Form 1120 C 2016

What is the Form 1120 C

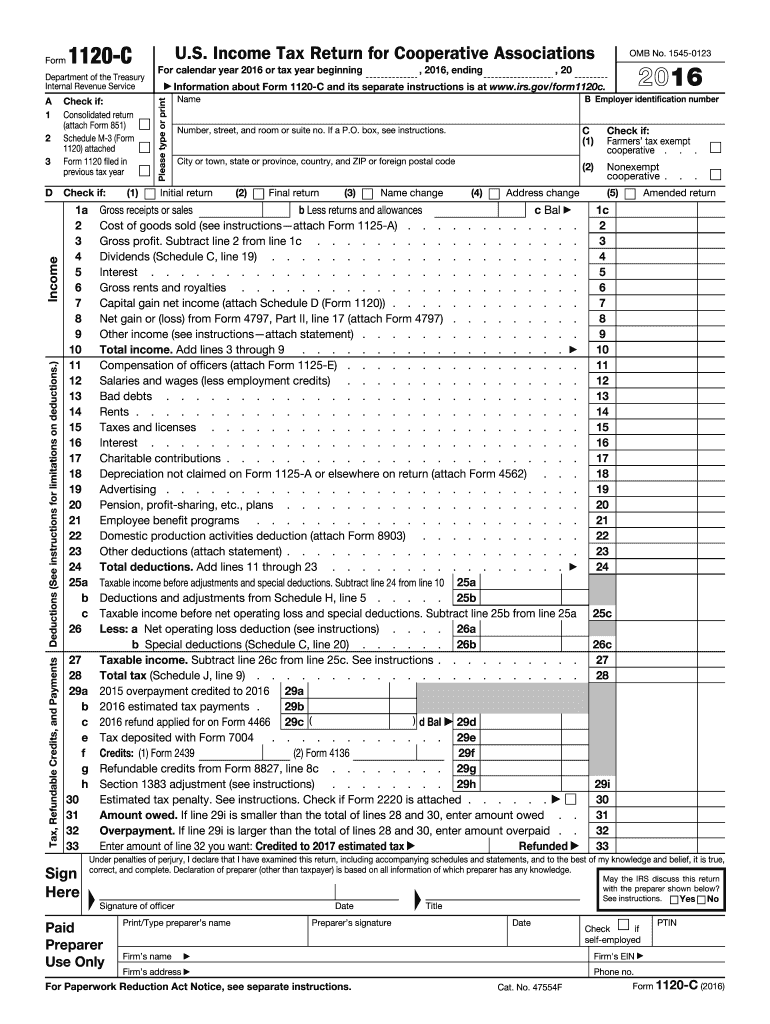

The Form 1120 C is a tax return specifically designed for corporations that elect to be treated as a C corporation under the Internal Revenue Code. This form is used to report income, gains, losses, deductions, and credits, as well as to calculate the corporation's tax liability. C corporations are separate legal entities from their owners, which means they are taxed independently of their shareholders. This form plays a crucial role in ensuring compliance with federal tax regulations for businesses operating in the United States.

How to use the Form 1120 C

To effectively use the Form 1120 C, corporations need to gather all relevant financial information for the tax year. This includes income from sales, interest, dividends, and any other sources, as well as expenses such as salaries, rent, and utilities. Once the necessary data is collected, businesses can fill out the form, ensuring accuracy in reporting. The completed form must be submitted to the IRS by the designated deadline, typically the fifteenth day of the fourth month following the end of the corporation's tax year.

Steps to complete the Form 1120 C

Completing the Form 1120 C involves several key steps:

- Gather financial records: Collect all necessary documents, including income statements, balance sheets, and receipts for deductible expenses.

- Fill out the form: Begin by entering the corporation's name, address, and Employer Identification Number (EIN). Proceed to report total income and calculate taxable income.

- Calculate tax liability: Use the appropriate tax rates to determine the amount owed based on taxable income.

- Review for accuracy: Double-check all entries for errors or omissions to avoid potential issues with the IRS.

- Submit the form: File the completed Form 1120 C electronically or via mail by the deadline.

Legal use of the Form 1120 C

The legal use of the Form 1120 C is governed by IRS regulations, which stipulate that corporations must file this form annually to report their financial activities. Proper completion and timely submission ensure compliance with federal tax laws and help avoid penalties. Additionally, e-signatures on electronically filed forms are recognized as legally binding, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Filing Deadlines / Important Dates

Corporations must be mindful of important deadlines when filing the Form 1120 C. The general deadline for submitting the form is the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations may also request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failure to file the Form 1120 C on time can result in significant penalties. The IRS imposes a penalty for late filing, which is typically calculated based on the number of months the return is late and the amount of tax owed. Additionally, if a corporation fails to pay the tax due by the deadline, interest will accrue on the unpaid balance. Non-compliance can also lead to further scrutiny from the IRS, potentially resulting in audits or additional penalties.

Quick guide on how to complete form 1120 c 2016

Complete Form 1120 C effortlessly on any gadget

Online document organization has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1120 C on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 1120 C without hassle

- Obtain Form 1120 C and click on Get Form to initiate your process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the information and click on the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device you prefer. Revise and eSign Form 1120 C to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 c 2016

Create this form in 5 minutes!

How to create an eSignature for the form 1120 c 2016

How to make an electronic signature for your Form 1120 C 2016 in the online mode

How to create an electronic signature for the Form 1120 C 2016 in Google Chrome

How to make an electronic signature for signing the Form 1120 C 2016 in Gmail

How to make an eSignature for the Form 1120 C 2016 straight from your smartphone

How to generate an electronic signature for the Form 1120 C 2016 on iOS devices

How to make an eSignature for the Form 1120 C 2016 on Android

People also ask

-

What is Form 1120 C and why do I need it?

Form 1120 C is the tax return used specifically by C corporations to report their income, gains, losses, deductions, and credits to the IRS. Understanding how to properly fill out Form 1120 C is crucial for compliance and can help your business avoid penalties. Utilizing airSlate SignNow can streamline the process of signing and submitting this form electronically.

-

How can airSlate SignNow help me with Form 1120 C?

airSlate SignNow simplifies the preparation and submission of Form 1120 C by allowing businesses to easily eSign and send documents securely. Our platform enhances collaboration among stakeholders, ensuring that all necessary signatures are obtained promptly. This efficiency can signNowly reduce the time spent on tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 1120 C?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Each plan includes features that assist with the completion and eSigning of important documents like Form 1120 C. The cost is competitive, and the investment in our platform can save you time and resources when managing tax documents.

-

Can I integrate airSlate SignNow with my accounting software for Form 1120 C?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easy to manage your Form 1120 C alongside your other financial documents. This integration enhances workflow efficiency and ensures that all your tax filings are organized and accessible.

-

What features does airSlate SignNow offer for completing Form 1120 C?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking to assist with Form 1120 C. These tools make it easier to gather required signatures and ensure that your submission is accurate and timely. Plus, our user-friendly interface simplifies the entire process.

-

How secure is my information when using airSlate SignNow for Form 1120 C?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and comply with industry standards to protect your sensitive information when completing and submitting Form 1120 C. You can trust that your data is safe while using our platform.

-

Can I access my completed Form 1120 C on mobile devices?

Yes! airSlate SignNow is accessible on mobile devices, allowing you to manage your Form 1120 C on the go. Whether you need to eSign or review documents, our mobile-friendly platform ensures that you can handle your tax obligations from anywhere.

Get more for Form 1120 C

- Quit deed claim form

- Florida prenuptial premarital agreement with financial statements form

- Real estate promissory note form

- Florida legal last will and testament form for married person with adult children from prior marriage

- Colorado residential lease or rental agreement for month to month form

- Sample operating agreement for llc form

- Release upon final form

- Arkansas quitclaim deed from husband to himself and wife form

Find out other Form 1120 C

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile