Ps 404 Pe Form

What is the Ps 404 Pe Form

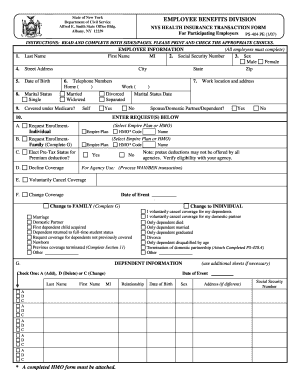

The Ps 404 Pe form is a specific document used primarily in the context of tax reporting and compliance. It is essential for individuals and businesses to accurately report their financial activities to the appropriate authorities. This form is often utilized by taxpayers to provide detailed information regarding their income, deductions, and other relevant financial data. Understanding the purpose and requirements of the Ps 404 Pe form is crucial for ensuring compliance with tax regulations.

How to use the Ps 404 Pe Form

Using the Ps 404 Pe form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, such as income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all sections are completed according to the instructions provided. It is important to double-check your entries for accuracy before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements set forth by the relevant tax authority.

Steps to complete the Ps 404 Pe Form

Completing the Ps 404 Pe form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts.

- Review the instructions for the Ps 404 Pe form to understand each section's requirements.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the form according to the specified submission methods, ensuring you keep a copy for your records.

Legal use of the Ps 404 Pe Form

The legal use of the Ps 404 Pe form is governed by tax laws and regulations. To be considered valid, the form must be filled out accurately and submitted within the designated deadlines. Compliance with the Internal Revenue Service (IRS) guidelines is essential to avoid penalties. Additionally, using electronic signatures can enhance the form's validity, provided that the e-signature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Required Documents

To complete the Ps 404 Pe form, several documents are typically required. These may include:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting other income sources.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any additional documentation that supports the information reported on the form.

Form Submission Methods

The Ps 404 Pe form can be submitted through various methods, allowing for flexibility based on individual preferences. Common submission methods include:

- Online submission through the IRS e-file system or authorized e-filing providers.

- Mailing a paper copy of the completed form to the appropriate tax authority address.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete ps 404 pe form

Complete Ps 404 Pe Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Ps 404 Pe Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to alter and eSign Ps 404 Pe Form seamlessly

- Find Ps 404 Pe Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Ps 404 Pe Form and guarantee effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ps 404 pe form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PS 404 PE form, and why is it important?

The PS 404 PE form is a crucial document used for processing employee information and tax withholding. It is essential for maintaining compliance with tax regulations and ensuring proper payroll management within your organization. Understanding the PS 404 PE form helps streamline your administrative tasks.

-

How does airSlate SignNow simplify the PS 404 PE form process?

airSlate SignNow streamlines the process of filling out and signing the PS 404 PE form by providing a user-friendly interface for electronic signatures. This makes it easy for employees to complete and submit the form quickly, reducing paperwork and delays. With airSlate SignNow, you can ensure that your forms are completed accurately and promptly.

-

What features does airSlate SignNow offer for managing the PS 404 PE form?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure storage that are perfect for managing the PS 404 PE form. You can easily create, send, and track the status of your forms, ensuring that nothing gets lost or overlooked. These features enhance the efficiency of your document management process.

-

Is there a cost associated with using airSlate SignNow for the PS 404 PE form?

Yes, airSlate SignNow operates on a subscription basis, offering various pricing plans to fit your business needs. The cost is typically very competitive considering the time and resources saved by digitizing the PS 404 PE form process. You can choose a plan that best suits the size and requirements of your organization.

-

Can I integrate airSlate SignNow with other tools for the PS 404 PE form?

Absolutely! airSlate SignNow offers seamless integrations with various business applications such as CRM systems, project management tools, and cloud storage services. This means you can easily manage your PS 404 PE forms alongside your other business processes, ensuring a smooth workflow.

-

What benefits can my business expect from using airSlate SignNow for the PS 404 PE form?

By using airSlate SignNow for the PS 404 PE form, you can expect enhanced efficiency, reduced administrative costs, and improved compliance with tax regulations. The electronic signing feature accelerates the approval process, allowing your team to focus on core business activities. Overall, airSlate SignNow simplifies document management and enhances productivity.

-

Is airSlate SignNow secure for processing the PS 404 PE form?

Yes, airSlate SignNow prioritizes security with advanced encryption and secure data storage. All documents, including sensitive information in the PS 404 PE form, are protected to ensure compliance with privacy regulations. You can have peace of mind knowing that your data is safe and secure with airSlate SignNow.

Get more for Ps 404 Pe Form

Find out other Ps 404 Pe Form

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online