Cbp Form 301 0611

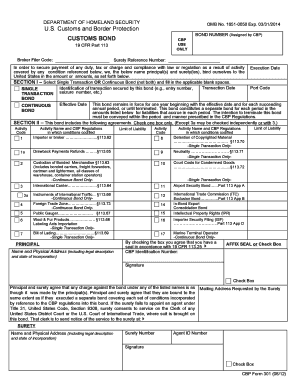

What is the CBP Form 301?

The CBP Form 301, also known as the Application for Foreign Trade Zone Admission and/or Status Designation, is a crucial document used by businesses seeking to utilize foreign trade zones (FTZs) in the United States. This form allows companies to apply for admission of merchandise into an FTZ, where they can benefit from various customs advantages, such as duty deferral and reduced tariffs. Understanding the purpose and requirements of this form is essential for businesses looking to optimize their import processes.

How to Use the CBP Form 301

Using the CBP Form 301 involves several steps to ensure accurate completion and submission. First, businesses must gather necessary information about the merchandise they wish to admit into the FTZ, including descriptions, quantities, and values. Next, the form must be filled out with precise details, ensuring compliance with U.S. Customs and Border Protection regulations. After completing the form, it should be submitted to the appropriate FTZ Board or port authority for approval. Utilizing digital tools can streamline this process, making it easier to manage and track submissions.

Steps to Complete the CBP Form 301

Completing the CBP Form 301 involves a systematic approach to ensure all required information is accurately provided. Here are the key steps:

- Gather all necessary documentation related to the merchandise.

- Provide detailed descriptions of the items, including their classification under the Harmonized Tariff Schedule.

- Fill in the quantities and values of the merchandise being admitted.

- Include the FTZ number and the location of the zone where the merchandise will be stored.

- Review the completed form for accuracy before submission.

Legal Use of the CBP Form 301

The legal use of the CBP Form 301 is governed by U.S. customs laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted to the appropriate authorities. The information provided must be truthful and comply with all applicable laws. Utilizing a reliable digital signature service can enhance the legal validity of the form, ensuring that all signatures are authenticated and traceable.

Key Elements of the CBP Form 301

Several key elements are essential for the effective use of the CBP Form 301:

- Merchandise Description: Clear and detailed descriptions of the items being admitted.

- HTS Classification: Accurate classification of merchandise under the Harmonized Tariff Schedule.

- Value and Quantity: Precise values and quantities for each item.

- FTZ Number: The specific number assigned to the foreign trade zone.

- Signature: An authorized signature to validate the application.

Form Submission Methods

The CBP Form 301 can be submitted through various methods, depending on the requirements of the specific FTZ Board or port authority. Common submission methods include:

- Online Submission: Many authorities allow electronic submissions through their designated portals.

- Mail: The form can be printed and mailed to the appropriate FTZ Board or port authority.

- In-Person: Some businesses may choose to submit the form in person at the local customs office.

Quick guide on how to complete cbp form 301 0611

Easily Prepare Cbp Form 301 0611 on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and store it securely online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Cbp Form 301 0611 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Cbp Form 301 0611 Effortlessly

- Locate Cbp Form 301 0611 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight relevant parts of your documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the information carefully and click the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Cbp Form 301 0611 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cbp form 301 0611

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cbp form 301 and why is it important?

The cbp form 301, also known as the Application for Customs Bond, is essential for businesses that need to expedite the customs clearance process. It provides proof that duties and taxes to the U.S. Customs and Border Protection will be paid, ensuring smoother international shipping operations.

-

How does airSlate SignNow help with the cbp form 301?

AirSlate SignNow simplifies the process of filling out and signing the cbp form 301. With our eSignature solution, users can quickly complete and securely send this important customs documentation, minimizing delays in shipping and enhancing efficiency.

-

Is airSlate SignNow’s feature set suitable for managing the cbp form 301?

Yes, airSlate SignNow offers robust features like templates and cloud storage that streamline the management of the cbp form 301. Our platform allows easy access and sharing of documents, which is crucial for any business dealing with customs regulations.

-

What is the pricing structure for using airSlate SignNow to handle the cbp form 301?

AirSlate SignNow offers competitive pricing plans that cater to different business sizes. Depending on your needs, you can choose a plan that allows you to efficiently manage multiple cbp form 301 submissions without breaking your budget.

-

Can I integrate airSlate SignNow with other tools for the cbp form 301 process?

Absolutely! AirSlate SignNow integrates seamlessly with many popular software and productivity tools. This capability enables you to automate workflows associated with the cbp form 301, enhancing overall productivity and streamlining processes.

-

What benefits does airSlate SignNow provide when dealing with the cbp form 301?

By using airSlate SignNow for the cbp form 301, you gain access to increased efficiency, reduced processing time, and enhanced accuracy in document handling. Our platform ensures that your customs documentation is always up-to-date and compliant with regulations.

-

Is airSlate SignNow user-friendly for eSigning the cbp form 301?

Yes, airSlate SignNow is designed with user experience in mind, making it extremely easy for anyone to eSign the cbp form 301. Our intuitive interface and thorough guides ensure that even users with minimal tech knowledge can navigate and complete their documents effortlessly.

Get more for Cbp Form 301 0611

- Register to vote alabama fillable application form

- Moped form

- Improvment certificate formpdffillercom

- National standard for arts information exchange data form

- Fim scale pdf form

- Authorization for use and disclosure of health information release of information for the palo alto medical foundation

- Minnesota youth soccer form

- Changing passport details for cfa exam form

Find out other Cbp Form 301 0611

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation