Ga 4 Form

What is the GA 4 Form?

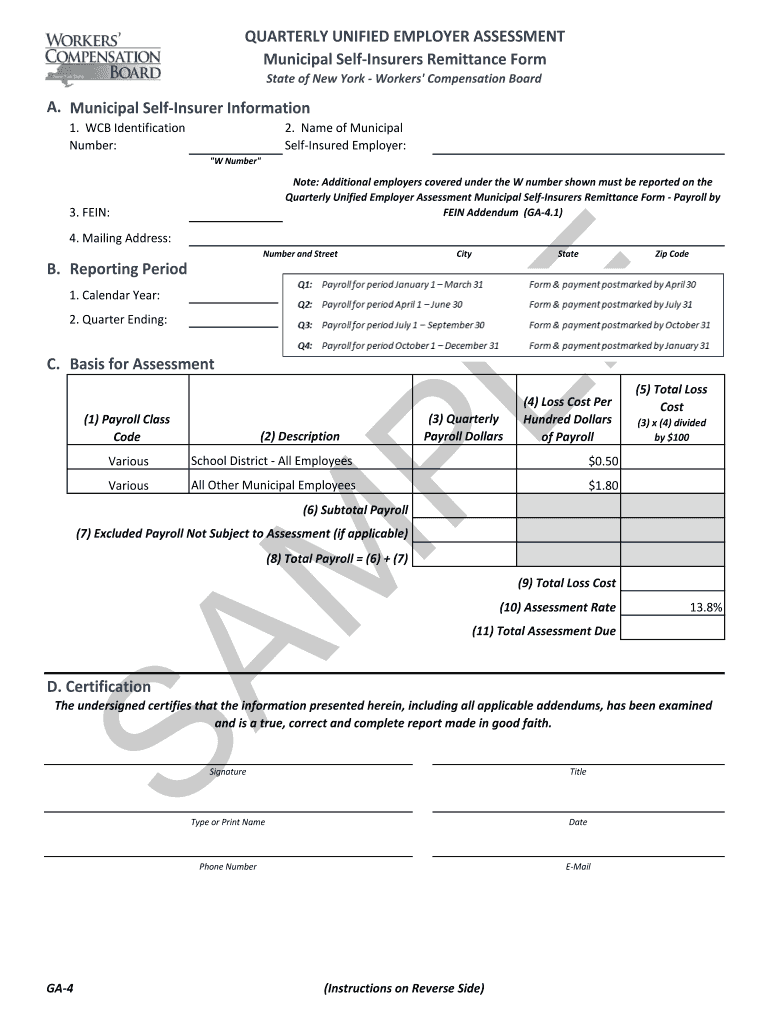

The GA 4 form, officially known as the New York State Workers Compensation Board Quarterly GA 4 Form, is a crucial document used for reporting wages and calculating workers' compensation premiums. Employers in New York must complete this form to provide accurate information about their employees' earnings during a specific quarter. This ensures compliance with state regulations and helps determine the appropriate workers' compensation coverage needed for their business.

How to Use the GA 4 Form

To effectively use the GA 4 form, employers should first gather all necessary information about their employees' wages for the reporting period. This includes total payroll amounts, classifications of employees, and any applicable deductions. Once the information is compiled, employers can fill out the form, ensuring that all sections are completed accurately. After completion, the form can be submitted to the New York State Workers Compensation Board either electronically or via mail, depending on the preference of the employer.

Steps to Complete the GA 4 Form

Completing the GA 4 form involves several key steps:

- Gather employee wage information for the reporting quarter.

- Access the GA 4 form, either in a printable format or as a fillable document online.

- Fill in the required fields, including employer information, total payroll, and employee classifications.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to ensure compliance with state regulations.

Legal Use of the GA 4 Form

The GA 4 form is legally binding when completed and submitted according to New York State laws. It serves as an official record of employee wages and is essential for calculating workers' compensation premiums. To ensure its legal validity, employers must adhere to the requirements set forth by the New York State Workers Compensation Board, including accurate reporting and timely submission. Failure to comply can result in penalties or increased premiums.

Key Elements of the GA 4 Form

The GA 4 form includes several key elements that employers must complete:

- Employer Information: Name, address, and contact details of the business.

- Reporting Period: The specific quarter for which wages are being reported.

- Total Payroll: The total amount of wages paid to employees during the reporting period.

- Employee Classifications: Categories of employees based on their job roles and associated risk levels.

- Signature: The form must be signed by an authorized representative of the business.

Form Submission Methods

Employers have multiple options for submitting the GA 4 form:

- Online Submission: Many employers choose to submit the form electronically through the New York State Workers Compensation Board's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Workers Compensation Board.

- In-Person: Employers may also deliver the form in person at designated Workers Compensation Board offices.

Quick guide on how to complete ga 4 printable form for new york

Effortlessly Prepare Ga 4 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary format and securely preserve it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Ga 4 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to Modify and Electronically Sign Ga 4 Form with Ease

- Locate Ga 4 Form and select Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal standing as a traditional ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document prints. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Ga 4 Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

Create this form in 5 minutes!

How to create an eSignature for the ga 4 printable form for new york

How to make an electronic signature for the Ga 4 Printable Form For New York in the online mode

How to make an electronic signature for your Ga 4 Printable Form For New York in Chrome

How to generate an electronic signature for signing the Ga 4 Printable Form For New York in Gmail

How to generate an eSignature for the Ga 4 Printable Form For New York from your smartphone

How to generate an eSignature for the Ga 4 Printable Form For New York on iOS devices

How to make an eSignature for the Ga 4 Printable Form For New York on Android OS

People also ask

-

What is GA 4 workers comp?

GA 4 workers comp refers to the latest iteration of the Google Analytics tracking for managing workers' compensation claims. It helps businesses analyze key metrics related to workers' compensation processes, allowing for better decision-making and improved operational efficiency.

-

How can airSlate SignNow facilitate GA 4 workers comp documentation?

airSlate SignNow allows businesses to easily send and eSign essential documents related to GA 4 workers comp. With our user-friendly platform, employers can streamline claims, ensuring compliance and faster processing times while maintaining accurate records.

-

What features does airSlate SignNow offer for managing GA 4 workers comp?

With airSlate SignNow, features include customizable templates, secure eSigning, and automated workflows tailored to GA 4 workers comp needs. These features enhance efficiency, reduce paper usage, and ensure that all documentation is handled properly and securely.

-

Is airSlate SignNow a cost-effective solution for GA 4 workers comp?

Yes, airSlate SignNow offers a cost-effective solution for managing GA 4 workers comp documentation. With flexible pricing plans designed for businesses of all sizes, it simplifies the eSignature process without straining your budget.

-

Can airSlate SignNow integrate with other platforms for GA 4 workers comp?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, including HR software and document management systems, enhancing its functionality for GA 4 workers comp processes. These integrations allow for smoother workflows and better resource management.

-

What are the benefits of using airSlate SignNow for GA 4 workers comp?

Using airSlate SignNow for GA 4 workers comp improves efficiency by reducing turnaround times for required signatures and documentation. It also enhances compliance measures, protects sensitive data, and provides a centralized place for all workers' compensation documents.

-

Is airSlate SignNow secure for handling GA 4 workers comp data?

Yes, airSlate SignNow is highly secure and compliant with industry standards, making it a safe choice for handling GA 4 workers comp data. Our platform utilizes encryption and has robust security protocols to ensure that all sensitive information remains protected.

Get more for Ga 4 Form

Find out other Ga 4 Form

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template