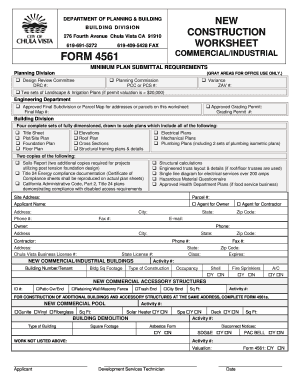

Form 4561 City of Chula Vista Chulavistaca

Understanding the W-9 Form

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is used by individuals and entities in the United States to provide their taxpayer identification information to others. This form is essential for reporting income to the Internal Revenue Service (IRS) and is commonly utilized by freelancers, independent contractors, and businesses that need to report payments made to individuals or entities. By filling out the W-9, you certify that the information provided is accurate and that you are not subject to backup withholding.

Steps to Complete the W-9 Form

Completing the W-9 form is straightforward. Here are the key steps:

- Provide your name: Enter your full name as it appears on your tax return.

- Business name (if applicable): If you operate under a business name, include it in this section.

- Select your tax classification: Indicate whether you are an individual, corporation, partnership, or another entity type.

- Enter your address: Provide your complete mailing address, including city, state, and ZIP code.

- Taxpayer Identification Number (TIN): Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify the accuracy of the information provided.

Legal Use of the W-9 Form

The W-9 form plays a critical role in U.S. tax compliance. It is used by businesses to collect taxpayer identification information from individuals or entities they pay. This information is necessary for the issuance of Form 1099, which reports various types of income. The legal implications of the W-9 include the requirement to provide accurate information, as incorrect details can lead to penalties or issues with the IRS. Additionally, the form ensures that the payer can correctly report payments and fulfill their tax obligations.

Obtaining the W-9 Form

The W-9 form is readily available online through the IRS website. You can download it in PDF format, which allows for easy printing and completion. Many businesses also provide their own copies of the form to contractors and vendors. If you need a physical copy, you can request one from the organization that requires it, or you can print it directly from the IRS site.

Filing Deadlines and Important Dates

While the W-9 form itself does not have a specific filing deadline, it is important to submit it promptly when requested by a payer. This ensures that they have the necessary information to issue Form 1099 by the IRS deadlines, which typically fall in January of the following year. Keeping track of these deadlines is crucial for maintaining compliance and avoiding potential penalties.

Digital vs. Paper Version of the W-9 Form

The W-9 form can be completed either digitally or on paper. Digital completion allows for easier submission and storage, especially when using eSignature tools. Electronic forms are legally binding, provided they meet the necessary compliance standards. On the other hand, paper forms may be preferred in certain situations, such as when a physical signature is required. Regardless of the format chosen, ensuring accuracy and timely submission is essential.

Quick guide on how to complete form 4561 city of chula vista chulavistaca

Effortlessly Prepare Form 4561 City Of Chula Vista Chulavistaca on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed documents by allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without hold-ups. Manage Form 4561 City Of Chula Vista Chulavistaca on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form 4561 City Of Chula Vista Chulavistaca with Ease

- Locate Form 4561 City Of Chula Vista Chulavistaca and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 4561 City Of Chula Vista Chulavistaca to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4561 city of chula vista chulavistaca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w9 4561 form and why is it important?

The w9 4561 form is a tax document used in the United States for businesses to report income paid to contractors. It is crucial for ensuring compliance with IRS regulations and for maintaining accurate tax records. Using airSlate SignNow, you can easily send and eSign the w9 4561, streamlining the process for both you and your contractors.

-

How does airSlate SignNow streamline the w9 4561 process?

airSlate SignNow offers an intuitive platform for sending and signing documents like the w9 4561 electronically. This eliminates the need for printing and scanning, signNowly reducing time and effort. The secure eSignature feature ensures that your documents are legally binding and compliant with industry standards.

-

Is there a fee associated with using airSlate SignNow for w9 4561 forms?

airSlate SignNow provides a cost-effective solution for managing documents, including the w9 4561 form. Pricing plans are designed to fit various business needs, with options for monthly or annual subscriptions. You can choose the plan that best suits your volume of document transactions.

-

What features does airSlate SignNow offer for managing w9 4561 forms?

In addition to eSigning, airSlate SignNow provides features like document templates, real-time tracking, and automated reminders for w9 4561 forms. These features enhance operational efficiency and ensure that you stay organized. The platform also supports multiple file formats for seamless uploads.

-

Can I integrate airSlate SignNow with other software to manage w9 4561 forms?

Yes, airSlate SignNow offers integrations with various software solutions, perfect for managing w9 4561 forms. You can connect it with CRM systems, accounting software, and more for a seamless workflow. This integration capability allows you to automate your document management processes further.

-

What are the benefits of using airSlate SignNow for sending w9 4561 forms?

Using airSlate SignNow to send w9 4561 forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signature process is faster, allowing for quicker turnaround times. Moreover, the platform provides a secure environment to protect sensitive information.

-

How secure is airSlate SignNow for handling w9 4561 forms?

airSlate SignNow prioritizes security, using encryption and secure storage to protect documents like the w9 4561 form. Compliance with major security standards ensures that your data remains confidential and secure from unauthorized access. This level of security gives you peace of mind when managing important tax documents.

Get more for Form 4561 City Of Chula Vista Chulavistaca

- Essential legal life documents for baby boomers delaware form

- Delaware general form

- Revocation of general durable power of attorney delaware form

- Essential legal life documents for newlyweds delaware form

- Essential legal life documents for military personnel delaware form

- Essential legal life documents for new parents delaware form

- General power of attorney for care and custody of child or children delaware form

- Delaware business form

Find out other Form 4561 City Of Chula Vista Chulavistaca

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms