Utu Job Insurance 2010

What is the Utu Job Insurance

The Utu Job Insurance is a specialized form designed to provide financial protection for individuals who may lose their jobs due to various circumstances, such as layoffs or company closures. This insurance aims to support individuals during transitional periods, offering a safety net that helps cover essential expenses while they seek new employment opportunities. Understanding the specific provisions and benefits of this insurance can help individuals make informed decisions about their financial security.

How to use the Utu Job Insurance

Using the Utu Job Insurance involves a straightforward process. First, individuals must ensure they meet the eligibility criteria, which typically include being actively employed and having a history of consistent work. Once eligibility is confirmed, applicants can fill out the Utu Job Insurance form, providing necessary information such as employment history, reason for job loss, and personal details. After submission, individuals should keep track of their application status and respond promptly to any requests for additional information from the insurance provider.

Steps to complete the Utu Job Insurance

Completing the Utu Job Insurance form involves several key steps:

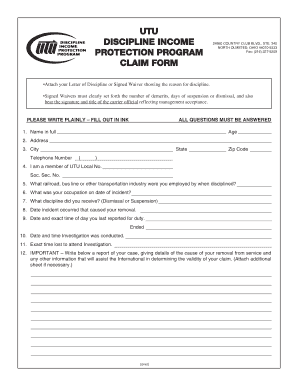

- Gather necessary documents: Collect employment records, identification, and any relevant financial information.

- Fill out the form: Provide accurate details regarding your employment history and the circumstances leading to job loss.

- Review the information: Ensure all entries are correct to avoid delays in processing.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

- Follow up: Monitor the status of your application and respond to any inquiries from the insurance provider.

Legal use of the Utu Job Insurance

The Utu Job Insurance is governed by specific legal frameworks that ensure its proper use and enforcement. It is essential for applicants to understand their rights and responsibilities under these laws. Compliance with state and federal regulations is crucial for the validity of the insurance. This includes adhering to deadlines for filing claims and providing accurate information throughout the application process. Legal protections are in place to safeguard both the insurer and the insured, ensuring fair treatment and accountability.

Eligibility Criteria

To qualify for the Utu Job Insurance, applicants must meet certain eligibility criteria. Generally, these criteria include:

- Being a full-time employee at the time of job loss.

- Having a minimum period of employment, often defined by the insurance provider.

- Experiencing job loss due to qualifying reasons, such as layoffs or company closures.

- Submitting the application within the designated timeframe after losing employment.

Understanding these criteria can help individuals assess their eligibility and prepare for the application process.

Key elements of the Utu Job Insurance

The Utu Job Insurance includes several key elements that define its coverage and benefits. These elements typically encompass:

- Benefit amount: The financial support provided, which may vary based on previous earnings.

- Duration of coverage: The length of time benefits are available, often determined by state regulations.

- Qualifying events: Specific circumstances under which benefits can be claimed, such as involuntary job loss.

- Application process: Steps required to apply for benefits, including necessary documentation and submission methods.

Familiarity with these elements can enhance an applicant's understanding of what to expect when applying for the Utu Job Insurance.

Quick guide on how to complete utu job insurance

Effortlessly Create Utu Job Insurance on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Utu Job Insurance on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Utu Job Insurance Effortlessly

- Find Utu Job Insurance and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Alter and eSign Utu Job Insurance to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct utu job insurance

Create this form in 5 minutes!

How to create an eSignature for the utu job insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is UTU job insurance and how does it work?

UTU job insurance is a specialized insurance program designed to provide financial protection for workers in the event of job loss. This insurance covers a portion of your income for a specified period, helping you manage expenses while seeking new employment. By ensuring that you have a financial safety net, UTU job insurance helps reduce the stress of unexpected job loss.

-

How much does UTU job insurance cost?

The cost of UTU job insurance can vary based on factors such as your job type, coverage amount, and duration. Typically, pricing is affordable, allowing you to choose a plan that fits your budget. Assessing your individual needs with an insurance provider can help you find the right balance between cost and coverage.

-

What are the key features of UTU job insurance?

Key features of UTU job insurance include coverage for lost income, support for job placement services, and access to career counseling. This comprehensive approach not only provides financial aid but also helps you transition back to work effectively. Understanding these features can help you determine how UTU job insurance fits your needs.

-

What are the benefits of having UTU job insurance?

Having UTU job insurance provides peace of mind knowing you are financially protected in case of job loss. It reduces stress and allows you to focus on finding new employment without the immediate pressure of financial constraints. Additionally, it can support better job search outcomes through added resources and guidance.

-

Can I integrate UTU job insurance with existing benefits or policies?

Yes, you can often integrate UTU job insurance with existing benefits and policies for comprehensive coverage. It is advisable to check with your current benefits provider to understand how UTU job insurance can complement your existing plans. Integration can enhance your overall financial security during transitions in employment.

-

Are there any prerequisites to apply for UTU job insurance?

There may be some prerequisites to apply for UTU job insurance, such as a minimum employment duration or specific job classifications. It's important to review the eligibility criteria with your provider to ensure you qualify. Understanding these requirements will make the application process smoother.

-

How do I file a claim for UTU job insurance?

Filing a claim for UTU job insurance typically involves submitting a claim form along with necessary documentation to prove job loss. Each provider may have specific steps, so it's crucial to follow their guidelines closely. Prompt filing can expedite the process and ensure you receive your benefits quickly.

Get more for Utu Job Insurance

- Roommate questionnaire for adults pdf 100535577 form

- Cdc license exempt provider application form

- Form r construction stormwater inspection city of knoxville cityofknoxville

- Parental consent form to exit us

- Recognition certification affidavit state of illinois www2 illinois form

- Nhamcs emergency department patient record form cdc

- The maintenance of hippocampal dependent fear conditioning does pantherfile uwm form

- Release and settlement agreement template form

Find out other Utu Job Insurance

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word