Irs Response Letter Template Form

What is the IRS Response Letter Template

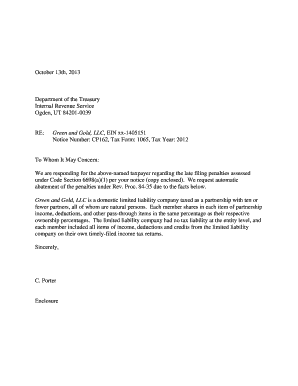

The IRS response letter template is a structured document used by taxpayers to reply to a CP2000 notice. This notice is issued by the Internal Revenue Service when there are discrepancies between the income reported on a tax return and the information received from third parties, such as employers or financial institutions. The template serves as a formal means for taxpayers to clarify, dispute, or acknowledge the discrepancies noted by the IRS. Utilizing this template can help ensure that the response is organized and contains all necessary information, which is crucial for a successful resolution.

Key Elements of the IRS Response Letter Template

When preparing an IRS response letter, certain key elements must be included to ensure clarity and compliance. These elements typically consist of:

- Taxpayer Information: Include your name, address, and Social Security number or taxpayer identification number.

- IRS Notice Details: Reference the CP2000 notice number, date received, and tax year in question.

- Explanation of Discrepancies: Clearly outline the discrepancies noted by the IRS and provide a detailed explanation or correction.

- Supporting Documentation: Attach any relevant documents that support your claims or corrections, such as W-2s, 1099s, or other income statements.

- Signature: Include a signature and date to validate the response.

Steps to Complete the IRS Response Letter Template

Completing the IRS response letter template involves several important steps to ensure accuracy and compliance:

- Gather all relevant tax documents, including the CP2000 notice and any supporting evidence.

- Fill in your personal information at the top of the letter, ensuring it matches IRS records.

- Clearly reference the discrepancies noted in the CP2000 notice, providing a point-by-point response.

- Attach supporting documents that validate your claims or corrections.

- Review the letter for clarity and completeness before signing and dating it.

- Submit the letter to the address specified in the CP2000 notice, either by mail or electronically, if applicable.

Legal Use of the IRS Response Letter Template

The IRS response letter template is legally recognized as a formal communication with the IRS. To ensure its legal validity, it must comply with specific guidelines set forth by the IRS. This includes providing accurate information, responding within the required time frame, and including all necessary documentation. By adhering to these legal requirements, taxpayers can protect their rights and ensure that their responses are considered in the resolution process.

Examples of Using the IRS Response Letter Template

Utilizing the IRS response letter template can take various forms based on individual circumstances. Here are a few examples:

- A taxpayer who received a CP2000 notice due to unreported income can use the template to provide documentation of income that was mistakenly omitted.

- In cases where a taxpayer disagrees with the IRS findings, the template can be used to present evidence supporting their position, such as corrected tax forms.

- For taxpayers who acknowledge discrepancies but wish to request a payment plan, the template can be adapted to include a request for consideration of their financial situation.

Quick guide on how to complete irs response letter template

Effortlessly prepare Irs Response Letter Template on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditionally printed and signed papers, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Response Letter Template on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Irs Response Letter Template with ease

- Obtain Irs Response Letter Template and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you select. Edit and electronically sign Irs Response Letter Template to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs response letter template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CP2000 response letter sample?

A CP2000 response letter sample is a template that helps individuals and businesses craft a formal response to the IRS regarding a CP2000 notice. This type of letter is crucial for addressing discrepancies in reported income or tax owed. Utilizing a sample can streamline your response process and ensure you include all necessary information.

-

How can airSlate SignNow help with sending a CP2000 response letter sample?

airSlate SignNow provides an efficient platform to create, send, and eSign a CP2000 response letter sample. Our easy-to-use interface allows users to quickly customize templates and securely deliver them to the IRS. This saves time and minimizes the chances of errors in your communication.

-

Are there specific features in airSlate SignNow that assist with document signing?

Yes, airSlate SignNow offers features specifically designed for document signing, including eSignature options, document templates, and audit trails. These features are particularly useful when handling a CP2000 response letter sample, ensuring that your response is legally binding and tracked throughout the process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to fit various business needs, making it a cost-effective solution for managing documents like a CP2000 response letter sample. Plans typically include features such as unlimited eSigning, integrations, and advanced security measures. It's advisable to review our website for the latest pricing details and promotions.

-

Can I integrate airSlate SignNow with other software for managing tax documents?

Absolutely! airSlate SignNow offers integrations with various software, including popular accounting and tax management tools. This makes it easy to manage your CP2000 response letter sample alongside other critical documents, streamlining the overall workflow and enhancing productivity.

-

What are the benefits of using airSlate SignNow for creating a CP2000 response letter?

Using airSlate SignNow for your CP2000 response letter sample offers numerous benefits, such as ease of access to templates, electronic signing capabilities, and secure document management. Our platform also ensures compliance with legal standards, giving you peace of mind while responding to the IRS.

-

Is there customer support available if I need help with my CP2000 response letter sample?

Yes, airSlate SignNow provides customer support to assist you with any questions or issues related to your CP2000 response letter sample. Our support team is available via phone, email, or live chat, ensuring you have the help you need when crafting your response.

Get more for Irs Response Letter Template

Find out other Irs Response Letter Template

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe