1040 X Form 2017

What is the 1040 X Form

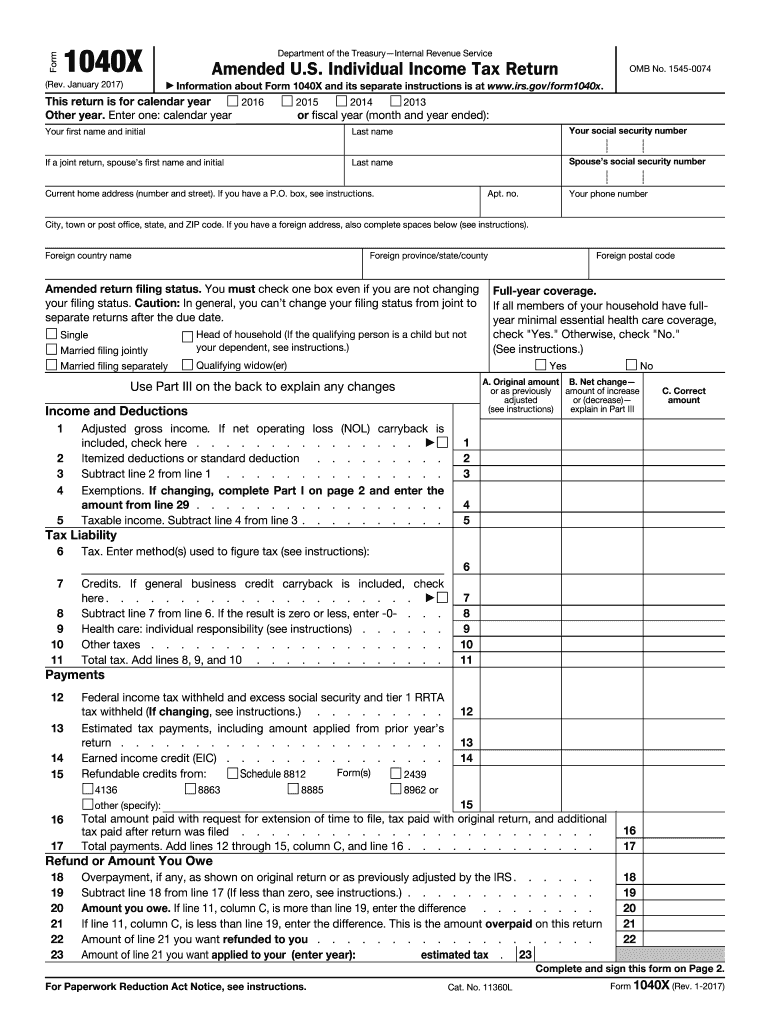

The 1040 X Form is an amended U.S. federal tax return form used by taxpayers to correct errors or make changes to their previously filed Form 1040, 1040 A, or 1040 EZ. This form allows individuals to amend their tax returns for various reasons, including correcting income, deductions, or credits. It is essential for ensuring that the information reported to the Internal Revenue Service (IRS) is accurate and up-to-date. The 1040 X Form is particularly important for addressing discrepancies that may affect tax liability or refunds.

How to use the 1040 X Form

To use the 1040 X Form, taxpayers must first obtain the form from the IRS website or through tax preparation software. After downloading the form, individuals should carefully read the instructions provided. The form consists of three columns: the first column shows the original amounts from the initial tax return, the second column reflects the changes being made, and the third column displays the corrected amounts. It is important to provide a clear explanation for each change in Part III of the form. Once completed, the form must be signed and submitted to the IRS.

Steps to complete the 1040 X Form

Completing the 1040 X Form involves several key steps:

- Gather all relevant documentation, including the original tax return and any supporting documents for the changes.

- Download the 1040 X Form and its instructions from the IRS website.

- Fill in the personal information section at the top of the form.

- In the first column, enter the amounts from the original return.

- In the second column, indicate the changes being made.

- In the third column, calculate and enter the corrected amounts.

- Provide a detailed explanation of the changes in Part III.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1040 X Form

The 1040 X Form is legally recognized as a valid method for amending a tax return in the United States. To ensure compliance with IRS regulations, it is crucial that taxpayers accurately report all necessary changes and provide supporting documentation where applicable. Failure to use the form correctly may result in penalties or delays in processing the amended return. It is advisable to keep copies of both the original and amended returns for personal records.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 1040 X Form. Generally, the amended return must be filed within three years from the original return's due date or within two years from the date the tax was paid, whichever is later. It is important to keep track of these deadlines to avoid missing the opportunity to amend a return. Additionally, if a taxpayer is expecting a refund from the original return, filing the 1040 X Form promptly can help expedite the processing of that refund.

Form Submission Methods (Online / Mail / In-Person)

The 1040 X Form can be submitted to the IRS via mail. Currently, the IRS does not allow electronic filing of amended returns. Taxpayers should print the completed form and send it to the appropriate address listed in the instructions based on their state of residence. It is recommended to use a trackable mailing service to confirm that the form has been received by the IRS. Keeping a copy of the submitted form and any correspondence with the IRS is also advisable for future reference.

Examples of using the 1040 X Form

There are several scenarios in which a taxpayer might need to use the 1040 X Form. Common examples include:

- Correcting a mistake in reported income, such as omitting a W-2 or 1099 form.

- Adjusting deductions, like changing the amount claimed for mortgage interest or charitable contributions.

- Updating filing status, such as changing from single to married filing jointly.

- Claiming additional credits that were not included in the original return, such as education credits.

Quick guide on how to complete 1040 x 2017 form

Complete 1040 X Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 1040 X Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1040 X Form effortlessly

- Obtain 1040 X Form and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text (SMS), invite link, or downloading it to your computer.

Forget about losing or misplacing files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 1040 X Form and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 x 2017 form

Create this form in 5 minutes!

How to create an eSignature for the 1040 x 2017 form

How to make an electronic signature for your 1040 X 2017 Form in the online mode

How to generate an eSignature for the 1040 X 2017 Form in Chrome

How to make an electronic signature for putting it on the 1040 X 2017 Form in Gmail

How to make an eSignature for the 1040 X 2017 Form right from your smart phone

How to create an electronic signature for the 1040 X 2017 Form on iOS

How to create an eSignature for the 1040 X 2017 Form on Android OS

People also ask

-

What is the 1040 X Form and when do I need to use it?

The 1040 X Form is an amendment form used to correct errors on your previously filed tax return. You need to use the 1040 X Form if you discover mistakes in your original filing, such as incorrect income or deductions. It's crucial to file this form to ensure your tax records are accurate and up to date.

-

How can airSlate SignNow help with the 1040 X Form?

airSlate SignNow simplifies the process of signing and sending your 1040 X Form electronically. With our platform, you can easily create, eSign, and share your amended tax return, ensuring a fast and secure submission. This streamlines the often tedious process of dealing with tax forms.

-

Is there a cost associated with using airSlate SignNow for the 1040 X Form?

Yes, airSlate SignNow offers a range of pricing plans to suit different needs, including features for managing the 1040 X Form. Our plans are designed to be cost-effective, allowing you to eSign documents and manage your paperwork without breaking the bank. Check our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow offer for managing the 1040 X Form?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage, all essential for managing the 1040 X Form. You can easily track the status of your documents and ensure they are signed on time. This enhances your efficiency during tax season.

-

Can I integrate airSlate SignNow with other software for the 1040 X Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage your 1040 X Form alongside your other business tools. Whether you use accounting software or CRMs, our integration capabilities ensure a smooth workflow.

-

Is airSlate SignNow secure for submitting my 1040 X Form?

Yes, airSlate SignNow prioritizes your security. Our platform uses advanced encryption and security protocols to protect your sensitive information, including the details on your 1040 X Form. You can trust that your documents are safe when using our service.

-

How long does it take to process the 1040 X Form once submitted through airSlate SignNow?

The processing time for the 1040 X Form can vary based on the IRS's workload, but submitting through airSlate SignNow can expedite the process. By ensuring your form is filled out correctly and submitted electronically, you minimize potential delays. Check the IRS guidelines for current processing times.

Get more for 1040 X Form

- Texas bill of sale camper form

- Arizona quitclaim deed from individual to individual form

- How to write land agreement in nigeria form

- Arizona prenuptial premarital agreement without financial statements form

- Oklahoma legal last will and testament form for single person with adult and minor children

- Iowa bill of sale of automobile and odometer statement for as is sale form

- Pennsylvania file form

- Us 00407pdf form

Find out other 1040 X Form

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document