Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok Form

What is the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok

The Oklahoma Individual Estimated Tax ITE is a form used by individuals to report and pay estimated income taxes to the state of Oklahoma. This form is particularly important for those who expect to owe tax of one thousand dollars or more when filing their annual tax return. It allows taxpayers to make quarterly payments throughout the year, helping to avoid a large tax bill at the end of the fiscal year. The due date for submitting the estimated tax payments is April 15, aligning with the federal tax deadline, ensuring consistency for taxpayers.

Steps to complete the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok

Completing the Oklahoma Individual Estimated Tax ITE involves several key steps:

- Gather your financial information, including income, deductions, and credits.

- Calculate your expected tax liability for the year based on your income projections.

- Divide your estimated tax liability by the number of payment periods, typically four.

- Fill out the form accurately, ensuring all sections are completed, including your personal information and payment details.

- Review the form for accuracy before submission.

- Submit the form electronically or via mail by the due date.

Legal use of the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok

The Oklahoma Individual Estimated Tax ITE is legally binding when completed and submitted according to state regulations. It must be signed by the taxpayer or an authorized representative. Digital signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This ensures that the form holds legal weight in the eyes of the state and can be used to validate tax payments.

Filing Deadlines / Important Dates

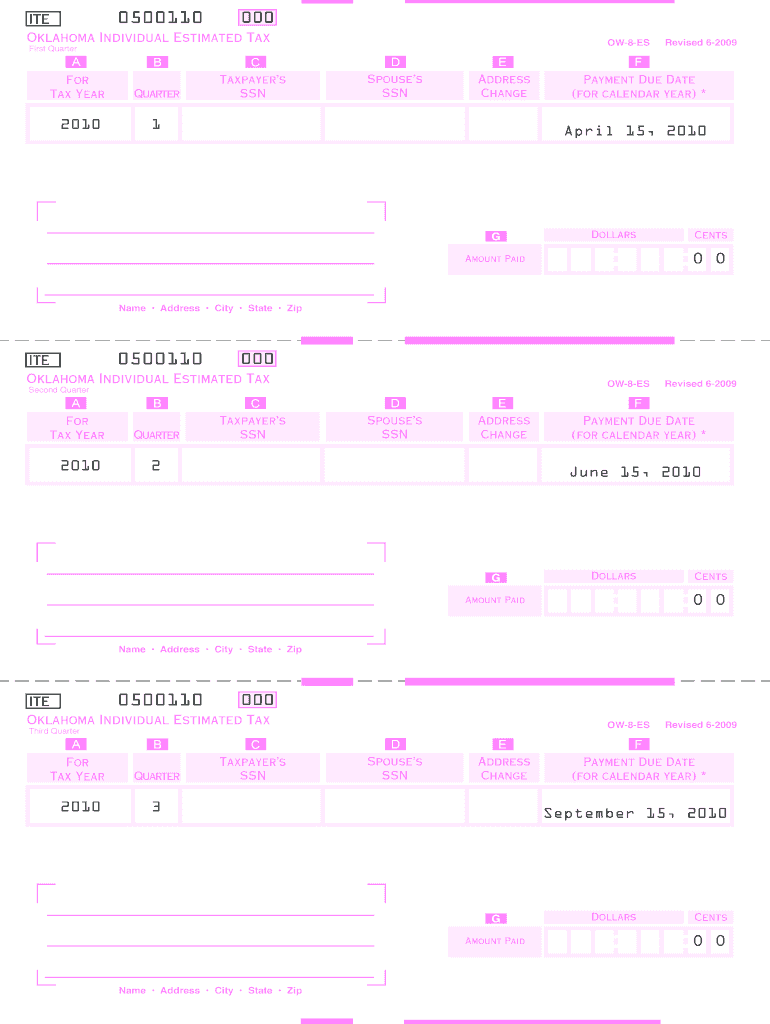

Filing deadlines for the Oklahoma Individual Estimated Tax ITE are crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is important to mark these dates on your calendar and ensure timely submission to avoid interest and penalties.

Who Issues the Form

The Oklahoma Individual Estimated Tax ITE is issued by the Oklahoma Tax Commission. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide resources and support for individuals needing assistance with the form, including guidelines for completion and submission.

Examples of using the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok

There are various scenarios in which an individual might need to use the Oklahoma Individual Estimated Tax ITE:

- A self-employed individual anticipating significant income and wanting to avoid a large tax bill at year-end.

- A retiree receiving pension income that is not subject to withholding.

- A taxpayer who has investment income that may not have taxes withheld throughout the year.

These examples illustrate the importance of the form in managing tax obligations effectively.

Quick guide on how to complete oklahoma individual estimated tax ite april 15 2010 2010 1 tax ok

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to Alter and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the oklahoma individual estimated tax ite april 15 2010 2010 1 tax ok

How to generate an eSignature for your Oklahoma Individual Estimated Tax Ite April 15 2010 2010 1 Tax Ok online

How to create an electronic signature for the Oklahoma Individual Estimated Tax Ite April 15 2010 2010 1 Tax Ok in Google Chrome

How to create an eSignature for signing the Oklahoma Individual Estimated Tax Ite April 15 2010 2010 1 Tax Ok in Gmail

How to create an electronic signature for the Oklahoma Individual Estimated Tax Ite April 15 2010 2010 1 Tax Ok straight from your smart phone

How to make an electronic signature for the Oklahoma Individual Estimated Tax Ite April 15 2010 2010 1 Tax Ok on iOS

How to create an eSignature for the Oklahoma Individual Estimated Tax Ite April 15 2010 2010 1 Tax Ok on Android

People also ask

-

What is the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok?

The Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok refers to the annual tax payment that individuals in Oklahoma must estimate and submit by April 15. It ensures that taxpayers meet their tax liabilities throughout the year and avoid penalties.

-

How can airSlate SignNow help with Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok submissions?

airSlate SignNow streamlines the process of eSigning and sending necessary documents for your Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok submissions. With its user-friendly interface, you can easily gather signatures and submit your paperwork quickly and securely.

-

What are the pricing plans for using airSlate SignNow for my tax needs?

airSlate SignNow offers several pricing tiers designed to fit every budget and need, making it an affordable choice for managing documents related to your Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok. You can choose a plan that fits your business size and volume of document transactions.

-

What features does airSlate SignNow provide for efficient document management?

airSlate SignNow provides features such as customizable templates, audit trails, and secure cloud storage, which are essential for managing documents related to the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok. These tools help ensure that your documents are organized and easily accessible.

-

Are there any benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok, offers numerous benefits. It enhances your efficiency by reducing paper usage, accelerating turnaround times, and ensuring that all signatures are legally binding and secure.

-

Can I integrate airSlate SignNow with other platforms for my tax related activities?

Yes, airSlate SignNow can easily integrate with various software and platforms often used for tax-related activities. This allows for seamless synchronization of your documents and data, enhancing your ability to manage the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok and other forms efficiently.

-

What support options does airSlate SignNow offer for new users?

airSlate SignNow offers comprehensive support options for new users, including tutorials, a knowledge base, and customer service. This is particularly helpful for those managing the Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok, ensuring you have the resources needed to make the most of the service.

Get more for Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok

- Soil profile pvt land company ltd form

- Pt 283t pt 283t form

- Form 4419 pdf

- Alaska travel declaration form pdf

- Photo copyright release form fill out online

- It s only a section 332 liquidation what possibly could go wrong operating and reporting requirements for chapter 11 cases form

- Notificacin de posicion vacante bcareersbbhomedepotbbcomb form

- Form 1276 100115240

Find out other Oklahoma Individual Estimated Tax ITE April 15, 1 Tax Ok

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document