Irs Form 3520 Instructions 2022

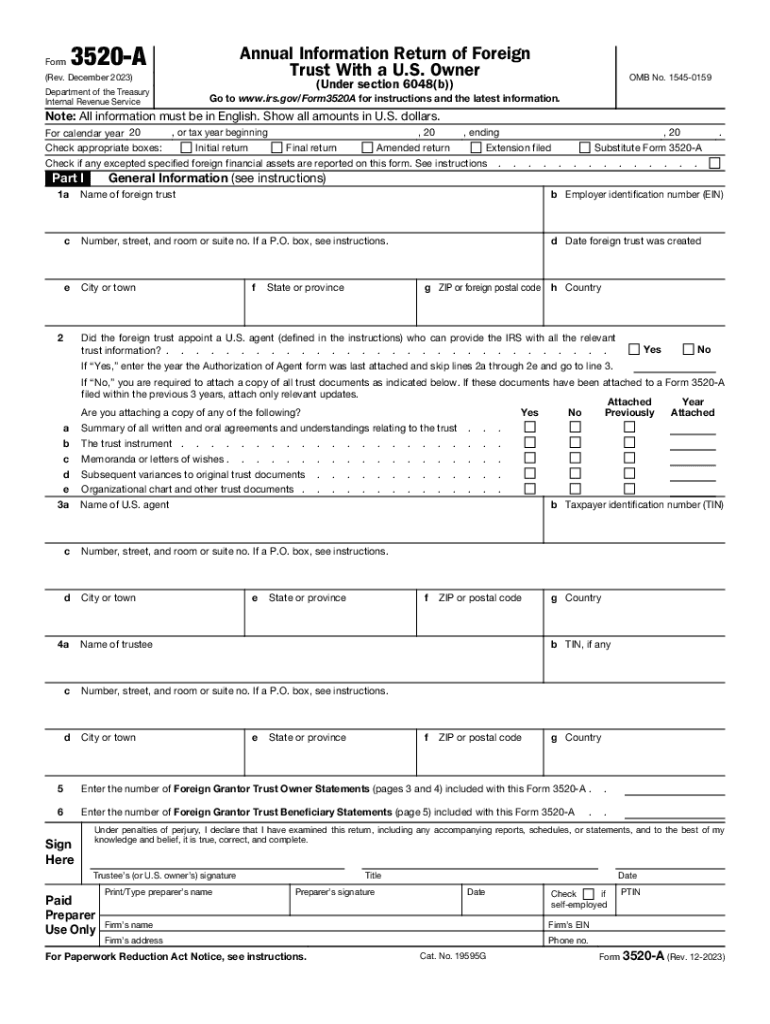

What is the IRS Form 3520?

The IRS Form 3520 is a tax form required for U.S. taxpayers who receive certain foreign gifts or are involved with foreign trusts. This form is crucial for reporting transactions with foreign entities, ensuring compliance with U.S. tax laws. It is important for individuals who have received gifts exceeding a specific threshold or those who are beneficiaries of foreign trusts to understand the implications of this form.

Key elements of the IRS Form 3520 Instructions

The instructions for IRS Form 3520 outline essential information regarding the completion and submission of the form. Key elements include:

- Filing requirements: Understanding who must file the form based on their financial transactions.

- Reporting thresholds: Specific amounts that trigger the requirement to file, particularly for foreign gifts.

- Information required: Details needed about the foreign trust or gift, including the identity of the donor or trust.

- Penalties for non-compliance: Potential consequences for failing to file or for filing inaccurately.

Steps to complete the IRS Form 3520 Instructions

Completing the IRS Form 3520 involves several steps to ensure accurate reporting. These steps include:

- Gather necessary documents: Collect all relevant information about foreign gifts or trusts.

- Fill out the form: Complete the form accurately, providing all required details.

- Review for accuracy: Double-check all entries to avoid mistakes that could lead to penalties.

- Submit the form: File the form by the due date, either electronically or via mail.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 3520 are critical to avoid penalties. Generally, the form is due on the same date as your income tax return, which is typically April 15. However, if you file for an extension on your tax return, the deadline for Form 3520 may also be extended. It is essential to stay informed about any changes to these deadlines to ensure timely submission.

Penalties for Non-Compliance

Failure to file IRS Form 3520 or filing it inaccurately can result in significant penalties. The IRS imposes a penalty of up to $10,000 for failing to report a foreign gift or trust. Additionally, if the failure is deemed intentional, the penalties can increase substantially. Understanding these risks is crucial for taxpayers involved with foreign entities.

How to obtain the IRS Form 3520 Instructions

The IRS Form 3520 instructions can be obtained directly from the IRS website. The instructions are available in PDF format, allowing taxpayers to download and print them for reference. Additionally, tax professionals can provide guidance and assistance in interpreting the instructions, ensuring compliance with all requirements.

Quick guide on how to complete irs form 3520 instructions

Easily Prepare Irs Form 3520 Instructions on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Irs Form 3520 Instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign Irs Form 3520 Instructions Effortlessly

- Locate Irs Form 3520 Instructions and click on Get Form to commence.

- Utilize the available tools to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Form 3520 Instructions to ensure seamless communication throughout every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 3520 instructions

Create this form in 5 minutes!

How to create an eSignature for the irs form 3520 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 IRS 3520 form, and why is it important?

The 2020 IRS 3520 form is a crucial tax document used by U.S. taxpayers to report certain transactions with foreign trusts. It's important because failing to file can result in signNow penalties, making it essential for anyone involved with foreign trusts to understand and manage this form properly.

-

How can airSlate SignNow assist with the 2020 IRS 3520 form?

airSlate SignNow streamlines the process of preparing and signing your 2020 IRS 3520 form by providing an easy-to-use electronic signature solution. This ensures that all necessary signatures are collected promptly, reducing delays and improving compliance with IRS regulations.

-

Is airSlate SignNow cost-effective for filing the 2020 IRS 3520?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals needing to manage their 2020 IRS 3520 documents. With flexible pricing plans, users can choose the level of service that fits their needs without breaking the bank.

-

What features does airSlate SignNow offer for handling forms like the 2020 IRS 3520?

airSlate SignNow provides several features beneficial for the 2020 IRS 3520, including customizable templates, secure cloud storage, and real-time collaboration tools. These features facilitate efficient document management, making it easier to complete necessary tasks.

-

Can I integrate airSlate SignNow with other software for managing the 2020 IRS 3520?

Absolutely! airSlate SignNow easily integrates with a variety of software platforms, enhancing your ability to manage the 2020 IRS 3520 form alongside financial or tax software. This integration simplifies your workflow and improves accuracy in your document submissions.

-

What are the benefits of using airSlate SignNow for the 2020 IRS 3520 form?

Using airSlate SignNow for the 2020 IRS 3520 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signature process also speeds up the signing and submission, minimizing the stress associated with tax filing.

-

How secure is airSlate SignNow when handling the 2020 IRS 3520 form?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance protocols to protect your 2020 IRS 3520 form and personal information. You can trust that your documents are safe while you manage your tax obligations.

Get more for Irs Form 3520 Instructions

- Dr 1151 amend of agreement on claiming tax exemption for children 10 15 domestic relations form

- Alaska anchorage veterans court form

- P 339 form

- Dr 485 alaska court records state of alaska form

- Pub 9 misdemeanor arraignments 12 08 misdemeanor arraignment publication form

- Download the pdf file alaska court records state of alaska 6967382 form

- P 331 order starting formal probate and appoint pr no will 8 15

- Alaska dr323 form

Find out other Irs Form 3520 Instructions

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself