Form AU 196 10 Department of Taxation and Finance New York

What is the Form AU 196 10 Department Of Taxation And Finance New York

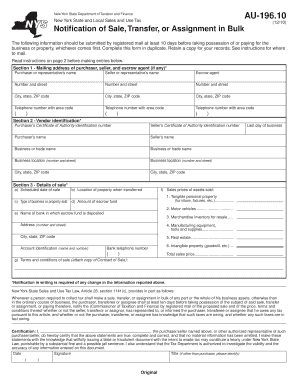

The Form AU 196 10 is a document issued by the New York State Department of Taxation and Finance. It is primarily used for tax purposes, specifically related to the exemption from sales and use tax for certain organizations. This form allows eligible entities to claim an exemption, ensuring they do not pay sales tax on qualifying purchases. Understanding the purpose of this form is essential for organizations that seek to benefit from tax exemptions in New York.

How to obtain the Form AU 196 10 Department Of Taxation And Finance New York

To obtain the Form AU 196 10, individuals or organizations can visit the New York State Department of Taxation and Finance website. The form is available for download in a PDF format, which can be printed and filled out. Additionally, physical copies may be requested directly from the department's offices. Ensuring you have the correct version of the form is crucial, as outdated forms may not be accepted.

Steps to complete the Form AU 196 10 Department Of Taxation And Finance New York

Completing the Form AU 196 10 involves several key steps:

- Begin by entering the name and address of the organization applying for the exemption.

- Provide the organization's tax identification number, ensuring accuracy to avoid processing delays.

- Indicate the type of exemption being claimed, selecting from the options provided on the form.

- Detail the specific purchases for which the exemption is requested, including descriptions and amounts.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal use of the Form AU 196 10 Department Of Taxation And Finance New York

The legal use of the Form AU 196 10 is governed by New York State tax laws. When completed correctly, the form serves as a valid claim for sales tax exemption. It is essential for organizations to ensure they meet the eligibility criteria outlined by the Department of Taxation and Finance. Misuse of the form or providing false information can lead to penalties, including fines and back taxes owed.

Key elements of the Form AU 196 10 Department Of Taxation And Finance New York

Several key elements are crucial when filling out the Form AU 196 10:

- Organization Information: Accurate details about the organization, including name and address.

- Tax Identification Number: Essential for processing the exemption request.

- Exemption Type: Clearly specify the basis for the exemption.

- Purchase Details: Include specific items or services for which the exemption is sought.

- Signature: A valid signature certifies the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The Form AU 196 10 can be submitted through various methods to accommodate different preferences:

- Online Submission: Some organizations may have the option to submit the form electronically through the department's online portal.

- Mail: Completed forms can be mailed to the designated address provided by the Department of Taxation and Finance.

- In-Person: Organizations may also choose to submit the form in person at local tax offices for immediate processing.

Quick guide on how to complete form au 196 10 department of taxation and finance new york

Complete Form AU 196 10 Department Of Taxation And Finance New York effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without any delays. Manage Form AU 196 10 Department Of Taxation And Finance New York on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form AU 196 10 Department Of Taxation And Finance New York without hassle

- Locate Form AU 196 10 Department Of Taxation And Finance New York and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form AU 196 10 Department Of Taxation And Finance New York and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form au 196 10 department of taxation and finance new york

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is au196 10 in the context of airSlate SignNow?

The au196 10 is a unique identifier associated with specific features and functionalities within airSlate SignNow. This code helps users navigate through various product offerings and ensures they receive the correct service tailored to their needs.

-

How can I use au196 10 to enhance my document signing experience?

By leveraging the unique features linked to au196 10, users can efficiently send and eSign documents with enhanced security and speed. The code represents specialized functionalities that simplify document workflows, making the signing process more streamlined.

-

What are the pricing options for airSlate SignNow that include au196 10 features?

airSlate SignNow offers various pricing plans that incorporate the functionalities of au196 10. Each plan is designed to provide cost-effective solutions to meet diverse business needs, ensuring that users can choose a package that best fits their budget and usage requirements.

-

What security measures are associated with au196 10 in airSlate SignNow?

Security is a top priority for airSlate SignNow, particularly regarding features linked to au196 10. The platform employs advanced encryption methods and authentication protocols to ensure that all signed documents are secure and legally binding, giving users peace of mind.

-

Can I integrate au196 10 with other software solutions?

Yes, you can seamlessly integrate features associated with au196 10 into existing software solutions. airSlate SignNow supports multiple integrations, allowing businesses to incorporate document signing workflows into various platforms they already use.

-

What benefits does au196 10 offer for businesses using airSlate SignNow?

For businesses, au196 10 offers signNow benefits including enhanced efficiency in document handling and faster transaction times. By utilizing the features tied to this code, organizations can streamline their processes, reduce paperwork, and ultimately improve overall productivity.

-

Is customer support available for issues related to au196 10?

Absolutely! airSlate SignNow provides comprehensive customer support for any questions or issues related to au196 10. Users can access resources including documentation, tutorials, and direct support channels to ensure they have assistance when needed.

Get more for Form AU 196 10 Department Of Taxation And Finance New York

- Employment application caine amp weiner form

- Tuberculin order form

- Individual characteristics form eta form 9061 doleta

- Health net appeal form

- Republicae form

- Short form domestic relations affidavit kansasjudicialcouncil

- Authorization for release of confidential informat

- Child support eservices florida department of revenue form

Find out other Form AU 196 10 Department Of Taxation And Finance New York

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors