What is Tax Form 8919 Social Security Medicare Tax on Wages 2023

What is IRS Form 8919?

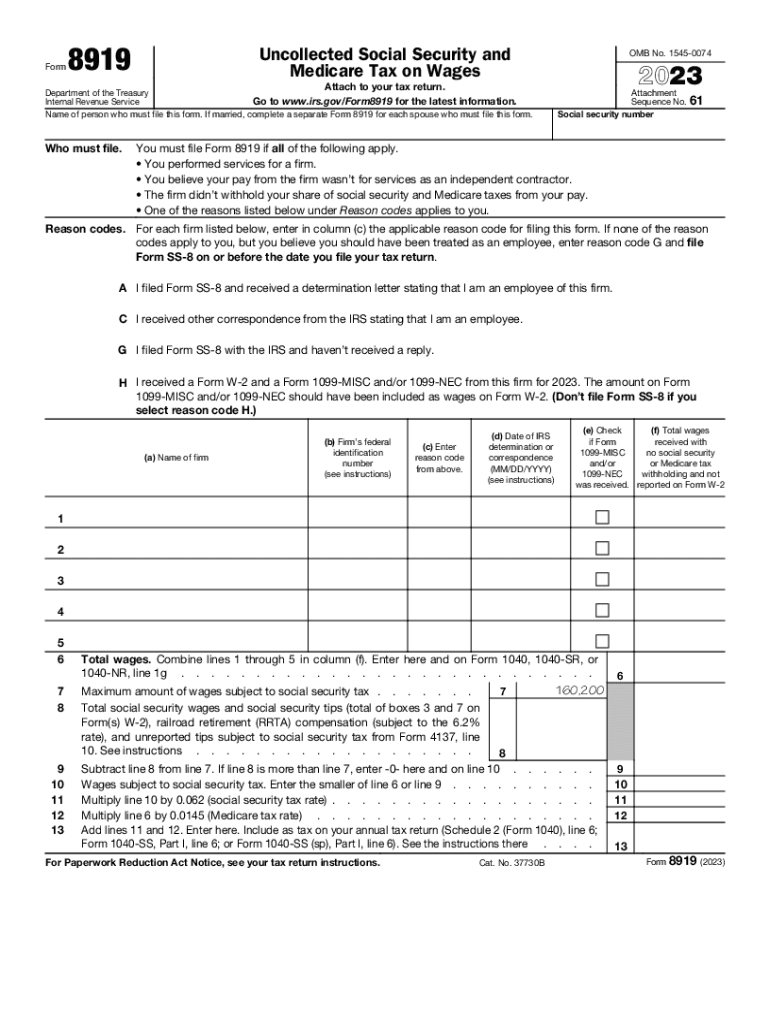

IRS Form 8919 is used to report uncollected Social Security and Medicare taxes on wages. This form is relevant for employees who believe that their employer failed to withhold these taxes correctly. It allows workers to calculate and pay the appropriate amount of taxes that should have been withheld from their wages. Understanding the purpose of this form is crucial for ensuring compliance with tax obligations and avoiding potential penalties.

How to Obtain IRS Form 8919

To obtain IRS Form 8919, individuals can visit the official IRS website, where they can download the form directly. The form is available in PDF format, making it easy to print and fill out. Additionally, taxpayers can request a physical copy by contacting the IRS directly or visiting a local IRS office. It is important to ensure that you are using the correct version of the form for the current tax year, such as the 2023 version.

Steps to Complete IRS Form 8919

Completing IRS Form 8919 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the total amount of wages you received from your employer that were not subject to Social Security and Medicare taxes.

- Calculate the total amount of uncollected taxes by applying the appropriate rates to the wages reported.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, it should be submitted according to the instructions provided by the IRS.

IRS Guidelines for Form 8919

The IRS provides specific guidelines for filling out Form 8919. These guidelines include instructions on who should file the form, how to calculate uncollected taxes, and the importance of accurate reporting. It is essential to review these guidelines carefully to ensure compliance and avoid any issues with the IRS. Taxpayers should also be aware of any updates or changes to the form or filing requirements for the current tax year.

Filing Deadlines for IRS Form 8919

Filing deadlines for IRS Form 8919 typically align with the annual tax filing deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to file the form timely to avoid penalties for late submission. Additionally, if you are unable to file by the deadline, you may consider requesting an extension, but this does not extend the time to pay any taxes owed.

Penalties for Non-Compliance with Form 8919

Failure to file IRS Form 8919 when required can result in penalties. The IRS may impose fines for late filing or for not reporting uncollected taxes. Additionally, taxpayers may be responsible for paying interest on any unpaid taxes. Understanding the potential consequences of non-compliance emphasizes the importance of properly completing and submitting this form.

Quick guide on how to complete what is tax form 8919 social security medicare tax on wages

Complete What Is Tax Form 8919 Social Security Medicare Tax On Wages effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly and without delays. Manage What Is Tax Form 8919 Social Security Medicare Tax On Wages on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and eSign What Is Tax Form 8919 Social Security Medicare Tax On Wages without any hassle

- Obtain What Is Tax Form 8919 Social Security Medicare Tax On Wages and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, either by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign What Is Tax Form 8919 Social Security Medicare Tax On Wages and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is tax form 8919 social security medicare tax on wages

Create this form in 5 minutes!

How to create an eSignature for the what is tax form 8919 social security medicare tax on wages

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8919 and how does it relate to airSlate SignNow?

Form 8919 is used by workers to report uncollected Social Security and Medicare taxes. airSlate SignNow streamlines the process of digitally signing and sending this form, making it easy for users to ensure compliance while saving time on paperwork.

-

How can airSlate SignNow assist me in filling out form 8919?

With airSlate SignNow, you can quickly access a template for form 8919, fill it out, and eSign it effortlessly. Our platform simplifies the entire process, ensuring you can complete your tax forms accurately and submit them promptly.

-

What pricing options are available for airSlate SignNow customers needing form 8919?

airSlate SignNow offers various pricing plans that cater to individual users as well as businesses. These plans include features for easy document management and eSigning, making it a cost-effective choice for those needing to manage forms like form 8919.

-

Does airSlate SignNow integrate with other software for managing form 8919?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and more. This allows users to easily pull in documents like form 8919 and manage them efficiently within their existing workflows.

-

What are the benefits of using airSlate SignNow for form 8919?

Using airSlate SignNow for form 8919 offers multiple benefits, including enhanced security for your sensitive information, faster turnaround times on document processing, and the ability to track the status of your forms. This ensures you can submit your form 8919 confidently and securely.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with form 8919?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those unfamiliar with form 8919. Our intuitive interface guides users through the process of filling out and signing documents, making it accessible for everyone.

-

Can multiple users collaborate on form 8919 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 8919 in real-time. This feature is particularly useful for teams working together to prepare tax forms, ensuring everyone can contribute efficiently and stay aligned.

Get more for What Is Tax Form 8919 Social Security Medicare Tax On Wages

- Provenge enrollment form

- Department of labour amp employment form

- Declaration in support of application for city of houston building permit form

- Brief jail mental health screen form

- Milady lesson plan template form

- Alarm system permit form pdf file city of inglewood cityofinglewood

- State of utah department of public safety bureau of form

- Harford glen home page harford county public schools form

Find out other What Is Tax Form 8919 Social Security Medicare Tax On Wages

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed