Personal Legal Plans Tax Organizer 2017

What is the Personal Legal Plans Tax Organizer

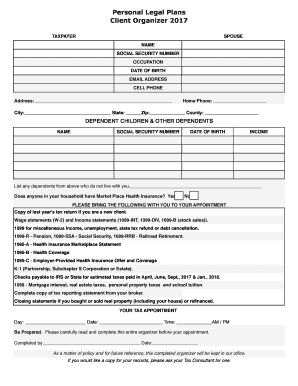

The Personal Legal Plans Tax Organizer is a comprehensive document designed to assist individuals in compiling essential information related to their legal and tax obligations. This organizer helps streamline the process of gathering necessary data, ensuring that all relevant details are readily available for tax preparation and legal compliance. It typically includes sections for personal information, income sources, deductions, and other pertinent financial details. By using this organizer, individuals can simplify their tax filing experience and ensure they meet all legal requirements.

How to use the Personal Legal Plans Tax Organizer

Using the Personal Legal Plans Tax Organizer effectively involves several straightforward steps. Begin by downloading the organizer from a trusted source or obtaining a physical copy. Fill in your personal details, including your name, address, and Social Security number. Next, document your income sources, such as wages, self-employment earnings, and investment income. Be sure to include any deductions you plan to claim, like mortgage interest or charitable contributions. Once completed, review the organizer for accuracy before submitting it with your tax return or using it for legal purposes.

Steps to complete the Personal Legal Plans Tax Organizer

Completing the Personal Legal Plans Tax Organizer requires careful attention to detail. Follow these steps for a thorough completion:

- Gather necessary documents: Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out personal information: Enter your name, address, and contact details at the top of the organizer.

- Document income: Clearly list all sources of income, ensuring accuracy in amounts.

- List deductions: Include any eligible deductions, providing supporting documentation where necessary.

- Review and finalize: Double-check all entries for completeness and accuracy before finalizing the document.

Legal use of the Personal Legal Plans Tax Organizer

The Personal Legal Plans Tax Organizer serves a vital role in ensuring compliance with tax regulations and legal requirements. When filled out correctly, it can be used as a reference for tax filings and legal documentation. This organizer helps individuals keep track of their financial information, which is crucial during audits or legal inquiries. Furthermore, maintaining accurate records through this organizer can protect individuals from potential legal issues related to tax compliance.

Required Documents

To complete the Personal Legal Plans Tax Organizer, several documents may be required. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements

- Investment income statements

Having these documents on hand will facilitate a smoother completion process and ensure that all necessary information is accurately captured.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Personal Legal Plans Tax Organizer is crucial for timely submissions. Typically, the deadline for filing individual tax returns in the United States is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines and to plan accordingly to avoid penalties.

Quick guide on how to complete personal legal plans tax organizer

Prepare Personal Legal Plans Tax Organizer effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Personal Legal Plans Tax Organizer on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Personal Legal Plans Tax Organizer without any hassle

- Obtain Personal Legal Plans Tax Organizer and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and has the same legal validity as a standard wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Personal Legal Plans Tax Organizer to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal legal plans tax organizer

Create this form in 5 minutes!

How to create an eSignature for the personal legal plans tax organizer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are personal legal plans tax organizer features?

The personal legal plans tax organizer includes features that streamline document management and assist users in organizing their tax-related files. This ensures that all necessary documents are easily accessible for tax preparation. With templates and reminders, it's designed to simplify the process and keep your records in order.

-

How does the personal legal plans tax organizer help with tax preparation?

The personal legal plans tax organizer helps with tax preparation by providing a structured framework for collecting and managing essential documents. By using this organizer, you can ensure that everything you need for tax filing is in one place, reducing stress and saving time during the tax season. This organization can lead to improved accuracy and potential savings on your taxes.

-

Is there a cost associated with the personal legal plans tax organizer?

Yes, there is a cost associated with the personal legal plans tax organizer, but it is designed to be cost-effective. Pricing varies based on the features you choose, allowing you to select a plan that suits your budget and needs. Investing in this organizer can save you money in the long run by streamlining your tax preparation process.

-

Can the personal legal plans tax organizer integrate with other tools?

Absolutely, the personal legal plans tax organizer is designed to integrate seamlessly with various other tools and platforms. This integration allows users to connect their existing financial software, making it easier to sync data and manage documents. Whether you use accounting software or cloud storage, the flexibility of the organizer suits a variety of workflows.

-

What are the benefits of using a personal legal plans tax organizer?

Using a personal legal plans tax organizer brings numerous benefits, including enhanced organization of your financial documents and improved efficiency in tax preparation. It provides a clear structure, helping to minimize errors and ensure that nothing is overlooked. By simplifying these processes, you can focus more on strategic planning for your finances.

-

Who can benefit from the personal legal plans tax organizer?

The personal legal plans tax organizer is beneficial for anyone needing to manage their tax documents effectively, including individuals, families, and small business owners. Whether you're preparing your own taxes or working with a professional, this organizer provides the tools necessary for clear documentation. It caters to a wide audience by simplifying complex tax obligations.

-

How does the personal legal plans tax organizer ensure document security?

The personal legal plans tax organizer includes robust security measures to keep your sensitive information safe. Encryption and secure access controls ensure that only authorized users can view your documents. Additionally, utilizing this organizer means your data is backed up, reducing the risk of loss during tax preparation.

Get more for Personal Legal Plans Tax Organizer

Find out other Personal Legal Plans Tax Organizer

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free