Form 4136 2016

What is the Form 4136

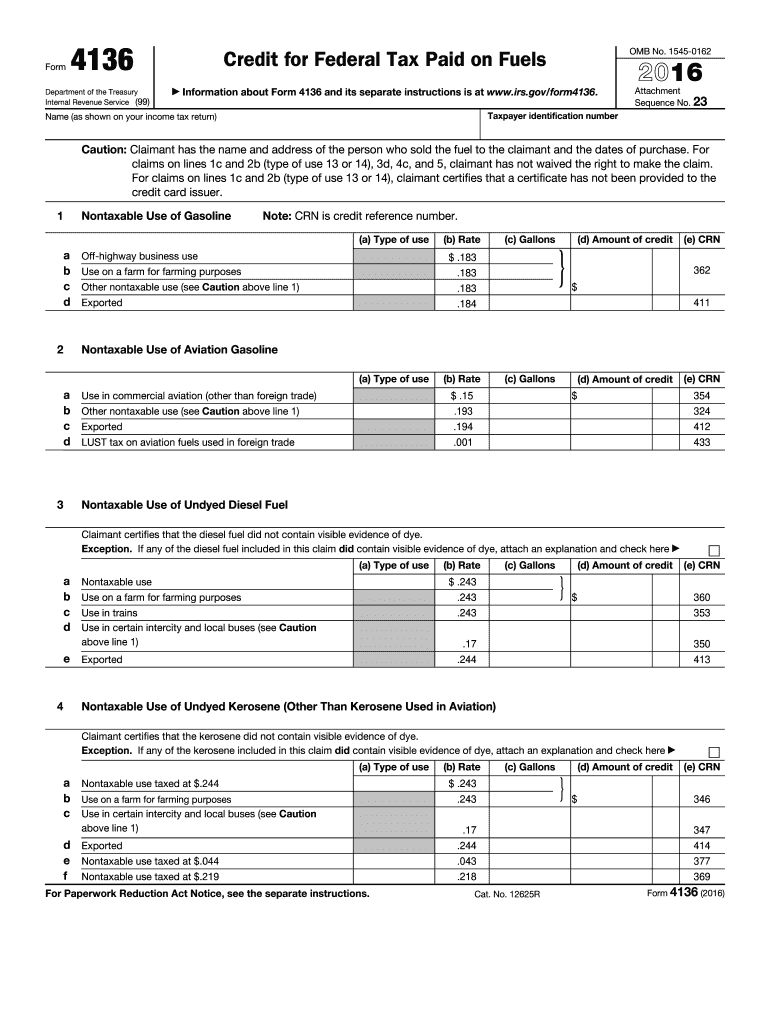

The Form 4136, also known as the Credit for Federal Tax Paid on Fuels, is a tax form used by individuals and businesses in the United States to claim a credit for certain federal taxes paid on fuel. This form is particularly relevant for those who use fuel for specific purposes, such as farming, fishing, or other exempt uses. The credit can help reduce the overall tax liability, making it an important document for eligible taxpayers.

How to use the Form 4136

Using the Form 4136 involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility for the credit by reviewing the specific uses of fuel that qualify. After confirming eligibility, individuals should gather all necessary documentation, including receipts and proof of fuel purchases. The form must be filled out accurately, detailing the amount of fuel used and the corresponding federal taxes paid. Once completed, it can be submitted with the taxpayer's annual tax return.

Steps to complete the Form 4136

Completing the Form 4136 requires careful attention to detail. Here are the essential steps:

- Obtain the latest version of the Form 4136 from the IRS website.

- Review the instructions provided with the form to understand eligibility and requirements.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Document the total gallons of fuel used and the federal excise tax paid on that fuel.

- Calculate the credit amount based on the information provided.

- Double-check all entries for accuracy before submitting.

Legal use of the Form 4136

The Form 4136 is legally binding when completed and submitted according to IRS guidelines. It is essential that taxpayers provide truthful and accurate information, as any discrepancies may lead to penalties or audits. The form must be filed in a timely manner, adhering to the deadlines set by the IRS. Understanding the legal implications of the information provided is crucial for maintaining compliance with tax regulations.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 4136. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, allowable uses of fuel, and documentation requirements. Adhering to these guidelines ensures that the credit is claimed correctly and helps avoid potential issues with the IRS. It is advisable to consult the latest IRS publications or a tax professional for any updates or changes to the guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4136 align with the annual tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following year. However, if April 15 falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to tax deadlines, as these can impact the timely filing of the Form 4136 and the ability to claim the credit.

Quick guide on how to complete form 4136 2016

Effortlessly Create Form 4136 on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without hassle. Handle Form 4136 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign Form 4136 effortlessly

- Obtain Form 4136 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, and errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 4136 and guarantee clear communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4136 2016

Create this form in 5 minutes!

How to create an eSignature for the form 4136 2016

How to generate an eSignature for your Form 4136 2016 online

How to generate an eSignature for your Form 4136 2016 in Chrome

How to create an eSignature for signing the Form 4136 2016 in Gmail

How to make an eSignature for the Form 4136 2016 right from your smart phone

How to create an electronic signature for the Form 4136 2016 on iOS devices

How to make an eSignature for the Form 4136 2016 on Android devices

People also ask

-

What is Form 4136 and how can airSlate SignNow help with it?

Form 4136 is used for claiming a credit for the federal tax on certain fuels. airSlate SignNow simplifies the process of filling out and eSigning Form 4136, allowing businesses to manage their tax credits efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Form 4136?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Using our platform to complete and eSign Form 4136 can be a cost-effective solution, providing excellent value for small and large businesses alike.

-

What features does airSlate SignNow offer for Form 4136?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time collaboration specifically for Form 4136. These features streamline the submission process, reducing errors and saving you time.

-

Can I integrate airSlate SignNow with other tools for managing Form 4136?

Absolutely! airSlate SignNow offers integrations with various third-party applications and software, including CRM systems and accounting platforms. This allows for seamless management of Form 4136 alongside your other business processes.

-

What are the benefits of using airSlate SignNow for Form 4136?

Using airSlate SignNow for Form 4136 provides multiple benefits, including increased efficiency, improved accuracy, and enhanced compliance. Our platform ensures that your forms are completed correctly and submitted on time.

-

How secure is the information I provide on Form 4136 when using airSlate SignNow?

airSlate SignNow prioritizes your security by using advanced encryption and secure data storage methods. When you fill out and eSign Form 4136 on our platform, you can be confident that your information is protected.

-

Is it easy to collaborate with others on Form 4136 using airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration on Form 4136. You can invite team members to review and eSign the form, ensuring that everyone stays in the loop and the process remains efficient.

Get more for Form 4136

- Myanmar passport application form

- 2012 myanmar fastival picture form

- Regional cooperation in transport myanmar perspective on csird csird org form

- Nfirs 50 field data collection form

- Grape crush and purchase inquiry form

- Ottawa county dob license by mailxls georgetown mi form

- Ielts form

- Subject declaration form politics amp society

Find out other Form 4136

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now