Deduct Form

What is the payroll deduction form?

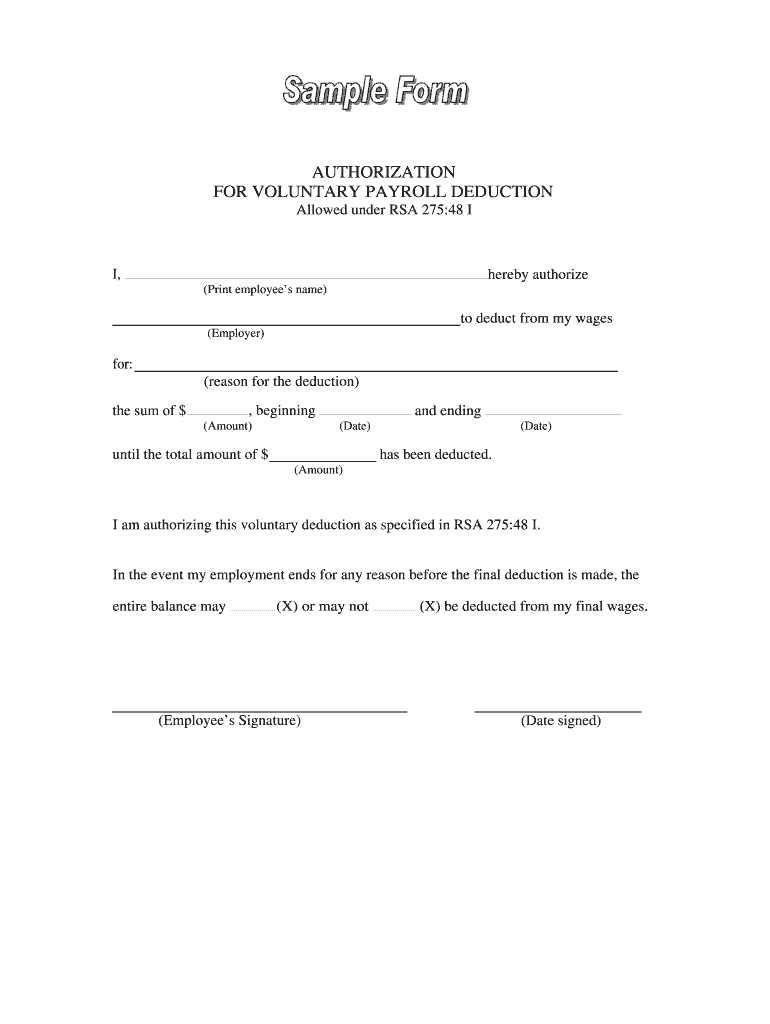

The payroll deduction form is a crucial document used by employers to authorize deductions from an employee's paycheck. This form allows employees to specify the types of deductions they wish to have taken from their wages, such as contributions to retirement plans, health insurance premiums, or other benefits. By completing this form, employees ensure that their preferences are accurately reflected in their payroll processing, which helps maintain transparency and compliance with employment laws.

Steps to complete the payroll deduction form

Completing the payroll deduction form involves several straightforward steps. First, employees should gather necessary information, including their employee ID, the specific deductions they wish to authorize, and any relevant account numbers. Next, they should accurately fill out the form, ensuring all sections are complete. It is essential to review the form for any errors before submission. Finally, employees must sign and date the form to validate their authorization, after which it should be submitted to the payroll department for processing.

Key elements of the payroll deduction form

A well-structured payroll deduction form typically includes several key elements. These include:

- Employee Information: Name, employee ID, and contact details.

- Deductions Authorized: Clear listing of each deduction type, such as health insurance or retirement contributions.

- Account Information: Necessary details for direct deposits or payment accounts.

- Signature and Date: Employee's signature to confirm authorization and the date of submission.

Legal use of the payroll deduction form

The payroll deduction form must comply with various legal standards to be considered valid. In the United States, employers must adhere to federal and state laws governing wage deductions. This includes obtaining written consent from employees for any deductions that are not mandated by law. Additionally, employers should retain copies of signed forms to ensure compliance with record-keeping regulations and to provide proof of authorization if needed.

Examples of using the payroll deduction form

There are various scenarios in which an employee might use a payroll deduction form. For instance, an employee may want to allocate a portion of their salary to a 401(k) retirement plan. Another example is an employee who wishes to have health insurance premiums deducted directly from their paycheck. Additionally, employees may use this form to authorize contributions to charitable organizations or flexible spending accounts for medical expenses.

Form submission methods

Employees can submit the payroll deduction form through various methods, depending on their employer's policies. Common submission methods include:

- Online Submission: Many employers offer digital platforms where employees can fill out and submit forms electronically.

- In-Person Submission: Employees may choose to hand in their forms directly to the payroll department.

- Mail Submission: Some employers may allow forms to be sent via postal mail, although this method may take longer for processing.

Quick guide on how to complete deduct form

Learn how to effortlessly navigate the Deduct Form completion with this simple guide

Submitting and signNowing documents online is becoming more widespread and is the preferred method for many users. It provides countless advantages over traditional printed documents, including convenience, time savings, improved accuracy, and security.

With tools like airSlate SignNow, you can find, edit, signNow, enhance, and dispatch your Deduct Form without getting caught up in endless printing and scanning. Follow this brief guide to begin and finalize your form.

Follow these steps to obtain and complete Deduct Form

- Begin by clicking the Get Form button to access your form in our editor.

- Observe the green label on the left indicating required fields to ensure you don’t overlook them.

- Utilize our expert tools to annotate, edit, sign, secure, and enhance your form.

- Secure your document or transform it into a fillable form using the appropriate tab features.

- Review the form and verify it for mistakes or inconsistencies.

- Select DONE to conclude editing.

- Change the name of your form or leave it as is.

- Choose the storage service you prefer for your form, send it via USPS, or click the Download Now button to retrieve your form.

If Deduct Form isn’t what you need, feel free to explore our extensive collection of pre-imported forms that you can complete with minimal effort. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

What are some skills that every 18-year-old needs to survive in life?

Oh my gosh, I love this question. I'm going to spend a lot of time on this answer!Financial Skills: How to open a checking and savings accountHow to balance a checkbook, emphasizing the use of debit cards and how banks process transactions"Credit" - What is it, how do you build it, how do you repair itCredit Cards - How interest works, how to take advantage of rewards and balance transfersLoans - What are the different kinds of loans, how do you get them, and what's involvedInvestments - What is the stock market and how does it work, what are Treasury Bonds, and what's an IRA. How do those things factor into a wise investment strategy for your retirement?Taxes - How taxes work, what deductions are, how to file a 1040EZ formTipping - How to quickly calculate a tip and split a tab at a restaurantHow to read a contract and interpret "fine print"Health Skills:Medical Insurance - how it works, what it costs, how to get itHow to fill out common medical and dental formsHow to find a general practitioner, dentist, and so onBasic First Aid - CPR, the Heimlich, how to treat minor injuriesHome Skills:How to cook! You don't need to be on Master Chef, but learning how to cook a few basic dishes, how to use a knife properly, use basic kitchen appliances, and so on.How to clean! I have no idea how so many kids don't know how to vacuum, sweep, dust, do dishes, make a bed, and clean and fold laundry.How to grocery shop - picking fresh fruit and vegetables, planning your shopping and meals, etc.How to use hand tools - hammers, axes, handsaws, et ceteraHow to move - opening or transferring utility accounts, moving companies, apartment and home leases.How to sew a button onHow to fix a running or clogged toilet.Life Skills:How to plan and budget your time!How to think critically.Negotiation - Preparation, discussion, clarification, negotiate, agreement, and implementation.Leadership! Vision, strategy, people skills, managementCONFLICT RESOLUTIONStress management!Problem solving!Study Skills:OrganizationTime managementFinding legitimate sourcesNote-takingCritical readingEssay planning and compositionAcademic referencingHow to use search engines effectively!Employability Skills:How to write a resume and a cover letterHow to interviewProfessional communications skills (both written and verbal)Interpersonal skills in a professional environmentProfessional developmentPublic speaking!How to use a computer - Windows, Google, and MS Office basics at a minimumPersonal:How to interact with the policeHow to tie a tie!How to iron clothesHow to establish a healthy exercise routineHow to maintain proper personal hygeine and groomingMANNERS - It varies from culture to culture, but the underlying principles of all manners remain constant: a respect for others, and a desire to treat all people with honesty and consideration – just as you’d like to be treated.Alcohol:Knowing your limitsHow to mix a basic set of drinksTravel: How to book airline tickets and hotelsHow to pack wellHow to travel lightAutomotive:How to drive - Actual skilled instruction on driving, a la Teen Safety & Survival - Skip Barber Racing School, both automatic and manual transmissionsThe basics of how a car worksThe basics of car maintenanceHow to change a tireHow to parallel parkHow to jump start a carWhat to do if you get into an accidentRead a road mapSex:Comprehensive sexual education including the vectors and effects of sexually transmitted infections, what are and how to use the various forms of contraception, what is PrEP, etc.The Campsite Rule - Leave them in better condition than you found themSafe, Sane, and Consensual - How to have safe sex, do it while you're sober, and with full informed consent from your partner.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

If a person is being sub contracted out for a job, and paid gross wages without any deductions, does he/she have to fill out the T2125 form?

If they are not on the company's payroll and are just being paid a gross amount with no deductions, that implies that they are a sub-contractor and have to report that income on the business statement (T2125). They would be responsible for paying their own taxes when they file their return.

-

While filling out the IBPS Clerk 2017 form, my transaction failed, but my money got deducted. What should I do so that I will get my money back?

H!Deducted money will be refunded automatically within 2–3 working days,till wait.And if you don’t get your money back within 2–3 days then consult them using their customer care number.

-

A payment was deducted from my bank account, but I have not received any confirmation in the process of filling out the NEET 2018 application form. What should I do?

First of all, do not panic!Here's the solution-Make an another payment through different gateway. While doing the transaction do not refresh the web page and do not go back to the previous page. Patiently and carefully follow the proper steps given in the Information BulletinEnter the correct OTP before the time runs out (basically 120 secs).When this payment is done successfully, your previous transactions amount will be refunded.Hope this helps :)

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

Create this form in 5 minutes!

How to create an eSignature for the deduct form

How to generate an eSignature for your Deduct Form online

How to make an electronic signature for the Deduct Form in Chrome

How to make an electronic signature for putting it on the Deduct Form in Gmail

How to generate an eSignature for the Deduct Form from your smart phone

How to generate an eSignature for the Deduct Form on iOS

How to make an eSignature for the Deduct Form on Android

People also ask

-

What is a Deduct Form and how can airSlate SignNow help?

A Deduct Form is a document used to claim deductions for tax purposes. airSlate SignNow simplifies the process of creating, sending, and signing Deduct Forms digitally, ensuring you can manage your tax documents efficiently and securely.

-

How does airSlate SignNow ensure the security of my Deduct Form?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry regulations. Your Deduct Form is protected at every step, from creation to signature, giving you peace of mind when handling sensitive financial information.

-

Can I integrate airSlate SignNow with other applications for managing my Deduct Form?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and more. This allows you to streamline your workflow and easily manage your Deduct Form alongside your other business processes.

-

What features does airSlate SignNow provide for managing Deduct Forms?

airSlate SignNow includes features like templates for Deduct Forms, customizable fields, and automated reminders for signatures. These tools enhance your efficiency and reduce the time spent on document management.

-

Is airSlate SignNow suitable for small businesses needing to process Deduct Forms?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it perfect for small businesses. You can quickly create and eSign Deduct Forms without the need for extensive training or resources.

-

What is the pricing structure for using airSlate SignNow to manage Deduct Forms?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes, starting from a free trial to competitive monthly subscriptions. This enables you to find the right plan that fits your needs for managing Deduct Forms.

-

Can I track the status of my Deduct Form in airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Deduct Form in real-time. You can see when it has been sent, viewed, and signed, ensuring you stay updated throughout the process.

Get more for Deduct Form

- Nevada vin inspection form

- State of illinois affidavit and certificate of correction request form

- Citizens crime report page 2 pub read only city of lompoc form

- Etf claim form 5709144

- Dd form 2790 24420231

- Intelligence report format pdf

- Termination form south carolina law enforcement division sled sc

- Form it 637 alternative fuels and electric vehicle

Find out other Deduct Form

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure