Form 4562 2016

What is the Form 4562

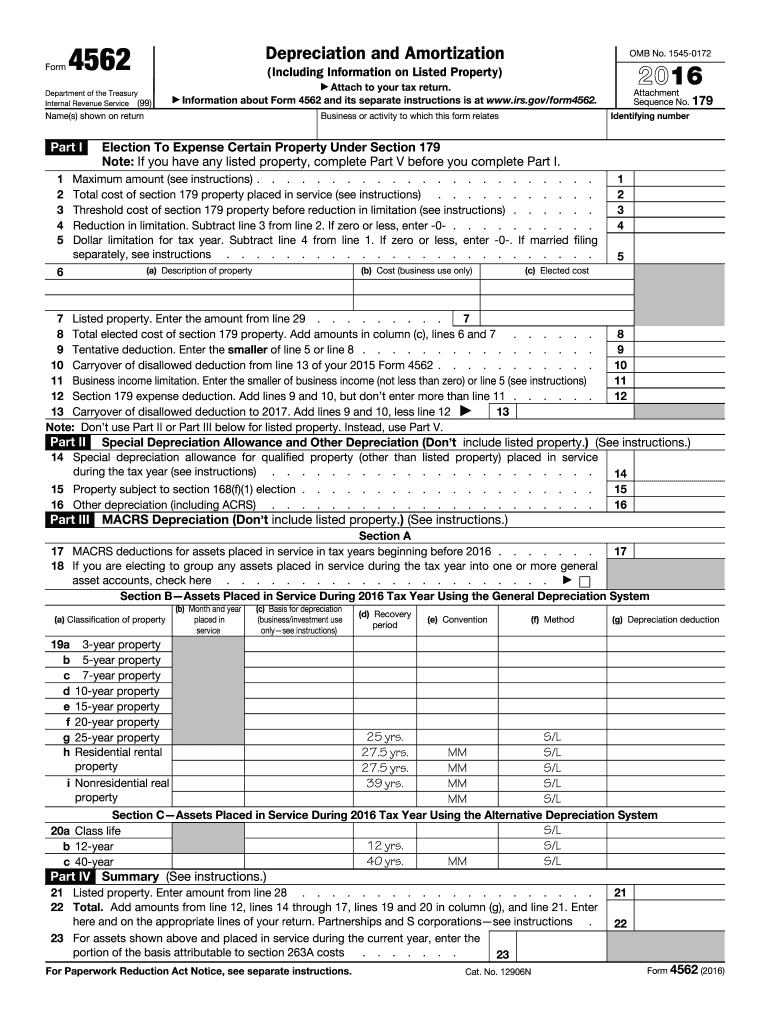

The Form 4562, officially known as the "Depreciation and Amortization" form, is used by businesses and individuals to claim deductions for depreciation on property and amortization of intangible assets. This form is essential for taxpayers who want to recover the cost of certain assets over time, reflecting the wear and tear or obsolescence of these assets. It is particularly relevant for those who own rental properties, vehicles, or equipment used in their trade or business.

How to use the Form 4562

Using the Form 4562 involves several steps. First, you must gather information about the assets you are claiming depreciation for, including the purchase date, cost, and method of depreciation. The form allows you to choose between several depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS) or straight-line depreciation. After filling out the relevant sections, the completed form must be submitted with your tax return, ensuring that all calculations are accurate to maximize your potential deductions.

Steps to complete the Form 4562

Completing the Form 4562 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including purchase receipts and asset details.

- Choose the appropriate depreciation method based on the asset type.

- Fill out Part I to report the current year’s depreciation.

- Complete Part II for listed property, if applicable.

- Use Part III to report amortization of intangible assets.

- Review all entries for accuracy and completeness.

- Attach the form to your tax return when filing.

Legal use of the Form 4562

The legal use of the Form 4562 is governed by IRS regulations, ensuring that taxpayers can claim depreciation and amortization deductions in compliance with tax laws. To be legally valid, the form must be completed accurately and submitted on time. Additionally, taxpayers should retain supporting documentation for all claims made on the form, as the IRS may request this information during audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4562 align with the overall tax return deadlines. Generally, individual taxpayers must submit their forms by April 15 of each year. However, if you file for an extension, the deadline may be extended to October 15. It is crucial to adhere to these deadlines to avoid penalties and ensure that you receive the full benefits of your deductions.

Examples of using the Form 4562

There are various scenarios where the Form 4562 is applicable. For instance, a small business owner may use the form to claim depreciation on a new delivery vehicle purchased for business use. Similarly, a real estate investor might use it to depreciate rental property improvements. Each example highlights the importance of the form in allowing taxpayers to recover costs associated with their business assets effectively.

Quick guide on how to complete 2016 form 4562

Easily Prepare Form 4562 on Any Device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Form 4562 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Form 4562 without hassle

- Obtain Form 4562 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 4562 while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 4562

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 4562

How to create an eSignature for the 2016 Form 4562 online

How to generate an eSignature for the 2016 Form 4562 in Google Chrome

How to make an eSignature for putting it on the 2016 Form 4562 in Gmail

How to generate an electronic signature for the 2016 Form 4562 from your smartphone

How to generate an electronic signature for the 2016 Form 4562 on iOS devices

How to make an eSignature for the 2016 Form 4562 on Android

People also ask

-

What is Form 4562 and why is it important?

Form 4562 is a tax form used to report depreciation and amortization for property placed in service during the tax year. It’s important because it helps businesses calculate their eligible deductions, potentially reducing taxable income. By accurately completing Form 4562, businesses can optimize their tax liabilities and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with Form 4562 submissions?

airSlate SignNow streamlines the process of preparing and submitting Form 4562 by allowing users to eSign and send documents securely. Its user-friendly interface ensures that businesses can easily fill out the form and gather necessary signatures, making the entire submission process efficient. With airSlate SignNow, you can manage your Form 4562 submissions from anywhere, enhancing productivity.

-

Is there a cost for using airSlate SignNow for Form 4562?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those specifically for handling Form 4562. You can choose from different tiers based on the features you require, ensuring you only pay for what you need. Additionally, airSlate SignNow provides a free trial, allowing users to explore its capabilities for Form 4562 without any upfront costs.

-

What features of airSlate SignNow assist with Form 4562?

Key features of airSlate SignNow that assist with Form 4562 include customizable templates, secure eSigning, and document tracking. These tools help ensure that all necessary information is accurately captured and that the form is completed efficiently. With these features, users can simplify their workflow and reduce the risk of errors when filing Form 4562.

-

Can I integrate airSlate SignNow with accounting software for Form 4562?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, making it easier to manage Form 4562 alongside your financial records. This integration allows for automatic data transfer, reducing manual entry and the potential for mistakes. By connecting your accounting software, you can enhance your efficiency when preparing Form 4562.

-

What are the benefits of using airSlate SignNow for Form 4562?

Using airSlate SignNow for Form 4562 provides several benefits, including enhanced efficiency, secure eSigning, and easy document management. You'll experience faster turnaround times for obtaining signatures, which can signNowly speed up the filing process. Additionally, the platform’s security features ensure that your sensitive tax information is protected.

-

How does airSlate SignNow ensure the security of Form 4562 documents?

airSlate SignNow employs industry-leading security protocols, including data encryption and secure cloud storage, to protect your Form 4562 documents. This ensures that all sensitive information remains confidential and is only accessible to authorized users. With airSlate SignNow, you can confidently manage your Form 4562 submissions without worrying about data bsignNowes.

Get more for Form 4562

Find out other Form 4562

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now