Nys 45 Instructions Form

Understanding the NYS 45 Instructions

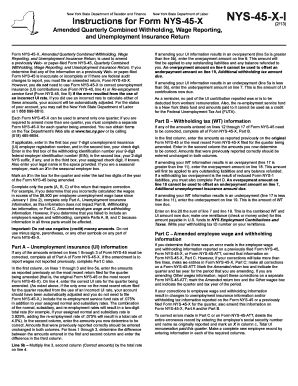

The NYS 45 instructions provide essential guidance for employers in New York State regarding the filing of quarterly wage reports. This form is crucial for reporting employee wages and withholding taxes. Understanding the instructions ensures compliance with state regulations and helps avoid penalties. The instructions outline the necessary information required, including employee details, wages paid, and tax withholdings. Familiarizing yourself with these requirements is vital for accurate reporting.

Steps to Complete the NYS 45 Instructions

Completing the NYS 45 requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary employee information, including names, Social Security numbers, and wages paid during the reporting period.

- Fill out the form accurately, ensuring that all figures are correct and match your payroll records.

- Review the completed form for any errors or omissions before submission.

- Submit the NYS 45 electronically or via mail, depending on your preference and compliance requirements.

Legal Use of the NYS 45 Instructions

The NYS 45 instructions are legally binding and must be followed to ensure compliance with New York State tax laws. Employers are required to submit this form quarterly, and failure to do so can result in penalties. Understanding the legal implications of the instructions helps protect your business from potential fines and legal issues. It is important to maintain accurate records and ensure timely submissions to comply with state regulations.

Filing Deadlines for the NYS 45

Filing deadlines for the NYS 45 are critical for maintaining compliance. Employers must submit the form quarterly, with specific deadlines for each quarter:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Meeting these deadlines is essential to avoid late fees and penalties.

Form Submission Methods for the NYS 45

The NYS 45 can be submitted through various methods, providing flexibility for employers. The available submission methods include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper form to the designated address for NYS 45 submissions.

- In-person submission at local tax offices, if applicable.

Choosing the right method can streamline the filing process and ensure timely compliance.

Required Documents for the NYS 45

Before completing the NYS 45, employers should gather the following documents:

- Employee payroll records for the reporting period.

- Tax identification numbers for both the employer and employees.

- Any previous NYS 45 forms filed, if applicable.

Having these documents ready will facilitate a smoother completion of the form and help ensure accuracy.

Quick guide on how to complete nys 45 instructions

Accomplish Nys 45 Instructions seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Nys 45 Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign Nys 45 Instructions effortlessly

- Find Nys 45 Instructions and click Obtain Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the details and click the Finish button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Nys 45 Instructions and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys 45 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys 45 x form?

The nys 45 x form is a critical document for businesses operating in New York, used for reporting annual employee wages and taxes. airSlate SignNow simplifies the process of preparing and submitting this form with its intuitive eSigning features, ensuring compliance and accuracy.

-

How does airSlate SignNow assist with the nys 45 x process?

airSlate SignNow streamlines the nys 45 x submission process by allowing users to electronically sign and send documents securely. Our platform helps businesses complete the form faster, reducing the risk of errors and enhancing efficiency in document management.

-

Is airSlate SignNow cost-effective for handling nys 45 x forms?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet the needs of various businesses. By using our service to manage nys 45 x forms, companies can save both time and money, making it a smart investment for their document needs.

-

What are the key features of airSlate SignNow for nys 45 x management?

Key features of airSlate SignNow for managing nys 45 x forms include easy document upload, customizable templates, and secure eSignature capabilities. These tools ensure that businesses can efficiently manage their paperwork while maintaining full compliance.

-

Can I integrate airSlate SignNow with other tools for nys 45 x management?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, enhancing productivity for nys 45 x management. This integration capability allows users to connect with their favorite applications for a smoother workflow.

-

How secure is the handling of nys 45 x documents on airSlate SignNow?

Security is a priority at airSlate SignNow. We implement advanced encryption and security protocols to protect all nys 45 x documents, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

Does airSlate SignNow offer customer support for nys 45 x users?

Yes, airSlate SignNow provides comprehensive customer support for users handling nys 45 x forms. Our team is available to assist with any inquiries, ensuring that businesses can efficiently navigate the signing and submission process.

Get more for Nys 45 Instructions

- Aadhar declaration idfc bank form

- Brat diet eating after an upset stomach or vomiting familydoctor org form

- Little league baseball game pitch log ll production uploads form

- Kmf application no form

- Bronx community college transcripts form

- Irs form 3520 instructions

- Manager managed llc operating agreement template form

- Manager managed operating agreement template form

Find out other Nys 45 Instructions

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now