Oklahoma W 9 2005

What is the Oklahoma W-9?

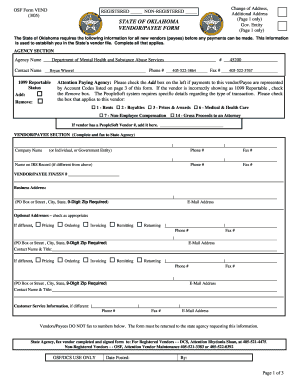

The Oklahoma W-9 form is a tax document used by individuals and businesses to provide their taxpayer identification information to entities that are required to report payments to the IRS. This form is essential for freelancers, contractors, and vendors who work with businesses and need to report income accurately. By completing the Oklahoma W-9, you confirm your taxpayer status and provide necessary details such as your name, address, and Social Security number or Employer Identification Number (EIN).

Steps to Complete the Oklahoma W-9

Completing the Oklahoma W-9 form involves several straightforward steps. Begin by entering your name as it appears on your tax return. If you are completing the form for a business, include the business name. Next, provide your business entity type, such as individual, corporation, or partnership. You will also need to fill in your address, including city, state, and ZIP code. Finally, enter your taxpayer identification number, which can be your Social Security number or EIN. Don’t forget to sign and date the form to validate it.

Legal Use of the Oklahoma W-9

The Oklahoma W-9 form is legally binding when filled out correctly. It serves as a declaration of your taxpayer status and is used by businesses to report payments made to you. To ensure its legal validity, it is crucial to provide accurate information and sign the form. The use of electronic signatures is permissible under U.S. law, provided that the signing process complies with regulations such as ESIGN and UETA. This means that using a reliable eSignature platform can facilitate the legal execution of the Oklahoma W-9.

How to Obtain the Oklahoma W-9

Obtaining the Oklahoma W-9 form is a simple process. You can download the form directly from the IRS website, where the W-9 is available in PDF format. Additionally, many businesses may provide their own version of the form, tailored to their specific requirements. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Filing Deadlines / Important Dates

While the Oklahoma W-9 form itself does not have a specific filing deadline, it is essential to provide it to the requesting business before they issue any payments to you. This allows them to accurately report the payments to the IRS. Generally, businesses must file Form 1099-MISC or 1099-NEC by January thirty-first of the following year, which is when they will need the completed W-9 form to report your income correctly.

Examples of Using the Oklahoma W-9

The Oklahoma W-9 form is commonly used in various scenarios. For instance, if you are a freelance graphic designer working with a marketing agency, the agency will request a W-9 to report the payments made to you. Similarly, if you are a contractor providing services to a construction company, they will require your W-9 to ensure proper tax reporting. These examples illustrate the form's importance in maintaining accurate tax records for both the payer and the payee.

Quick guide on how to complete oklahoma w 9

Effortlessly Prepare Oklahoma W 9 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle Oklahoma W 9 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to Edit and Electronically Sign Oklahoma W 9 with Ease

- Locate Oklahoma W 9 and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Oklahoma W 9 to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma w 9

Create this form in 5 minutes!

How to create an eSignature for the oklahoma w 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Oklahoma W9 form and why do I need it?

The Oklahoma W9 form is a document used by individuals and businesses to provide their Taxpayer Identification Number (TIN) to entities that need it for tax reporting purposes. Completing the Oklahoma W9 form ensures that you comply with state and federal tax laws, making it essential for freelancers, contractors, and businesses.

-

How can airSlate SignNow assist with filling out the Oklahoma W9 form?

airSlate SignNow offers a user-friendly platform that allows you to fill out the Oklahoma W9 form digitally. With our easy-to-use interface, you can complete the form efficiently, ensuring accuracy while saving time compared to traditional paper methods.

-

Is the airSlate SignNow service cost-effective for managing Oklahoma W9 forms?

Yes, airSlate SignNow provides a cost-effective solution for managing the Oklahoma W9 form and other documents. By utilizing our service, you eliminate the costs associated with printing, mailing, and manual processing, making it an economical choice for businesses of all sizes.

-

What features make airSlate SignNow ideal for handling Oklahoma W9 forms?

airSlate SignNow includes features such as electronic signatures, secure document storage, and customizable templates, all of which streamline the process of handling the Oklahoma W9 form. These features enhance efficiency, allowing users to send and receive forms quickly and securely.

-

Can I integrate airSlate SignNow with other applications for Oklahoma W9 forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications, ensuring smooth workflow management for the Oklahoma W9 form. You can connect it with popular tools like Dropbox, Google Drive, and others to enhance your document processing capabilities.

-

How does eSigning the Oklahoma W9 form work with airSlate SignNow?

With airSlate SignNow, eSigning the Oklahoma W9 form is straightforward. Once the form is filled out, you can invite the necessary parties to sign electronically, which is legally binding and ensures a fast turnaround on document handling.

-

What benefits can I expect from using airSlate SignNow for Oklahoma W9 forms?

Using airSlate SignNow for the Oklahoma W9 form brings numerous benefits, including enhanced efficiency, improved compliance, and reduced paperwork. Our platform allows for quick edits and secure document sharing, making the entire process hassle-free for you and your clients.

Get more for Oklahoma W 9

- Adult application 2 whiteys ice cream form

- Individual development plan pdf form

- Application for registration exemption south carolina secretary davmembersportal form

- Therapist imaginal exposure recording form oxford university

- Superior healthplan star plus form

- Affidavit of withdrawal of candidacy saffire form

- Forms bernalillo county metropolitan court

- Answer to civil complaint form

Find out other Oklahoma W 9

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile