T2203 Form

What is the T2203?

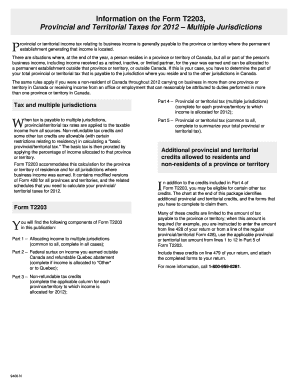

The T2203 form, also known as the Income Tax Form T2203, is a crucial document used by individuals and businesses in Canada to report income earned in multiple provinces. This form is specifically designed for those who need to allocate their income based on the provinces where it was earned, ensuring compliance with provincial tax regulations. The T2203 is essential for accurately calculating taxes owed to each province, making it a vital part of the income tax filing process.

How to use the T2203

Using the T2203 form involves several steps to ensure that all income is reported correctly. First, gather all necessary documentation that outlines income earned in different provinces. This includes pay stubs, invoices, and any other relevant financial records. Next, fill out the T2203 by entering the total income for each province in the designated sections. It is important to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form should be submitted along with your main income tax return.

Steps to complete the T2203

Completing the T2203 form requires attention to detail. Here are the key steps:

- Collect all income documentation for each province where income was earned.

- Fill out the personal information section at the top of the form.

- Report total income for each province in the appropriate fields.

- Calculate the total income and ensure it matches your overall income reported on your tax return.

- Review the form for accuracy before submission.

Legal use of the T2203

The T2203 form is legally binding when filled out correctly and submitted on time. It is essential to ensure compliance with both federal and provincial tax laws. The form must be signed and dated to validate the information provided. Inaccuracies or omissions can lead to legal repercussions, including penalties or audits. Therefore, it is advisable to consult with a tax professional if there are uncertainties about the form's completion.

Filing Deadlines / Important Dates

Filing deadlines for the T2203 form align with the general income tax return deadlines in Canada. Typically, individual taxpayers must submit their returns by April 30 of the following year. If you are self-employed, the deadline extends to June 15, but any taxes owed are still due by April 30. It is crucial to be aware of these deadlines to avoid late fees and interest charges.

Required Documents

To complete the T2203 form accurately, several documents are required:

- Income statements from employers or clients.

- Invoices for services rendered in different provinces.

- Any previous tax returns that may provide context for income allocation.

- Documentation of any deductions or credits that may apply.

Form Submission Methods (Online / Mail / In-Person)

The T2203 form can be submitted through various methods. Taxpayers can file their returns online using certified tax software, which often includes the T2203 as part of the process. Alternatively, the form can be printed and mailed to the appropriate tax authority. In some cases, individuals may also choose to file in person at designated tax offices. Each method has its own processing times, so selecting the most convenient option is important.

Quick guide on how to complete t2203

Prepare T2203 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage T2203 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign T2203 effortlessly

- Obtain T2203 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in a matter of clicks from any device you prefer. Modify and eSign T2203 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t2203

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2203 form and why is it important?

The t2203 form is a tax document used in Canada for calculating provincial and territorial tax credits. Understanding how to properly fill out the t2203 form is essential for ensuring compliance with tax regulations and maximizing potential returns. With airSlate SignNow, you can easily eSign and send your t2203 form securely.

-

How can airSlate SignNow help with the t2203 form?

airSlate SignNow streamlines the process of preparing, signing, and sending the t2203 form. Our platform allows you to effortlessly gather signatures, making it suitable for both individuals and businesses. By using airSlate SignNow, you ensure that your t2203 form is processed efficiently and securely.

-

Is airSlate SignNow cost-effective for managing the t2203 form?

Yes, airSlate SignNow offers cost-effective solutions for managing various documents, including the t2203 form. Our pricing plans are designed to fit businesses of all sizes, ensuring that you receive great value while efficiently handling your tax-related forms. Start your free trial today to see how affordable it can be.

-

Can I integrate the t2203 form into other software using airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with various software, allowing you to incorporate the t2203 form into your workflows effortlessly. Whether it’s a CRM, accounting software, or cloud storage, our integrations enhance your productivity by keeping all your documents coordinated.

-

What features does airSlate SignNow offer for electronic signing of the t2203 form?

With airSlate SignNow, electronic signing features for the t2203 form include secure, legally binding eSignatures, customizable templates, and real-time tracking of document status. These features ensure that your signature process for the t2203 form is both quick and compliant with legal standards.

-

Is the t2203 form eSigning process compliant with legal regulations?

Yes, the t2203 form signing process through airSlate SignNow is fully compliant with all applicable legal regulations. Our platform adheres to strict security measures and eSignature laws to ensure that your signed t2203 form is recognized and valid both in Canada and internationally.

-

How long does it take to complete and send the t2203 form using airSlate SignNow?

Using airSlate SignNow, completing and sending the t2203 form can take just minutes. Our user-friendly interface simplifies the process, allowing you to fill out, sign, and send the t2203 form quickly. Experience enhanced efficiency and save valuable time with our platform.

Get more for T2203

Find out other T2203

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter