Form 8919 Uncollected Social Security and Medicare Tax 2024-2026

What is the Form 8919: Uncollected Social Security And Medicare Tax

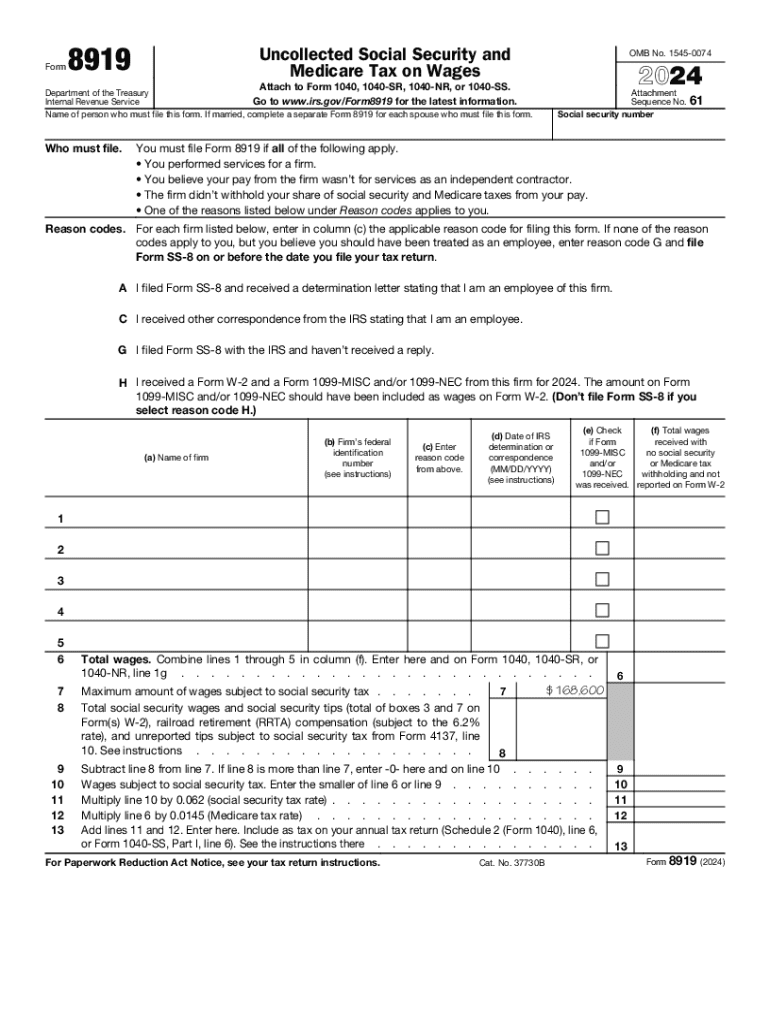

The Form 8919 is used by employees to report uncollected Social Security and Medicare taxes on wages paid by an employer who did not withhold these taxes. This situation often arises when an employer misclassifies an employee as an independent contractor or fails to withhold the necessary taxes due to other reasons. Filing this form allows the employee to claim these taxes on their federal income tax return, ensuring compliance with IRS regulations.

How to Use the Form 8919: Uncollected Social Security And Medicare Tax

To use Form 8919, individuals must first determine if they have uncollected Social Security and Medicare taxes. If applicable, they should complete the form by providing details about their wages, the amount of uncollected taxes, and the employer's information. The completed form should then be attached to the individual's federal income tax return. It is crucial to ensure all information is accurate to avoid delays or penalties.

Steps to Complete the Form 8919: Uncollected Social Security And Medicare Tax

Completing Form 8919 involves several key steps:

- Gather necessary information, including your wages and the employer's details.

- Fill out the form by entering your name, Social Security number, and the total amount of uncollected Social Security and Medicare taxes.

- Indicate whether you believe you were misclassified as an independent contractor.

- Review the form for accuracy before submission.

Once completed, attach the form to your tax return and file it with the IRS.

Filing Deadlines / Important Dates

Form 8919 must be filed by the same deadline as your federal income tax return. For most taxpayers, this is April 15 of the following year. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Eligibility Criteria for Form 8919

To qualify for using Form 8919, you must have received wages from an employer who did not withhold Social Security and Medicare taxes. This typically applies to individuals who were misclassified as independent contractors or those who worked for employers that failed to fulfill their tax withholding responsibilities. It is essential to review your employment status and tax situation to determine eligibility.

IRS Guidelines for Form 8919

The IRS provides specific guidelines for completing and submitting Form 8919. It is important to adhere to these guidelines to ensure compliance and avoid potential issues. The form must be accurately filled out, and all required information should be included. Additionally, the IRS recommends keeping copies of the form and any supporting documents for your records.

Examples of Using the Form 8919: Uncollected Social Security And Medicare Tax

Common scenarios for using Form 8919 include:

- An employee who was classified as an independent contractor but performed duties similar to those of a regular employee.

- A worker who received wages from an employer that failed to withhold Social Security and Medicare taxes due to administrative errors.

In both cases, filing Form 8919 allows the employee to report the uncollected taxes and ensure proper compliance with tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct form 8919 uncollected social security and medicare tax

Create this form in 5 minutes!

How to create an eSignature for the form 8919 uncollected social security and medicare tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8919 and why do I need it?

Form 8919 is used to determine the amount of unreported income from self-employment. It is essential for individuals who need to report income that was not included on their tax return. Using airSlate SignNow, you can easily eSign and submit Form 8919, ensuring compliance and accuracy in your tax filings.

-

How can airSlate SignNow help me with Form 8919?

airSlate SignNow provides a user-friendly platform to create, send, and eSign Form 8919. With our solution, you can streamline the process of completing and submitting this form, saving you time and reducing the risk of errors. Our features ensure that your documents are secure and legally binding.

-

Is there a cost associated with using airSlate SignNow for Form 8919?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and designed to provide value for users who need to manage documents like Form 8919 efficiently. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Form 8919?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 8919 alongside your other business tools. This integration enhances your workflow and ensures that all your documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for Form 8919?

Using airSlate SignNow for Form 8919 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly, track their status, and ensure compliance with tax regulations. This means you can focus more on your business and less on administrative tasks.

-

Is airSlate SignNow secure for handling Form 8919?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and security protocols to protect your data when handling Form 8919 and other sensitive documents. You can trust that your information is safe with us.

-

How do I get started with airSlate SignNow for Form 8919?

Getting started with airSlate SignNow for Form 8919 is easy! Simply sign up for an account, choose your pricing plan, and start creating or uploading your Form 8919. Our intuitive interface guides you through the process, making it simple to eSign and manage your documents.

Get more for Form 8919 Uncollected Social Security And Medicare Tax

Find out other Form 8919 Uncollected Social Security And Medicare Tax

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure