Colorado Form B 569

What is the Colorado Form B 569

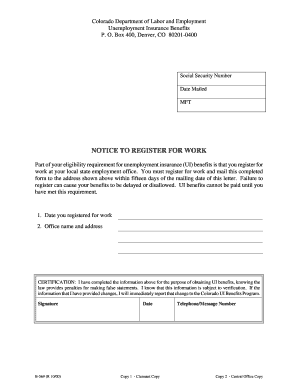

The Colorado Form B 569 is a document used for specific tax-related purposes within the state of Colorado. This form is essential for individuals and businesses to report certain financial information accurately. It is designed to ensure compliance with state tax regulations and helps in the assessment of taxes owed. Understanding the purpose of this form is crucial for anyone who needs to fulfill their tax obligations in Colorado.

How to use the Colorado Form B 569

Using the Colorado Form B 569 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents and details that pertain to the reporting period. Next, carefully fill out the form, ensuring that each section is completed with accurate data. After filling out the form, review it for any errors or omissions. Once verified, the form can be submitted according to the specified submission methods.

Steps to complete the Colorado Form B 569

Completing the Colorado Form B 569 requires a systematic approach. Begin by downloading the form from an official source. Next, follow these steps:

- Enter your personal or business information at the top of the form.

- Fill in the financial data as required, ensuring accuracy in all entries.

- Review the form for completeness and correctness.

- Sign and date the form where indicated.

- Submit the form via the chosen method, whether online, by mail, or in person.

Legal use of the Colorado Form B 569

The legal use of the Colorado Form B 569 is governed by state tax laws. It is essential to ensure that the form is filled out accurately and submitted on time to avoid any legal repercussions. Failure to comply with the regulations associated with this form can result in penalties or fines. Understanding the legal framework surrounding the use of this form helps individuals and businesses maintain compliance and avoid issues with tax authorities.

Key elements of the Colorado Form B 569

The Colorado Form B 569 includes several key elements that must be accurately reported. These elements typically consist of:

- Taxpayer identification information, including name and address.

- Financial data relevant to the reporting period.

- Any deductions or credits applicable to the taxpayer.

- Signature and date to validate the submission.

Each of these elements plays a crucial role in ensuring the form's accuracy and compliance with state tax laws.

Form Submission Methods

The Colorado Form B 569 can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission through the Colorado Department of Revenue website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Quick guide on how to complete colorado form b 569

Effortlessly Prepare Colorado Form B 569 on Any Device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Colorado Form B 569 across any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

Edit and eSign Colorado Form B 569 with Ease

- Obtain Colorado Form B 569 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Colorado Form B 569 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado form b 569

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form B 569 and how can airSlate SignNow help with it?

Form B 569 is a standard document used for specific business processes. airSlate SignNow provides an intuitive platform that allows users to seamlessly create, send, and eSign Form B 569 quickly and efficiently. Our solution ensures that all signatures are legally binding, which is essential for business compliance.

-

Is airSlate SignNow a cost-effective solution for managing Form B 569?

Yes, airSlate SignNow offers competitive pricing tailored to fit businesses of all sizes. By streamlining the process of creating and eSigning Form B 569, businesses can save both time and money. Our transparent pricing model means no hidden fees, making it easy to manage expenses.

-

What features does airSlate SignNow offer for Form B 569?

AirSlate SignNow includes a variety of features specifically designed to enhance the management of Form B 569. Key features include customizable templates, automated workflows, and comprehensive tracking of document status. These tools ensure a smoother user experience from creation to signature.

-

How does airSlate SignNow ensure the security of Form B 569?

At airSlate SignNow, security is a top priority. Our platform employs advanced encryption techniques to protect all documents, including Form B 569, from unauthorized access. Additionally, we comply with industry standards for data protection, giving businesses peace of mind.

-

Can I integrate airSlate SignNow with other tools for Form B 569 management?

Absolutely! AirSlate SignNow offers a range of integrations with popular tools, allowing for seamless management of Form B 569. Whether you use CRM systems, cloud storage solutions, or productivity applications, our platform can easily connect and enhance your workflow.

-

What are the benefits of using airSlate SignNow for eSigning Form B 569?

Using airSlate SignNow for eSigning Form B 569 offers numerous benefits, including increased efficiency and reduced turnaround time on documents. It also minimizes paper usage and enables tracking of who signed what and when. This digital solution enhances overall productivity for any business.

-

Is there a mobile option for using airSlate SignNow with Form B 569?

Yes, airSlate SignNow provides a mobile app that allows users to manage Form B 569 on-the-go. This means you can create, send, and eSign documents from your mobile device, ensuring that you never miss a critical deadline. The mobile solution is user-friendly and designed for convenience.

Get more for Colorado Form B 569

- Captax form

- Ched form

- Tceq dry cleaning facility registration form fill in

- Metro home inspections llc report pdf form

- Navy reenlistment request form 38966528

- Local road safety plan template form

- Department of justice united states marshals service request for service abroad of judicial or extrajudicial documents pursuant form

- White sands national park service u nps form

Find out other Colorado Form B 569

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online