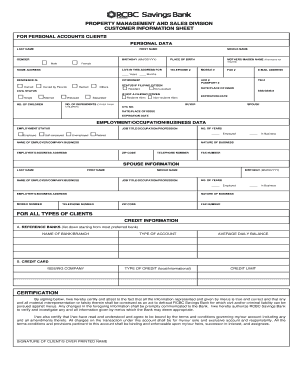

Rcbc Account Opening Form

Key elements of the RCBC loan application form

The RCBC loan application form includes essential information that applicants must provide to facilitate the processing of their loan requests. Key elements typically consist of personal identification details, financial information, and the purpose of the loan. Applicants are required to fill in their full name, contact information, and social security number. Additionally, income details, employment status, and monthly expenses are crucial for assessing eligibility.

Understanding these elements helps applicants prepare the necessary documentation, ensuring a smoother application process. It is advisable to have all relevant financial documents ready, such as pay stubs, bank statements, and tax returns, to support the information provided in the application.

Application process & approval time

The application process for the RCBC loan involves several steps. Initially, applicants must complete the RCBC loan application form accurately and submit it along with the required documentation. Once submitted, the bank will review the application, which typically includes a credit check and verification of the provided information.

Approval time can vary based on several factors, including the type of loan and the completeness of the application. Generally, applicants can expect to receive a decision within a few business days to a couple of weeks. Staying in communication with the bank during this period can help address any potential issues that may arise.

Required documents

To successfully complete the RCBC loan application form, applicants must prepare specific documents that validate their financial status and identity. Commonly required documents include:

- Proof of identity, such as a government-issued ID or passport.

- Proof of income, including recent pay stubs or tax returns.

- Bank statements from the last few months.

- Employment verification, such as a letter from the employer.

- Any additional documentation specific to the loan type, such as property details for home loans.

Having these documents ready can expedite the application process and increase the likelihood of approval.

Legal use of the RCBC loan application form

The RCBC loan application form must be completed and submitted in accordance with applicable laws and regulations. Understanding the legal framework surrounding loan applications is crucial for ensuring compliance and protecting personal information. The form serves as a legal document, and any false information provided can lead to serious consequences, including denial of the loan or legal action.

It is important for applicants to familiarize themselves with the terms and conditions associated with the loan, as well as their rights and responsibilities. This knowledge can help navigate the application process more effectively and ensure that all legal requirements are met.

Digital vs. paper version

Applicants have the option to complete the RCBC loan application form in either digital or paper format. The digital version offers convenience, allowing users to fill out and submit the form online, often resulting in faster processing times. Digital submissions can also reduce the risk of errors that may occur with handwritten forms.

On the other hand, some individuals may prefer the traditional paper version for various reasons, such as comfort with physical documents or lack of access to technology. Regardless of the format chosen, it is essential to ensure that all information is accurate and complete to avoid delays in the application process.

Eligibility criteria

Eligibility for the RCBC loan depends on several factors, including creditworthiness, income level, and employment stability. Applicants typically need to meet specific income thresholds and demonstrate a reliable source of income. Additionally, a good credit score can significantly enhance the chances of approval.

Each loan type may have its own set of eligibility requirements, so it is advisable for applicants to review these criteria carefully before submitting the application. Understanding these requirements can help potential borrowers assess their likelihood of approval and prepare accordingly.

Quick guide on how to complete rcbc account opening

Complete Rcbc Account Opening effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without holdups. Manage Rcbc Account Opening on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Rcbc Account Opening without hassle

- Locate Rcbc Account Opening and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Rcbc Account Opening and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rcbc account opening

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RCBC loan application form used for?

The RCBC loan application form is designed for individuals and businesses seeking financial assistance from RCBC. This form collects essential information needed to assess your eligibility for loans. By using the airSlate SignNow platform, you can easily create and send this application form and expedite the signing process.

-

How can I fill out the RCBC loan application form online?

Filling out the RCBC loan application form online is simple with airSlate SignNow. You can access the form, input your data, and submit it electronically, all while ensuring your information is securely stored. Additionally, the platform allows for easy collaboration with any parties involved.

-

What are the benefits of using airSlate SignNow for the RCBC loan application form?

Using airSlate SignNow for the RCBC loan application form offers several benefits, including an intuitive user interface, automated workflows, and enhanced security features. It streamlines the submission and approval process, helping you save time and reduce paperwork. Plus, you can track the status of your application seamlessly.

-

Is there a cost associated with using airSlate SignNow for the RCBC loan application form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs. While the basic features may be available for free, premium functionalities associated with the RCBC loan application form require a subscription. Check the pricing page for detailed information on what each plan includes.

-

Can I integrate airSlate SignNow with other applications for the RCBC loan application form?

Absolutely! airSlate SignNow supports integration with various applications to help streamline your workflow around the RCBC loan application form. This allows you to connect with CRMs, cloud storage services, and other tools, making it easier to manage your documents.

-

What types of documents can I send along with the RCBC loan application form?

You can send various supporting documents along with the RCBC loan application form using airSlate SignNow. This includes identification, financial statements, and any additional information required by RCBC for loan assessment. The platform ensures all these documents are securely transmitted and stored.

-

How does airSlate SignNow ensure the security of my RCBC loan application form?

airSlate SignNow prioritizes the security of your documents, including the RCBC loan application form. The platform utilizes encryption technology, secure data storage, and compliance with industry standards to protect your sensitive information. You can rest assured that your application is safe from unauthorized access.

Get more for Rcbc Account Opening

- Positive returns from investment in fusiform rust research srs fs usda

- Maine state police traffic division motor vehicle form

- Cl8 5 19 mandatory 7 19 form

- Cl8 9 12 mandatory 1 13 form

- Iowa notary acknowledgments form

- Dupage juvenile data sheet hand written format

- Fiscal agent contract template form

- Fitness coach contract template form

Find out other Rcbc Account Opening

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe