Sample Completed Irs Form 709

What is the Sample Completed IRS Form 709

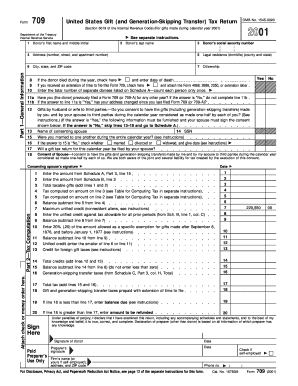

The IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a crucial document for individuals who make gifts exceeding the annual exclusion amount. This form is used to report gifts to the IRS and to calculate any potential gift tax liability. A sample completed IRS Form 709 provides a clear example of how to fill out the form correctly, showcasing the necessary information and sections that need to be completed. It is essential for taxpayers to understand this form, especially if they are planning to make significant gifts or are involved in estate planning.

Steps to Complete the Sample Completed IRS Form 709

Completing the IRS Form 709 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including details about the donor and recipient, as well as the value of the gifts made during the tax year. Next, follow these steps:

- Provide your name, address, and taxpayer identification number at the top of the form.

- Detail each gift made, including the recipient's information and the fair market value of the gift.

- Calculate any applicable deductions, such as the annual exclusion amount and any marital deductions.

- Complete the sections related to generation-skipping transfers if applicable.

- Sign and date the form before submission.

Review the completed form for accuracy before filing to avoid potential issues with the IRS.

How to Obtain the Sample Completed IRS Form 709

The sample completed IRS Form 709 can be obtained through various channels. The IRS website provides access to the form in PDF format, which can be downloaded and printed. Additionally, tax preparation software often includes sample forms that can guide users through the completion process. Tax professionals may also provide their clients with examples of completed forms as part of their services. It is advisable to ensure that any sample obtained is current and reflects the latest IRS guidelines.

Legal Use of the Sample Completed IRS Form 709

The legal use of the IRS Form 709 is essential for compliance with federal tax laws. This form must be filed by individuals who make gifts exceeding the annual exclusion amount, which is adjusted periodically. Failure to file the form when required can result in penalties and interest on any unpaid gift tax. The completed IRS Form 709 serves as a legal document that records the details of gifts made and is crucial for estate planning. Understanding the legal implications of this form helps taxpayers avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 709 align with the annual tax return deadlines. Typically, the form must be filed by April fifteenth of the year following the tax year in which the gifts were made. If additional time is needed, taxpayers can file for an extension, which provides an additional six months to submit the form. However, it is important to note that any gift tax owed must still be paid by the original deadline to avoid penalties. Staying aware of these important dates ensures timely compliance with IRS requirements.

Examples of Using the Sample Completed IRS Form 709

Understanding practical examples of using the IRS Form 709 can help clarify its application. For instance, if an individual gifts a piece of real estate valued at three hundred thousand dollars to a family member, they must report this on Form 709. Another example is when a parent gifts cash exceeding the annual exclusion amount to their child. Each scenario requires careful documentation and reporting on the form to ensure compliance with tax laws. Reviewing these examples can provide valuable insights into the form's usage and requirements.

Quick guide on how to complete sample completed irs form 709

Effortlessly Prepare Sample Completed Irs Form 709 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without complications. Handle Sample Completed Irs Form 709 on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Alter and eSign Sample Completed Irs Form 709 with Ease

- Find Sample Completed Irs Form 709 and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Mark signNow portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for these tasks.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or mislaid files, laborious form searches, or errors that necessitate reprinting new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Sample Completed Irs Form 709 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample completed irs form 709

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 709 and why do I need it?

Form 709 is the United States Gift (and Generation-Skipping Transfer) Tax Return. It is required for individuals who make gifts exceeding the annual exclusion amount to report these gifts to the IRS. Using airSlate SignNow, you can easily eSign and send your completed form 709 securely and efficiently.

-

How can airSlate SignNow help me with form 709?

airSlate SignNow streamlines the process of preparing and signing form 709 by allowing you to fill out, eSign, and send the document digitally. This reduces the time and effort required to handle your tax reporting obligations. Our platform ensures compliance while making document management hassle-free.

-

Is there a cost associated with using airSlate SignNow for form 709?

Yes, airSlate SignNow offers competitive pricing plans tailored to different business needs. Depending on your subscription, you can access features designed specifically for handling documents like form 709. Check our pricing page for detailed options and choose the one that fits your requirements.

-

Can I integrate airSlate SignNow with my existing software for form 709 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, which can help manage your form 709 submissions more effectively. This means you can connect your CRM, cloud storage, and other tools to ensure a streamlined process.

-

What are the benefits of using airSlate SignNow for eSigning form 709?

Using airSlate SignNow to eSign form 709 offers numerous benefits, including enhanced security, tracking, and accessibility. You can sign your documents from anywhere at any time, reducing the need for physical copies. This convenience makes it easier to manage your gifting-related tax obligations.

-

Is my data safe when using airSlate SignNow for form 709?

Yes, your data is safe with airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your information while filling out and submitting form 709. We prioritize user privacy and compliance with all relevant data protection regulations.

-

How will I know if my form 709 is properly completed and signed?

AirSlate SignNow provides confirmation notifications once your form 709 is completed and signed. You’ll receive email alerts and can also track the document's status within the platform, ensuring you never miss an important step in the process.

Get more for Sample Completed Irs Form 709

Find out other Sample Completed Irs Form 709

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple