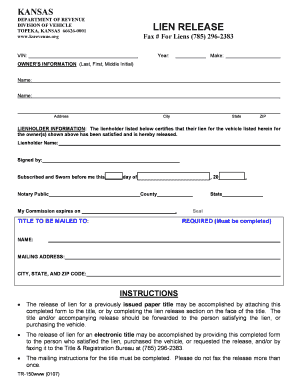

Kansas Lien Release Form

What is the Kansas Lien Release Form

The Kansas lien release form is a legal document used to officially release a lien on a property or asset. When a lien is placed on a property, it signifies that a creditor has a legal claim to the asset until a debt is satisfied. The lien release form serves as proof that the debt has been paid or settled, thereby removing the creditor's claim. This document is essential for property owners who wish to clear their title and ensure that they have full ownership rights without encumbrances.

How to use the Kansas Lien Release Form

Using the Kansas lien release form involves several steps to ensure its validity. First, the form must be filled out accurately, including details such as the property description, the names of the parties involved, and the date of lien release. After completing the form, it should be signed by the lienholder, confirming that the debt has been satisfied. Once signed, the form should be filed with the appropriate county office to officially record the release. This process helps protect the property owner's rights and ensures that the lien is removed from public records.

Steps to complete the Kansas Lien Release Form

Completing the Kansas lien release form requires careful attention to detail. Here are the steps to follow:

- Obtain the correct lien release form from the Kansas Department of Revenue or a trusted source.

- Fill in the required information, including the property address, lienholder's name, and debtor's name.

- Clearly state the reason for the lien release, typically indicating that the debt has been paid.

- Have the lienholder sign the form in the presence of a notary public to ensure its authenticity.

- Submit the completed form to the appropriate county office for recording.

Legal use of the Kansas Lien Release Form

The legal use of the Kansas lien release form is crucial for both creditors and debtors. It serves as a formal declaration that a lien has been released, which is legally binding once properly executed. This form must comply with Kansas state laws regarding lien releases, ensuring that all necessary information is included and that it is signed by the appropriate parties. Failure to use the form correctly may result in continued claims against the property, potentially leading to legal disputes.

Key elements of the Kansas Lien Release Form

Several key elements must be present in the Kansas lien release form for it to be considered valid. These include:

- The names and addresses of the lienholder and the debtor.

- A description of the property subject to the lien.

- The date the lien was originally placed and the date of release.

- A statement confirming that the debt has been satisfied.

- The signature of the lienholder, preferably notarized.

Who Issues the Form

The Kansas lien release form is typically issued by the lienholder, which could be a bank, financial institution, or individual creditor. In some cases, the form may also be available through the Kansas Department of Revenue or legal document services. It is important for the lienholder to ensure that the form is completed correctly and filed with the appropriate county office to finalize the release of the lien.

Quick guide on how to complete kansas lien release form

Manage Kansas Lien Release Form seamlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Kansas Lien Release Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign Kansas Lien Release Form effortlessly

- Locate Kansas Lien Release Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of the documents or conceal sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or invite link, or download it to your computer.

No more worries about lost or misfiled documents, frustrating form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any gadget of your choice. Edit and eSign Kansas Lien Release Form to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kansas lien release form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Kansas lien release?

A Kansas lien release is a legal document that formally removes a lien from a property once the associated debt has been paid. This process ensures that the property can be sold or refinanced without any encumbrances. Using airSlate SignNow, you can easily create and eSign a lien release document, making the process quick and efficient.

-

How can airSlate SignNow help with Kansas lien release documents?

airSlate SignNow provides a seamless platform for creating, signing, and managing Kansas lien release documents. Its user-friendly interface allows you to upload any required documents, fill out necessary details, and eSign them securely. This streamlined process saves time and reduces paperwork.

-

What are the costs associated with using airSlate SignNow for Kansas lien release?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. The cost depends on the number of users and features you need, but it remains an affordable solution for creating Kansas lien release documents. You can choose a plan that suits your business's budget while maximizing efficiency.

-

Can I integrate airSlate SignNow with other software for Kansas lien release processes?

Yes, airSlate SignNow supports integrations with a variety of software tools, enhancing your ability to manage Kansas lien release documents effectively. You can connect it with CRM systems, document management platforms, and other essential applications. This integration capability helps centralize your workflow.

-

Is there a mobile app available for managing Kansas lien releases on the go?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage Kansas lien release documents anytime, anywhere. This app includes features for eSigning and document management, ensuring that you never miss an opportunity to finalize a lien release, even when you're out of the office.

-

What security measures does airSlate SignNow provide for Kansas lien release documents?

airSlate SignNow prioritizes the security of your Kansas lien release documents by implementing advanced encryption and compliance with e-signature regulations. The platform ensures that only authorized users can access and sign documents. Your sensitive information is safe and secure throughout the process.

-

How does airSlate SignNow improve the efficiency of Kansas lien release processing?

Using airSlate SignNow signNowly speeds up the Kansas lien release processing by automating document creation and signatures. This eliminates manual handling and reduces the likelihood of errors, allowing your team to focus on more strategic tasks. Improved efficiency means faster turnaround times for your clients.

Get more for Kansas Lien Release Form

- Data review and form

- Oregon parks ampamp recreation department oregon heritage state form

- Unified inventory management form

- Dog train contract template form

- Dog stud fee contract template form

- Dog walk and pet sitt contract template form

- Dog walk contract template form

- Dog walker contract template form

Find out other Kansas Lien Release Form

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later