Loan Application Form PDF Download

Understanding the ASA Loan Application Form PDF Download

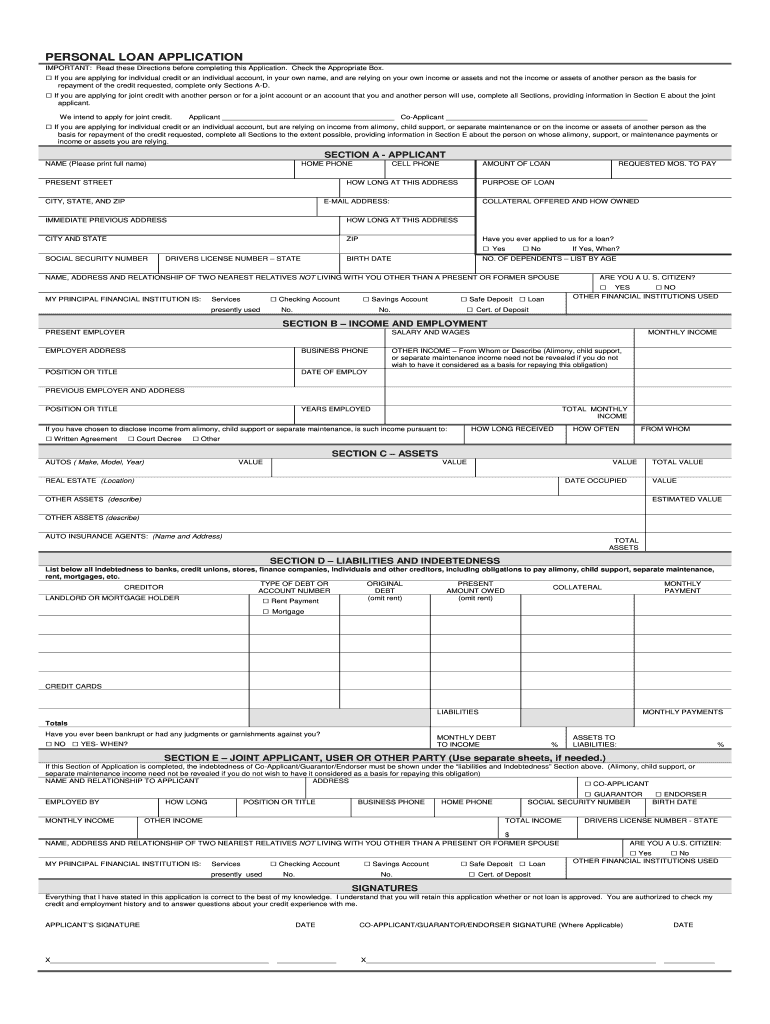

The ASA loan application form is a crucial document for individuals seeking financial assistance through ASA lending. This form is available in a PDF format, which allows for easy downloading and printing. The PDF version ensures that users can fill out the form at their convenience, whether at home or in a public space. It is essential to have this form completed accurately to avoid delays in the loan approval process.

Steps to Complete the ASA Loan Application Form PDF Download

Completing the ASA loan application form involves several key steps to ensure accuracy and compliance with lending requirements. First, download the form from a reliable source. Next, gather all necessary information, including personal identification details, financial information, and employment history. Carefully fill out each section of the form, ensuring that all information is accurate and up-to-date. After completing the form, review it thoroughly for any errors or omissions before submitting it.

Required Documents for the ASA Loan Application

When applying for an ASA loan, several documents are typically required to support your application. These may include:

- Proof of identity, such as a government-issued ID or driver's license.

- Proof of income, such as recent pay stubs or tax returns.

- Bank statements to verify financial stability.

- Employment verification letters, if applicable.

Having these documents ready can streamline the application process and improve the chances of approval.

Legal Use of the ASA Loan Application Form PDF Download

The ASA loan application form, when completed and signed, serves as a legally binding document. It is essential to understand that electronic signatures are recognized under U.S. law, provided they comply with the ESIGN Act and UETA. This means that submitting the form electronically, using a secure platform, can be just as valid as a handwritten signature. Ensure that you follow all legal guidelines to maintain the integrity of your application.

Application Process and Approval Time for ASA Loans

The application process for ASA loans typically involves submitting the completed loan application form along with required documents. Once submitted, the lender will review your application, which may take anywhere from a few days to a couple of weeks, depending on the lender's policies and the completeness of your application. It is advisable to stay in touch with the lender during this period to address any questions or additional requirements that may arise.

Eligibility Criteria for ASA Loans

Eligibility for ASA loans generally depends on several factors, including credit history, income level, and employment status. Lenders may also consider your debt-to-income ratio and any existing financial obligations. Meeting the eligibility criteria is crucial for a successful application, so it is beneficial to review these requirements before submitting your ASA loan application form.

Quick guide on how to complete personal loan applications form

Prepare Loan Application Form Pdf Download effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed forms, allowing you to access the right template and securely save it online. airSlate SignNow provides all the features necessary for you to create, modify, and electronically sign your documents promptly without delays. Manage Loan Application Form Pdf Download on any device through airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and electronically sign Loan Application Form Pdf Download with ease

- Obtain Loan Application Form Pdf Download and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign Loan Application Form Pdf Download to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I apply online for an instant personal loan?

Faced with an unexpected financial requirement? One of the quickest and smoothest solutions that you can get via a formal channel would be to avail of a personal loan. Like other loan products, banks and financial institutions (including NBFCs) offer a personal loan by applying in person, but with advanced technology a loan can be made available to you literally at the click of a button.Most of the larger banks in India offer a personal loan online, simplifying the process such that not only is it hassle-free, but the loan is sanctioned within a few hours, cutting down on processing time signNowly. Let’s take a quick look at the process, should you want to apply online.Step 1: Log on to the lender’s website.Step 2: Fill in a simple, easy-to-use online application form. Depending on whether you are salaried or self-employed, the information will differ.Step 3: Check your eligibility online.Step 4: Once your application is approved, the money will be credited to your account via an online transfer. Some lending institutions disburse loans within 72 hours, following a small 5-minute approval process. Hence before you apply for a loan, compare loan offerings across lenders before you make the decision to proceed.What you should know:Most lenders offer online loans of up to Rs. 25.0 lacs, with loan repayment tenures ranging from between 24 months to 60 months.Make use of online personal loan EMI calculators, that help you approximately gauge the amount you would need to repay month on month towards your loan.Once you have availed of a loan, lenders provide you online access to help you track your loan – right from personal details to complete loan information including g the repayment schedule, interest certificate and other relevant details.Check for any offers or promotions that the lender may have going at the time you apply, to ensure you get yourself the best deal out there. For example: discounted interest rates or lower processing fees for a certain promotional period, or as an ongoing offer for employees of category A companies (as defined by the lender).And finally…Do keep in mind that any loan you avail of needs to be repaid in a timely manner, to ensure that your credit score is not impacted negatively. With this information at hand, go ahead and live your dream!

-

How much time will it take for my personal loan to get approved?

(1) Check the loan eligibility criteria before applyingIt’s essential to check whether you are able to meet the personal loan eligibility criteria of the lender you wish to borrow from. Most of the lenders require applicants to be in a particular age group, preferably between 21 and 65 years. Moreover, you must annually earn a minimum amount that is specified by the lender. Also, you should not have any outstanding defaults on loans or on any of your credit cards.(2) Check your credit scoreIf you are not attentive of your credit score while applying for a personal loan, your loan application might get rejected. Obtain your credit report, so as to identify your credit score and rectify errors, if any. A decent credit score not only increases your chances of loan approval but also helps you grab an attractive interest rate.(3) Avoid multiple applicationsApplying for a loan at numerous places is not a good idea. The probability of getting your loan application approved is less in such cases. Also, rejection of multiple loan applications will influence your credit score.(4) Provide truthful informationLoan providers verify the information provided by you through supporting documents. They may possibly give you a call to verify your information personally. Therefore, you must provide factual information about your residential details, annual income, past loan repayments etc.(5) Aim for a realistic loan amountOften, many borrowers apply for an extremely huge amount and get rejected by the lender. It is crucial to recognize how much you need to borrow. Apply for a loan amount based on your capability to repay the amount. Most lenders conduct a check of your income and repayment ability before approving your loan. Thus, aim for a reasonable amount in order to avoid loan rejection.Now, you can conveniently assess your personal loan eligibility or EMI using utility tools like personal loan eligibility calculator& personal loan EMI calculator at Compare and Apply For Loans in India, Best Car Loan, Home Loan in Delhi/NCR Noida Jan 2018. The calculator will help you to determine your factual loan amount, EMI outflow every month including the interest rate you need to pay. Using the calculator at afinoz.com is free, easy and simple.(6) Maintain work stabilityLending institutions require loan applicants to have a stable job history. Many lenders require the borrower to have at least two years of work experience in a particular job. Thus, avoid switching jobs frequently if you are planning to apply for a personal loan. Constancy in the job helps in assuring that you have a steady source of income.

-

How do I apply for a personal loan?

It is very simple to apply for a personal loan and the process gets easier if the application is made online. You have to first figure out which financial institution you need the loan from. Next, go their website and fill out the personal loan application form by keying in personal, financial, and employment details. Once you submit the online form, select the loan amount and tenor that you require.These procedures hardly take a few minutes and you will get online approval instantly. Once you get an approval, a representative from the financial institution will get in touch with you; to whom you have to submit the required documents. If you apply for a personal loan Bajaj, you can even get the loan amount in your bank within 24 hours of loan approval subject to meeting the eligibility criteria and verification of the required documents.Eligibility Criteria:The eligibility criteria to get the loan application approved are from most of the reputed financial institutions are as follows:Aged between 23 to 55 years of ageSalaried employee in an MNC, public or private companyResident of IndiaDocuments required:You need the following documents to apply for a personal loan:KYC documentsEmployee ID cardSalary slips of the previous two monthsBank account statement of your salary account for the last three monthsAs long as your documents are authentic and you meet the eligibility criteria, applying for a personal loan is extremely straightforward.Additional watch:

-

Are personal loans taxable in India?

No. The funds received from personal loans are not counted in your taxable income. This is because these funds are ‘borrowed’ and not part of your income. However, if the lender is not a registered lender, then they might fall under taxable income in your IT Returns. This is why it’s best you borrow funds from a registered bank or non-banking financial institute.On the other hand, the interest you pay on personal loans can be used to avail deductions on your taxable income. Yes, that’s right – you can actually benefit from the interest rate of a personal loan. This silver lining is applicable in the following conditions:1. Purchase/construction/repair of a home.Under the purview of Section 24 of the Indian Income Tax Act, the interest amount paid towards a personal loan that is used to purchase, construct or repair a home can be used to claim equal deduction on taxable income. All you have to do is prove that the funds were used for one of these causes. However, there might be come capping on the amount you can claim as deductions.2. Education:If you use the funds of a personal loan to cover education costs, you can the interest amount paid in a year to claim equal deductions on your taxable income. However, unlike the case of a home purchase or construction or repair, there is capping on the amount you can claim.3. Business: If you are going to invest the funds acquired from a personal loan into your business, then, you can show the personal loan as expenses. This will reduce your net profit and, in turn, reduce your tax liability. On other hand, if you use the funds to buy assets, then you use the interest amount to claim equal deductions.How do I apply for a personal loan?Applying for a personal loan has become easier & easier over the years. Now, you can go from application to approval and even get sanctions in a single day! This is all thanks to the internet and the wonders it has made possible. Therefore, if you are planning on borrowing a personal loan, you can rest assured that things will be super easy as long you follow the below steps:1. Go online: Sure, you could visit a branch or make a trip to your bank. But this would mean enduring the real-world annoyances of filling out forms, submitting paperwork, standing in line, etc. You can skip all this by going online. All you have to do is visit your preferred lender (after doing a detailed comparison) and find the ‘apply now’ button.2. Fill out the forms & upload your documents: Upon hitting the ‘apply now’ button, you should be redirected to an application form. Just fill in the required details and hit submit. The next step with most lenders would be to scan and upload the required documents.3. Get approvals: Once you’ve filled the form & submitted the documents, the lender will evaluate your request and if all is in place, they will approve your application. Then all you have to do is wait for the funds to arrive in your account.If you are still at the consideration phase, then you should try visiting a personal loan aggregator site. These sites will present you a detailed comparison of all the options available in the market. They will also have pre-negotiated deals that lenders won’t provide if your approached them directly. Once you zero in on the loan product you want, you can also apply through these sites in a process similar to the one described above.

-

How easy is it to get a personal loan?

Many fintech companies understand your needs and importance of time. They come up with easy personal loans with easy documentation and sanction to help you in an emergency situation and not to harass you with the tedious application process.Let's understand some features of quick loans via the app:Speedy Processing: The loan will be approved within 5-10 mins as it offers you e-approval. If you hold a good social quotient score, credit score, income stability and requisite salary slab the loan is approved and disbursed to your bank account in 24-48 hours.Low-Interest Rates: Fintech firms offer low and attractive interest rates compared to banks and credit unions. Usually, the interest rate ranges from 16-22% and there is a mere processing fee on it. The rate will be based on loan amount, tenure, income.No Collateral: If you're worried what all things you will have to keep collateral to get a loan then just remove it from your minds. You can borrow collateral free loan amount up to Rs 2 lakhs from some of the leading fintech companies in India.Secure Platform: Reputed Fintech companies will respect and understand your privacy. They will never share your personal details with anyone. They safeguard customer information, a transaction that happens on the website through a secure server and data encrypt which is tough to break.24 X 7: The best part of quick loans online is you don't have to apply it during business hours. You can anytime download an app, fill up the form and hit the 'SUBMIT' button. Within a couple of minutes, you will know the status of your loan and if it’s approved you can ask an executive to collect the documents from the place of your convenience. Once you hand over a signed copy of your form to the executive, the loan amount will be disbursed to your bank account within 24-48 hours.Don’t let financial obstacles put a brake on your dreams. Instead, download an app and apply for easy personal loans now.

-

Where can I get personal loan in bangalore?

Bangalore is the metro city. Here you can get easily your personal loan. There are many banks and NBFCs to apply for loans.As my experience I got good response and immediate loan from Finance Buddha. Finance Buddha is a NBFC you will good response from them. So I always suggest to go for personal loan with Finance Buddha.Here Only you need to submit the application and you should have good credit score above 750, income should be 50000 per month.

-

How do people manage to take loans out in other people's names?

The way I describe is the professional method. This won't cause the perpetrator to become a suspect unless they are stupid. Many people have easier ways, but they get caught.The first thing that a person would need is a profile of another person.That includes their name, birthdate, drivers license number, maiden name, physical description, bank account numbers, SSN, birth certificate and anything else they could get on that person.They then commit that person's details to memory so that they can answer questions easily. They will also pay a very large amount of money to get a serious fake ID. Banks and government agencies are good at exposing a fake ID, so the one they need will be flawless. This could cost from $5000 to $10000.From there they go into a bank and open an account. They may need employment history for that. From there they will sit on the account for a while before they take out any signNow loans. When they do take out the loan, its gonna be large. At least $40000.Then they don't pay and disappear.

-

What is the best thing you've looked forward to in your life?

Getting my medical license.The process is so painful that sometimes I feel like stabbing myself in the heart and gouging my eye out, and jumping off a bridge at the same time. And the most frustrating part of it is that there’s not a single thing I can do to speed things up.The website isn’t very user friendly.They request way too many documents. Like, you need to submit 6 different things to prove your citizenship. Can’t it be assumed that if the Federal Government gave me a passport, they know that it’s because I’m a citizen? Can’t it also safely be assumed that if I graduated from a residency program, I must have graduated from a medical school at some point?The website doesn’t tell you everything you need to send. After you’ve filled out the application online, there is a PDF you’re supposed to find somewhere. The PDF was the old application form. You’d fill it out by hand or by editing the PDF. If you did that, you’d see an number of appendices that told you what other documentation you were supposed to supply. But if you apply online, there’s nothing to let you know what you’re missing. So, you have to call them. When you do, they tell you that you need a bunch of stuff you’d never have guessed: a background check, forms you’re supposed to submit to your residency programs, etc. Why not put that in the online application?Then, after you do all that, you might wonder if your file is complete. So, you call. They’ll tell you that your application hasn’t been processed yet. How long till it gets processed? 3 to 4 weeks! So, they won’t even look at your file for 3 to 4 weeks. And, 3 to 4, of course, means 4. Then, when they look at your file, it might even be week 5 by the time they respond to you. At that point, they’ll tell your that your file is missing some stuff.You ask for clarification about the missing stuff, because you’re pretty sure you’ve already sent it. You hear nothing back for a week. You call them, only to hear that they thought they’d emailed you what you were supposed to fill out… You submit what they’re asking for, having wasted another week waiting. Then, they tell you that your file has been submitted for final approval. YAY!Then you’re told that, since you used to be a nurse, you should also submit a nursing license verification. Okay, no biggie, you think. You did a similar thing for Iowa a few years back. You’ll just go online and have the state of Michigan send the state of Tennessee some information about the nursing license that expired 6 years ago.You get on the Michigan website, and things are so disorganized that you can’t for the life of you figure out how to submit the verification request. Oh, and the process has changed. In 2015, you could use the Nursys verification site. But Michigan has pulled out of this process, because… just because. Now, you have to call during business hours, realize that you’re supposed to download and fill out a form, attach a money order (you can’t pay online anymore), and mail it to a P.O. Box.You do that, sending it by express mail. You call the next day to see if it’s been received. Now you’re told that if you want to send things by express mail, there’s another address you should have sent it to, an address that was never communicated to you when you talked to the Michigan people on the phone. You learn that sending mail to the P.O. Box means that it will sit there for a week, after which it will be processed by the Cashier’s office/Finance office/Treasury office, then slowly make its way to the Bureau of Licensing… this process might take 2 weeks. At this point, you’ve sent your initial application 8 weeks before. You wonder why it is that the process couldn’t be more streamlined. Why couldn’t they be a uniform process for all states? Why couldn’t they at least be a central database where healthcare providers could send their documentation, so that whenever they apply for licensing in a new state, that state can immediately receive all the relevant documentation. You’re powerless. You try to think of other things you might do.You remember that Iowa must have a copy of your nursing verification license. You wonder if you could talk to them and see if they’d share it with you. You’re told that they will emphatically not release the document to you. Why? Who knows. Anyway, they might consider releasing it to the Tennessee people if they are contacted directly by their Medical Board. You sheepishly ask the people in Tennessee if they’d be willing to contact Iowa, giving them a phone number, email, and fax number, knowing full well that it will be to no avail.You decide that maybe, if you were to track down the cashier’s office in Michigan, you could fly there and make the payment in person, in a bid to speed up the processing of your license verification request. It’s after hours now, so you can’t be sure. There’s a plane early in the morning. You could fly to Detroit, rent a car, drive to Lansing, and give it a shot. But… what if it doesn’t work? You decide to wait until the morning and call the office to see if getting there in person would make a difference. You are told that it is impossible to make a payment in person, because… rules. There’s literally not a damn thing you can do.And that, my friends, is the story of my life right now. The most frustrating part of this saga is that not only can I not work, but I’m sort of homeless right now. Let me explain. A while back, I bid on a house. I used what is called a physician loan. What my lender did not tell me is that you need an active medical license. So, we were a week from the closing date before I learned this. At this point, I had three options:Walk away from the home purchase and rent. This wouldn’t have been a terrible idea.Prolong my temporary lease at the place I was renting. I would not do this because I hated, hated, hated them with their nickle-and-diming tactics.Wait for my license.I opted for number 3, because I thought it couldn’t take much longer until I’d get my license. My belongings are currently in storage. I’m staying with my sister in Florida. It’s not the worst thing that’s ever happened to anyone in human life, but it’s still really frustrating. The only bright spot is that I get to spend time with my family. I have a nephew and two nieces here that I hadn’t seen in 9 months. They’re growing so very fast. I am constantly peppering them with mental math questions, but they seem to love me for some reason. So, all in all, things could be worse.

-

How did bank managers and staff in India treat you whenever you approach them for some loans?

When I was making plans to go to the USA to attend graduate school, my father and I went to different banks asking for education loan.At that time, my father made just enough to support our family and all he has is a small house. No Savings or any other property.The home value is more than the loan amount we requested for. Most of the banks turned us down and I almost gave up on my dream to go to Grad school.I went to Andhra bank near my area. This was a new branch and I just went to try my luck. The bank manager is a soft-spoken person. He asked me for my details and other stuff. He told me that he can’t guarantee a loan until the appraisal is done.Two days later, he called me telling that the appraiser is in town and they want to see my home to estimate it’s value. I called my dad and they got the appraisal done. The manager looked into my study certificates and told me that he will do his best to get the loan approved.He went above and beyond his duty and got the loan approved. I got my loan papers and the next day, he got transferred to a different branch.I finished my Master’s degree and now, I am having a good job. I called the manager to convey my thanks for his help. He told me that he is really happy for me and that I was the first one who got an education loan from the new branch.Thank you, Sir!!!!

Create this form in 5 minutes!

How to create an eSignature for the personal loan applications form

How to create an eSignature for your Personal Loan Applications Form online

How to generate an electronic signature for your Personal Loan Applications Form in Google Chrome

How to make an eSignature for putting it on the Personal Loan Applications Form in Gmail

How to make an electronic signature for the Personal Loan Applications Form straight from your smartphone

How to make an eSignature for the Personal Loan Applications Form on iOS

How to generate an eSignature for the Personal Loan Applications Form on Android OS

People also ask

-

What is the Loan Application Form Pdf Download feature in airSlate SignNow?

The Loan Application Form Pdf Download feature in airSlate SignNow allows users to easily create and download customizable loan application forms in PDF format. This feature streamlines the application process and ensures that all necessary information is collected efficiently. With our platform, you can easily design forms that meet your specific requirements before downloading them as PDFs.

-

How can I download a Loan Application Form using airSlate SignNow?

To download a Loan Application Form Pdf, simply create your form using our intuitive interface, fill in the necessary details, and then choose the download option. airSlate SignNow ensures that your form is saved in a convenient PDF format, allowing you to share it with clients or keep it for your records. This process is quick and user-friendly, making it accessible for everyone.

-

What are the benefits of using airSlate SignNow for loan applications?

Using airSlate SignNow for your loan applications offers numerous benefits, including the ability to create and download forms in PDF format quickly. Our platform not only simplifies the process of managing loan applications but also integrates eSigning capabilities, which enhances the overall efficiency and security of your transactions. This makes it an ideal solution for businesses looking to streamline their loan processing.

-

Is there a cost associated with the Loan Application Form Pdf Download feature?

While airSlate SignNow offers various pricing plans, the ability to download a Loan Application Form Pdf is included in all subscription tiers. This means you can access this feature at an affordable rate, tailored to your business needs. Investing in our service not only gives you access to form downloads but also to a suite of tools that enhance document management.

-

Can I integrate airSlate SignNow with other applications for loan processing?

Yes, airSlate SignNow offers seamless integrations with various applications commonly used in loan processing, such as CRM systems and accounting software. This allows for a more streamlined workflow when managing your loan applications. By integrating these tools, you can easily download and manage your Loan Application Form Pdf alongside other business operations.

-

What security measures does airSlate SignNow have for loan applications?

airSlate SignNow takes security seriously, employing industry-standard encryption and authentication processes to protect your loan application data. When you use our platform to download a Loan Application Form Pdf, you can rest assured that sensitive information is safeguarded against unauthorized access. Our commitment to security ensures that your documents remain confidential and secure.

-

Can I customize my Loan Application Form before downloading it?

Absolutely! airSlate SignNow provides a variety of customization options for your Loan Application Form, allowing you to tailor it to your specific needs. You can add or remove fields, change layouts, and include branding elements before downloading the form as a PDF. This flexibility ensures that your application forms align with your business's requirements.

Get more for Loan Application Form Pdf Download

Find out other Loan Application Form Pdf Download

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free