Georgia State Tax Form

What is the Georgia State Tax Form

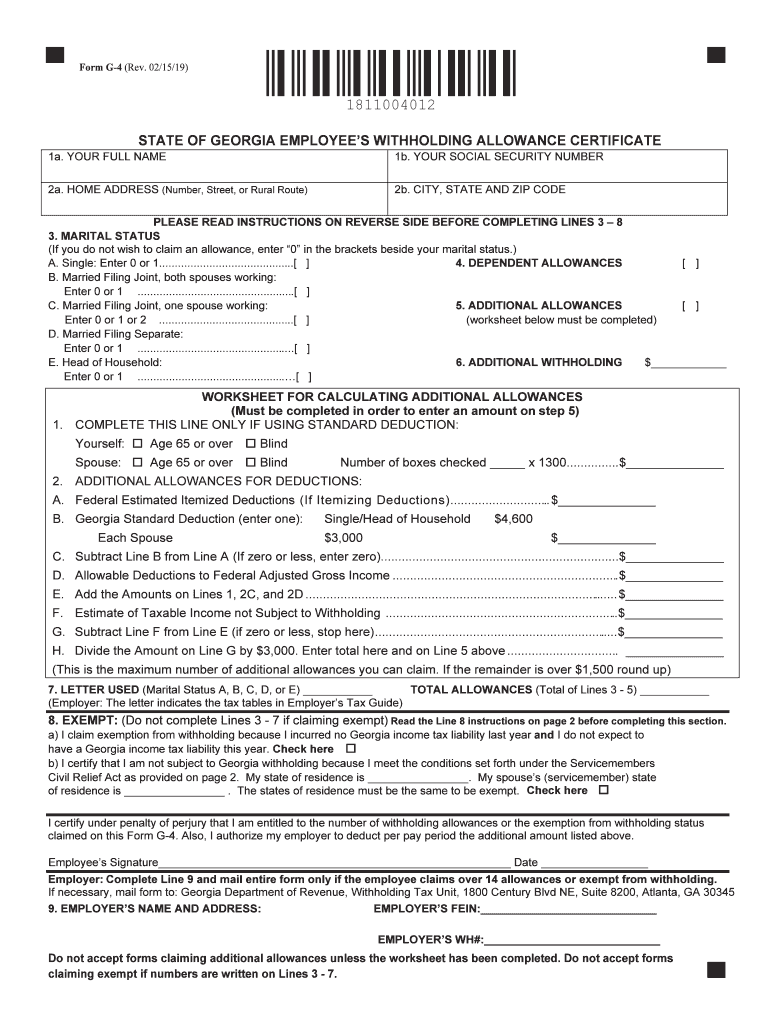

The Georgia State Tax Form is an essential document used by residents to report their income and calculate their state tax obligations. This form is designed for individuals and businesses to ensure compliance with Georgia tax laws. It includes various sections to capture personal information, income details, deductions, and credits applicable to the taxpayer. Understanding this form is crucial for accurate filing and to avoid penalties associated with non-compliance.

Steps to complete the Georgia State Tax Form

Completing the Georgia State Tax Form involves several key steps:

- Gather necessary documents: Collect your W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number accurately.

- Report income: Include all sources of income, ensuring that you account for any adjustments.

- Claim deductions: Utilize the GA standard deduction or itemize deductions as applicable to your situation.

- Calculate tax owed: Use the tax tables provided with the form to determine your tax liability.

- Review and sign: Ensure all information is correct before signing the form to validate it.

How to obtain the Georgia State Tax Form

The Georgia State Tax Form can be obtained through several methods:

- Online: Visit the Georgia Department of Revenue website to download the form in PDF format.

- By mail: Request a physical copy of the form by contacting the Georgia Department of Revenue.

- In-person: Visit local tax offices or public libraries that may have copies available.

Key elements of the Georgia State Tax Form

Understanding the key elements of the Georgia State Tax Form is vital for proper completion. Key components include:

- Filing status: Indicates whether you are filing as single, married filing jointly, or head of household.

- Income sections: Areas designated for reporting various types of income, including wages and investment earnings.

- Deductions and credits: Sections to claim the GA standard deduction or itemized deductions and any applicable tax credits.

- Signature line: A required area where the taxpayer must sign to validate the form.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Georgia State Tax Form can be done through various methods, ensuring convenience for taxpayers:

- Online submission: Many taxpayers opt to file electronically through state-approved e-filing services.

- Mail: Completed forms can be mailed to the designated address provided in the form instructions.

- In-person: Taxpayers may also submit their forms at local tax offices during designated hours.

Penalties for Non-Compliance

Failure to comply with Georgia tax regulations can result in significant penalties. Common penalties include:

- Late filing penalty: A percentage of the unpaid tax amount for each month the return is late.

- Underpayment penalty: Charged if the taxpayer does not pay enough tax throughout the year.

- Interest charges: Accrued on any unpaid tax balance from the due date until paid in full.

Quick guide on how to complete federal estimated itemized deductions if itemizing deductions

Easily prepare Georgia State Tax Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and eSign your documents without issues. Manage Georgia State Tax Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The easiest method to alter and eSign Georgia State Tax Form effortlessly

- Locate Georgia State Tax Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to store your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Georgia State Tax Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal estimated itemized deductions if itemizing deductions

How to generate an electronic signature for your Federal Estimated Itemized Deductions If Itemizing Deductions in the online mode

How to make an eSignature for your Federal Estimated Itemized Deductions If Itemizing Deductions in Chrome

How to generate an electronic signature for signing the Federal Estimated Itemized Deductions If Itemizing Deductions in Gmail

How to create an eSignature for the Federal Estimated Itemized Deductions If Itemizing Deductions straight from your smart phone

How to create an eSignature for the Federal Estimated Itemized Deductions If Itemizing Deductions on iOS

How to make an eSignature for the Federal Estimated Itemized Deductions If Itemizing Deductions on Android

People also ask

-

What is a Georgia state tax form?

A Georgia state tax form is a document used by residents of Georgia to report their income and calculate their tax liability to the state. It is essential for filing your annual taxes accurately. Using airSlate SignNow can simplify the process of completing and signing these forms electronically.

-

How can I eSign my Georgia state tax form with airSlate SignNow?

With airSlate SignNow, you can easily eSign your Georgia state tax form by uploading the document to our platform. Once uploaded, you can add your signature and other required fields with just a few clicks. This process ensures that your signed forms are compliant and securely stored.

-

Is there a cost associated with using airSlate SignNow for Georgia state tax forms?

Yes, airSlate SignNow offers various pricing plans to fit the needs of individuals and businesses. Our affordable solutions are designed to help you efficiently manage your Georgia state tax forms without breaking the bank. You can choose a plan that works for you based on the frequency of use and required features.

-

What features does airSlate SignNow offer for managing Georgia state tax forms?

AirSlate SignNow provides features such as document uploading, customizable templates, secure eSigning, and automatic reminders for important deadlines. These tools make it easy to manage your Georgia state tax forms and ensure you're always on top of your filing obligations.

-

Can airSlate SignNow integrate with accounting software for filing Georgia state tax forms?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software, allowing for smooth data transfer and easier management of your Georgia state tax forms. This integration helps streamline the process of filing and ensures accuracy in your tax documentation.

-

What are the benefits of using airSlate SignNow for Georgia state tax forms?

Using airSlate SignNow for your Georgia state tax forms provides numerous benefits, including increased efficiency, enhanced security, and the convenience of eSigning. It allows you to complete your tax forms from anywhere, saving time and reducing the hassle of physical paperwork.

-

Is my information secure when using airSlate SignNow for Georgia state tax forms?

Yes, security is a top priority for airSlate SignNow. We employ advanced encryption and compliance measures to ensure that your information is safe while working with Georgia state tax forms. You can trust that your sensitive data is protected throughout the entire signing process.

Get more for Georgia State Tax Form

- Can landlord refuse sending certificate of rent paid if they form

- Minnesota passes tax conformity bill

- Minnesota sales and use tax form

- 50 765 designation of tax refund 50 765 designation of tax refund form

- Fillable 01 924 texas agricultural sales and use tax exemption certification form

- Statement of fact to correct error on title 488463118 form

- Tf 956 victim notice of change of alaska court system form

- Rev 14 to procedure em 09 02 ampquotinservice testing of plant valves ampquot form

Find out other Georgia State Tax Form

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template