Rev 1220 as 07 16 Form

What is the Rev 1220 As 07 16

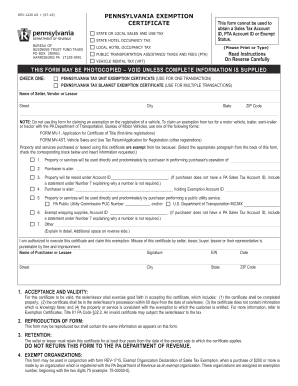

The Rev 1220 As 07 16 form is an important document used primarily for tax purposes in the United States. This form is utilized to report specific information to the Internal Revenue Service (IRS) regarding various financial activities. It is essential for individuals and businesses to understand the purpose and requirements of this form to ensure compliance with tax laws. The Rev 1220 As 07 16 may encompass details such as income, deductions, and credits, which are crucial for accurate tax reporting.

How to use the Rev 1220 As 07 16

Using the Rev 1220 As 07 16 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed as required. It is important to double-check the information for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific guidelines provided by the IRS.

Steps to complete the Rev 1220 As 07 16

Completing the Rev 1220 As 07 16 form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary financial documents, such as W-2s, 1099s, and receipts.

- Review the instructions for the form to understand specific requirements.

- Fill out each section of the form carefully, ensuring all information is accurate.

- Check for any additional schedules or forms that may need to accompany the Rev 1220 As 07 16.

- Sign and date the form, if required, to validate the submission.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Rev 1220 As 07 16

The Rev 1220 As 07 16 form is legally binding when completed and submitted according to IRS guidelines. To ensure its legal standing, it is crucial to provide accurate information and adhere to all required regulations. The form serves as an official record of financial reporting, and any discrepancies may lead to legal repercussions, including audits or penalties. Therefore, understanding the legal implications of this form is essential for both individuals and businesses.

Filing Deadlines / Important Dates

Filing deadlines for the Rev 1220 As 07 16 form are critical for compliance with IRS regulations. Typically, the form must be submitted by April 15 of the following tax year, although extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as they can vary based on specific situations or legislative updates. Missing the deadline may result in penalties, so timely submission is essential.

Who Issues the Form

The Rev 1220 As 07 16 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidance on how to complete the form, including any updates or changes to filing requirements. Understanding the role of the IRS in the issuance of this form is important for ensuring compliance and accessing the necessary resources for accurate completion.

Quick guide on how to complete rev 1220 as 07 16

Complete Rev 1220 As 07 16 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without obstacles. Handle Rev 1220 As 07 16 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Rev 1220 As 07 16 with ease

- Find Rev 1220 As 07 16 and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Mark relevant parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Rev 1220 As 07 16 and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1220 as 07 16

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev 1220 as 07 16 and how does it relate to airSlate SignNow?

Rev 1220 as 07 16 is a specific regulatory reference that can impact how businesses manage their electronic signatures. airSlate SignNow provides an efficient platform to facilitate compliance with these regulations, ensuring that your eSignatures are legally binding and secure.

-

What features does airSlate SignNow offer for managing rev 1220 as 07 16 compliance?

airSlate SignNow offers features such as customizable templates, audit trails, and secure document storage to help businesses comply with rev 1220 as 07 16. These tools ensure that every signature is tracked and verifiable, giving you peace of mind in your document process.

-

How does pricing work for airSlate SignNow if we need to comply with rev 1220 as 07 16?

The pricing for airSlate SignNow is designed to be affordable for businesses of any size. Our plans offer different levels of access to features necessary for managing rev 1220 as 07 16 compliance, allowing you to choose the best fit for your needs without sacrificing budget.

-

Can airSlate SignNow integrate with other tools for managing rev 1220 as 07 16?

Yes, airSlate SignNow can seamlessly integrate with various tools and applications such as CRM systems, making compliance with rev 1220 as 07 16 even easier. These integrations streamline your workflow and help maintain compliance across different platforms.

-

What are the benefits of using airSlate SignNow for rev 1220 as 07 16 compliance?

Using airSlate SignNow for rev 1220 as 07 16 compliance offers increased efficiency, enhanced security, and improved tracking of documents. By digitizing your signature processes, you can save time and ensure that all regulatory requirements are met without hassle.

-

Is airSlate SignNow user-friendly for those unfamiliar with rev 1220 as 07 16?

Absolutely! airSlate SignNow has an intuitive interface that makes it easy for users, even those unfamiliar with rev 1220 as 07 16, to navigate and utilize its features. Our support resources also help users understand compliance requirements and how to meet them effectively.

-

Are there any customer support resources available for questions about rev 1220 as 07 16?

Yes, airSlate SignNow provides comprehensive customer support for inquiries related to rev 1220 as 07 16. Our knowledgeable team is ready to assist with any questions, ensuring you have the guidance needed to effectively use our platform to meet regulatory requirements.

Get more for Rev 1220 As 07 16

- Bad check complaint form pdf jacksongov org jacksongov

- Prior authorization durable medical equipment mercy care plan form

- Pc 585a 907 petition to allow account michigan courts barrycounty form

- Obligation request and status sample form

- Shift swap request form

- Public partnership payroll schedule b form

- Construction west virginia economic census census form

- Form 2210 f underpayment of estimated tax by farmers

Find out other Rev 1220 As 07 16

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online