8829 Form

What is the 8829 Form

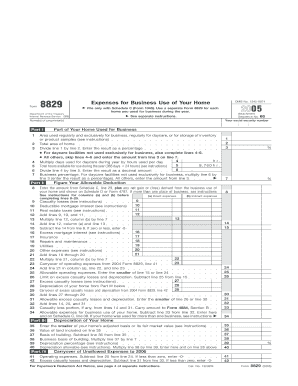

The 8829 Form, officially known as the "Expenses for Business Use of Your Home," is a tax form used by self-employed individuals and certain employees to claim deductions related to the business use of their home. This form allows taxpayers to detail the expenses incurred for maintaining a home office, which can include mortgage interest, utilities, repairs, and depreciation. Properly completing the 8829 Form can result in significant tax savings for eligible individuals by allowing them to deduct a portion of their home expenses against their business income.

How to use the 8829 Form

Using the 8829 Form involves several steps to ensure accurate reporting of home office expenses. First, you need to determine the portion of your home used for business purposes, typically measured in square footage. Next, gather all relevant expense documentation, such as receipts and bills. The form requires you to categorize expenses into direct and indirect costs. Direct costs are those specifically related to the business area, while indirect costs apply to the entire home. After filling out the form, it should be attached to your tax return when filing.

Steps to complete the 8829 Form

Completing the 8829 Form involves a systematic approach:

- Determine the total area of your home and the area used exclusively for business.

- Gather all necessary documents, including receipts for utilities, repairs, and mortgage interest.

- Fill out the form, starting with your business information and the percentage of your home used for business.

- List your direct and indirect expenses in the appropriate sections of the form.

- Calculate the total deductions and ensure all figures are accurate.

- Attach the completed form to your tax return.

Legal use of the 8829 Form

The 8829 Form is legally recognized by the IRS for claiming deductions related to the business use of a home. To ensure compliance, it is essential to follow IRS guidelines regarding eligibility. The space claimed must be used regularly and exclusively for business activities. Additionally, maintaining accurate records of all expenses is crucial for substantiating your claims in the event of an audit. Utilizing a reliable eSignature platform can help ensure that your completed form is securely signed and stored.

IRS Guidelines

The IRS provides specific guidelines for completing the 8829 Form. Taxpayers must ensure that the home office is their principal place of business or a place where they meet clients. The IRS also outlines the types of expenses that can be deducted, emphasizing the need for direct correlation between the expenses claimed and the business use of the home. Familiarity with these guidelines is critical to maximize deductions and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 8829 Form align with the standard tax return deadlines. Typically, individual tax returns are due on April fifteenth each year. If you are unable to meet this deadline, you may file for an extension, but any taxes owed must still be paid by the original due date to avoid penalties. Keeping track of these important dates is essential for timely and compliant filing.

Required Documents

To complete the 8829 Form accurately, several documents are required. These include:

- Receipts for utilities, repairs, and maintenance related to the home.

- Mortgage interest statements or property tax records.

- Documentation of the square footage of your home and the area used for business.

- Any additional records that support your business use claims.

Quick guide on how to complete 8829 form

Effortlessly Prepare 8829 Form on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage 8829 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign 8829 Form with Ease

- Find 8829 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether it's by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign 8829 Form to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8829 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8829 Form?

The 8829 Form is a tax form used by self-employed individuals to claim expenses for the business use of their home. This form helps you determine the percentage of your home that is used for business purposes, allowing you to maximize your deductions. By using airSlate SignNow for the 8829 Form, you can easily fill out and eSign the document digitally.

-

How can I fill out the 8829 Form easily?

Filling out the 8829 Form can be made easier with airSlate SignNow's intuitive interface. Our platform allows you to customize and complete the form quickly, ensuring that you include all necessary details for a smooth submission. Plus, you can eSign the 8829 Form directly within the application, streamlining the entire process.

-

What features does airSlate SignNow offer for the 8829 Form?

airSlate SignNow offers features that enhance the eSigning process for the 8829 Form, including digital signatures, document templates, and automated workflows. These tools simplify the management of tax-related documents while ensuring compliance with IRS guidelines. With our platform, you can track your document status and securely store your signed forms.

-

Are there any costs associated with using airSlate SignNow for the 8829 Form?

Yes, there is a pricing model for airSlate SignNow, which varies based on the plan you choose. Our services are designed to be cost-effective, ensuring you get great value while managing essential documents like the 8829 Form. We recommend reviewing our plans to select the one that best fits your business needs.

-

Can airSlate SignNow integrate with other tools I use to manage the 8829 Form?

Absolutely! airSlate SignNow seamlessly integrates with various tools and software commonly used for business operations, making it easier to manage the 8829 Form. Whether you're using accounting software or document management systems, our integrations will help streamline your workflow and ensure that your forms are readily accessible.

-

What are the benefits of using airSlate SignNow for the 8829 Form?

Using airSlate SignNow for the 8829 Form provides several benefits, including enhanced efficiency, secure eSigning, and easy document management. This helps business owners save time and minimize the hassle of paperwork, allowing you to focus on growing your business. Additionally, our platform ensures that your forms are legally binding and compliant.

-

Is my information safe when using airSlate SignNow for the 8829 Form?

Yes, your information is safe with airSlate SignNow. We prioritize data security and use encryption to protect all documents, including the 8829 Form. Our robust security measures ensure that your personal and financial information is kept confidential and secure throughout the eSigning process.

Get more for 8829 Form

Find out other 8829 Form

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer