Form 8919 2011

What is the Form 8919

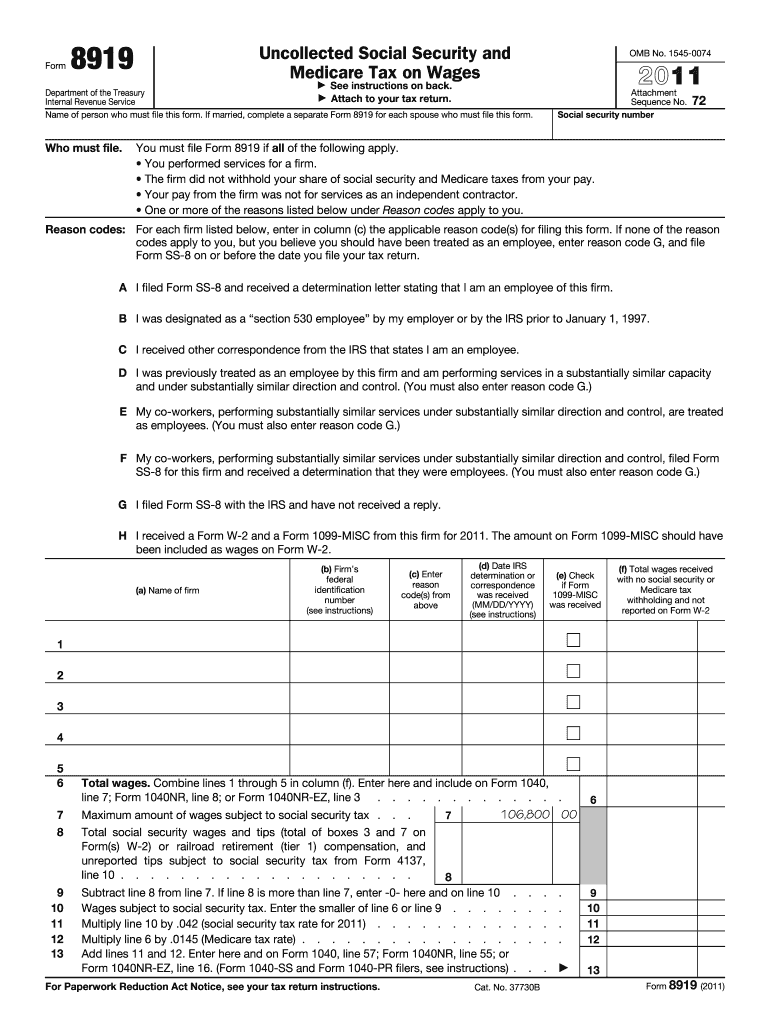

The Form 8919, also known as the Uncollected Social Security and Medicare Tax on Wages, is a tax form used by employees to report uncollected Social Security and Medicare taxes on their wages. This situation typically arises when an employer has not withheld these taxes from an employee's paycheck. The form allows employees to calculate and report the amount owed to the IRS for these taxes, ensuring compliance with federal tax regulations.

How to use the Form 8919

Using the Form 8919 involves several steps. First, gather your wage statements and any relevant documentation that indicates the uncollected taxes. Next, complete the form by providing your personal information, including your name, Social Security number, and the details of your employer. Calculate the uncollected amounts based on your wages and the applicable tax rates. Finally, submit the completed form along with your tax return to the IRS.

Steps to complete the Form 8919

Completing the Form 8919 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information in the designated fields.

- List your employer's information, including name and address.

- Calculate the total wages you received during the tax year.

- Determine the amount of Social Security and Medicare tax that should have been withheld.

- Subtract any amounts that were actually withheld to find the uncollected tax.

- Complete the form by signing and dating it before submission.

Legal use of the Form 8919

The legal use of the Form 8919 is essential for ensuring compliance with IRS regulations. This form must be filed accurately to avoid penalties. It serves as a formal declaration of uncollected taxes, allowing the IRS to track and enforce tax obligations. When used correctly, the form protects taxpayers from potential legal issues related to unpaid taxes.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8919. It is important to refer to the latest IRS instructions to ensure compliance with current tax laws. These guidelines outline eligibility criteria, filing procedures, and deadlines. Adhering to these instructions helps prevent errors that could lead to delays or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8919 are typically aligned with the annual tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following year. However, if you file for an extension, ensure that the Form 8919 is included with your extended return. Staying aware of these dates is crucial for maintaining compliance and avoiding late fees.

Quick guide on how to complete form 8919 1649707

Complete Form 8919 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 8919 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented operation today.

The easiest way to modify and eSign Form 8919 without hassle

- Find Form 8919 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal value as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Form 8919 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8919 1649707

Create this form in 5 minutes!

How to create an eSignature for the form 8919 1649707

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8919 and why is it important?

Form 8919 is used to determine the amount of uncollected Social Security and Medicare tax on wages paid by an employer. Filling out form 8919 is essential for employees who believe their employer failed to withhold these taxes. By using airSlate SignNow, you can easily complete and eSign form 8919, ensuring compliance with tax regulations.

-

How can airSlate SignNow help with form 8919?

AirSlate SignNow provides a user-friendly platform for completing and signing form 8919. With our eSignature capabilities, you can fill out this tax form quickly and securely. Our solution streamlines the process, making it simple to manage your tax documentation from anywhere.

-

Is airSlate SignNow compatible with form 8919 integrations?

Absolutely! AirSlate SignNow seamlessly integrates with various applications, making it easier to manage your documents related to form 8919. This integration saves time by allowing you to access and send necessary forms directly within your existing workflows.

-

What are the pricing options for using airSlate SignNow to eSign form 8919?

AirSlate SignNow offers flexible pricing plans that cater to different needs, including individual users and businesses. Each plan provides various features to help you efficiently manage documents like form 8919. Our cost-effective solution ensures that you get the best value for your eSignature needs.

-

Can I track the status of my form 8919 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 8919 throughout the signing process. You can receive real-time notifications on document activity, ensuring that you are always informed about the progress of your tax forms. This feature enhances the reliability and transparency of your document management.

-

How secure is my information when using airSlate SignNow for form 8919?

Your security is our priority. AirSlate SignNow implements industry-leading encryption and compliance measures to protect sensitive information when completing form 8919. You can trust that your data is safe while you utilize our eSignature solution.

-

Can multiple users collaborate on form 8919 using airSlate SignNow?

Yes, airSlate SignNow supports collaboration, allowing multiple users to work on form 8919 simultaneously. This feature is especially useful for teams who need to coordinate efforts for tax documentation and signatures, making the process more efficient.

Get more for Form 8919

Find out other Form 8919

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself