Mi Form R0782ghb

What is the Mi Form R0782ghb

The Mi Form R0782ghb is a specific document used within the state of Michigan for various administrative purposes. It serves as an essential tool for individuals and businesses to report information or apply for certain benefits. Understanding its function is crucial for compliance and effective communication with state authorities. This form may be required for tax-related matters, licensing applications, or other official processes, depending on the context in which it is used.

How to Use the Mi Form R0782ghb

Using the Mi Form R0782ghb involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur. Next, fill out the required fields accurately, providing all necessary information as specified. It is important to review the form for completeness and accuracy before submission. Depending on the requirements, you may need to provide supporting documentation alongside the completed form. Finally, submit the form through the designated method, whether online, by mail, or in person.

Steps to Complete the Mi Form R0782ghb

Completing the Mi Form R0782ghb can be done efficiently by following these steps:

- Obtain the latest version of the form from an official source.

- Read the instructions carefully to understand the requirements.

- Fill in personal or business information as required.

- Attach any necessary documents that support your submission.

- Review the form to ensure all information is accurate and complete.

- Submit the form through the appropriate channel, ensuring you keep a copy for your records.

Legal Use of the Mi Form R0782ghb

The Mi Form R0782ghb holds legal significance when completed and submitted correctly. It is essential to adhere to the guidelines set forth by the state to ensure that the form is recognized as valid. This includes ensuring that all signatures are properly executed and that the form is filed within any specified deadlines. Compliance with state laws and regulations is crucial to avoid potential penalties or issues with processing.

Key Elements of the Mi Form R0782ghb

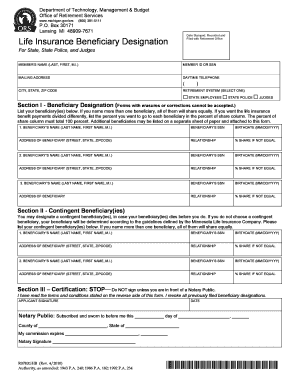

Several key elements must be included in the Mi Form R0782ghb to ensure its validity. These typically include:

- Identification information for the individual or entity submitting the form.

- Details relevant to the purpose of the form, such as financial data or application specifics.

- Signature lines for affirmation of the information provided.

- Instructions for submission, including deadlines and acceptable methods.

Form Submission Methods

The Mi Form R0782ghb can be submitted through various methods, depending on the specific requirements. Options typically include:

- Online submission through the designated state portal.

- Mailing the completed form to the appropriate state office.

- In-person delivery at specified locations, such as government offices.

Choosing the correct submission method is essential for ensuring timely processing and compliance with state regulations.

Quick guide on how to complete mi form r0782ghb

Effortlessly Prepare Mi Form R0782ghb on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed forms, allowing you to access the necessary document and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Mi Form R0782ghb across any platform with the airSlate SignNow mobile applications for Android or iOS, and streamline your document-related tasks today.

The Most Efficient Way to Modify and eSign Mi Form R0782ghb Seamlessly

- Locate Mi Form R0782ghb and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to finalize your modifications.

- Decide how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Mi Form R0782ghb to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi form r0782ghb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mi form r0782ghb and how can it be used?

The mi form r0782ghb is a designated document template that allows users to streamline their eSigning process. With airSlate SignNow, you can easily upload, customize, and send this form for signatures. It's designed to enhance efficiency in document management, making it suitable for various business scenarios.

-

What features does airSlate SignNow provide for mi form r0782ghb?

airSlate SignNow offers a range of features for mi form r0782ghb, including template creation, real-time tracking, and secure eSigning. Users can also enjoy customizable workflows and integrations with popular applications, which help in maximizing productivity while handling documents.

-

How much does it cost to use mi form r0782ghb with airSlate SignNow?

AirSlate SignNow provides flexible pricing plans that make utilizing mi form r0782ghb cost-effective for businesses of all sizes. Depending on your needs, you can choose from different subscription levels, which offer various features and functionalities to support your document signing processes.

-

Can mi form r0782ghb integrate with other software?

Yes, mi form r0782ghb can seamlessly integrate with various software applications such as CRM systems and cloud storage services. AirSlate SignNow’s robust API capabilities allow for easy integration, ensuring that your document workflows can be enhanced across your entire tech stack.

-

Is mi form r0782ghb secure for sensitive information?

Absolutely! mi form r0782ghb on airSlate SignNow is protected with advanced security measures including encryption and secure data storage. The platform adheres to strict compliance standards, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using mi form r0782ghb for businesses?

Utilizing mi form r0782ghb with airSlate SignNow offers several benefits, including enhanced efficiency and reduced turnaround times for document signing. Businesses can save time, reduce paper waste, and improve overall customer satisfaction by simplifying the eSigning process.

-

How do I get started with mi form r0782ghb on airSlate SignNow?

Getting started with mi form r0782ghb on airSlate SignNow is easy. Simply create an account, upload your form, and customize it as needed. The intuitive interface guides you through the process, making it accessible even for those new to eSigning solutions.

Get more for Mi Form R0782ghb

- Kansas sentencing guidelines journal entry of judgment form

- Georgia non disclosure agreement form

- Form w 4 caluedu

- Business sponsorship form

- To whom it may concern letter sample for student form

- Critical incident form bluecross blueshield of tennessee

- Dwc form 022 request for a required medical examination rme

- Form i non fmla certification family members health condition

Find out other Mi Form R0782ghb

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple