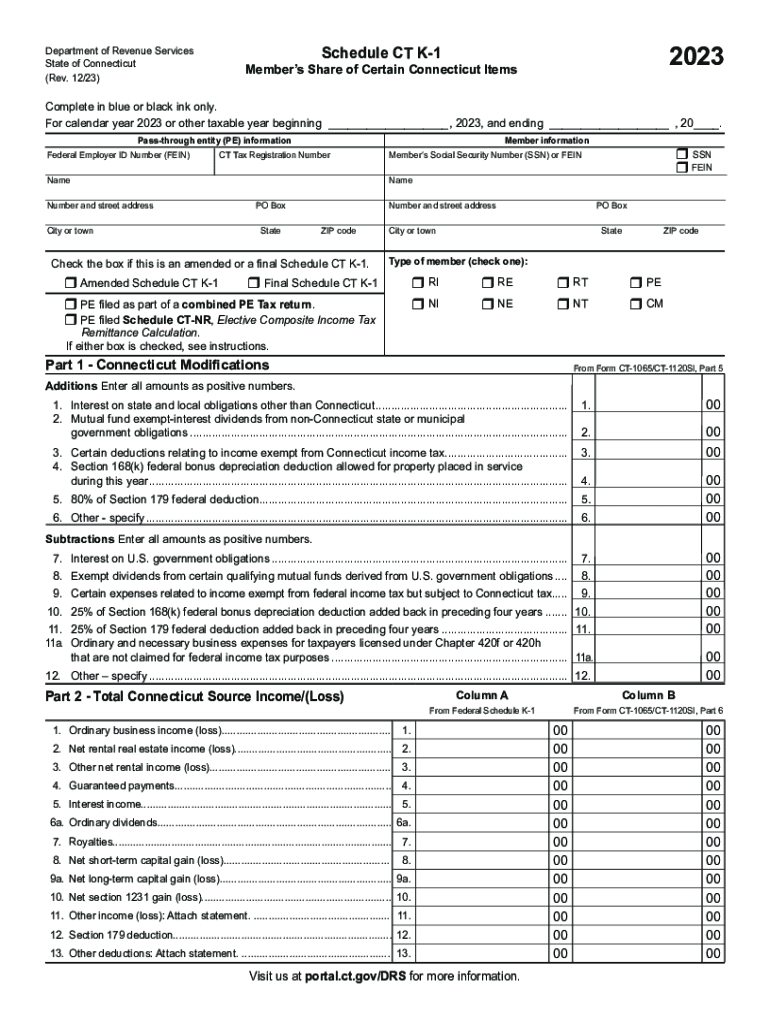

The Form CT K-1T serves as a transmittal document for Schedule CT K-1, which is used to report income, deductions, and credits for partners in a partnership or beneficiaries of an estate or trust in Connecticut. This form is essential for ensuring that the information reported on the Schedule CT K-1 is accurately transmitted to the Connecticut Department of Revenue Services. It provides a summary of the individual K-1 forms issued to partners or beneficiaries, facilitating the proper reporting of income for tax purposes.

Steps to Complete the Form CT K-1T

Completing the Form CT K-1T requires careful attention to detail. Begin by entering the name and address of the entity issuing the K-1 forms. Next, include the Connecticut tax identification number of the entity. You will also need to list the total number of K-1 forms being submitted. Each K-1 form must be attached to the CT K-1T, ensuring that all relevant information is included. Finally, sign and date the form to certify its accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the Form CT K-1T to avoid penalties. Typically, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For entities operating on a calendar year basis, this means the deadline is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Keeping track of these dates ensures compliance with state tax regulations.

Legal Use of the Form CT K-1T

The Form CT K-1T is legally required for partnerships and certain trusts to report income and distributions to partners or beneficiaries. Failure to file this form can result in penalties and complications during tax audits. It is important to understand that the information reported on the CT K-1T must align with federal reporting requirements, ensuring consistency across state and federal tax filings. Proper use of this form supports transparency and compliance with Connecticut tax laws.

Key Elements of the Form CT K-1T

Key elements of the Form CT K-1T include the entity's name, address, and tax identification number, as well as the total number of K-1 forms being filed. Each K-1 form attached should detail the individual partner's or beneficiary's share of income, deductions, and credits. Additionally, the form requires the signature of an authorized representative of the entity, affirming that all information provided is accurate and complete. These elements are crucial for ensuring that the form serves its purpose effectively.

Who Issues the Form CT K-1T

The Form CT K-1T is issued by partnerships, limited liability companies (LLCs), and certain trusts operating in Connecticut. These entities are responsible for preparing and submitting the form along with the individual K-1s to report the respective income and deductions for each partner or beneficiary. It is essential for these entities to understand their obligations under Connecticut tax law to ensure compliance and avoid potential penalties.

Quick guide on how to complete form ct k 1t transmittal of schedule ct k 1

Effortlessly prepare Form CT K 1T, Transmittal Of Schedule CT K 1 on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without any delays. Manage Form CT K 1T, Transmittal Of Schedule CT K 1 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form CT K 1T, Transmittal Of Schedule CT K 1 with ease

- Find Form CT K 1T, Transmittal Of Schedule CT K 1 and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Select important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form CT K 1T, Transmittal Of Schedule CT K 1 and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct k 1t transmittal of schedule ct k 1

Create this form in 5 minutes!

How to create an eSignature for the form ct k 1t transmittal of schedule ct k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct k 1 2021 form and why is it important?

The ct k 1 2021 form is a tax document utilized by partnerships, S corporations, and estates to report income, deductions, and credits. Understanding this form is crucial for accurate tax reporting and ensuring compliance with IRS regulations, especially for businesses using services like airSlate SignNow for document management.

-

How does airSlate SignNow help with the ct k 1 2021 form?

airSlate SignNow streamlines the process of preparing, signing, and sending the ct k 1 2021 form. With its user-friendly interface and eSignature capabilities, businesses can expedite their filing process while ensuring that all necessary disclosures are properly delivered.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as secure document sharing, templates for common tax forms like the ct k 1 2021, and robust eSignature tools. These features not only enhance the efficiency of document management but also ensure safe and compliant transactions.

-

Is there a pricing plan for businesses needing the ct k 1 2021 features?

Yes, airSlate SignNow offers various pricing plans tailored to business needs. These plans provide access to features that make managing the ct k 1 2021 form and other essential documents both cost-effective and efficient.

-

Can I integrate airSlate SignNow with my existing software for handling ct k 1 2021?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business software, making it easy to incorporate into your existing systems for managing the ct k 1 2021 form and other documents. This integration helps maintain workflow continuity and enhances productivity.

-

What are the benefits of using airSlate SignNow for ct k 1 2021 document management?

Using airSlate SignNow for ct k 1 2021 document management offers numerous benefits, including reduced paperwork, faster processing times, and improved accuracy. The platform’s secure eSignature functionality also adds a layer of trust for businesses managing sensitive tax documents.

-

How secure is airSlate SignNow when handling tax forms like the ct k 1 2021?

Security is a top priority at airSlate SignNow. The platform employs industry-standard encryption and compliance measures to ensure that documents, including the ct k 1 2021 form, are securely managed and protected from unauthorized access.

Get more for Form CT K 1T, Transmittal Of Schedule CT K 1

- No contact contract form

- Abc antecedent behavior consequence analysis chart form

- Petition for admissions iuk form

- Core vocabulary assessment pdf form

- Ferpa recommendation form external oregon state university oregonstate

- Luke preschool form

- College research worksheet for high school form

- Protocol education printable paper timesheet form

Find out other Form CT K 1T, Transmittal Of Schedule CT K 1

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple