Instructions for Alaska Fishery Resource Landing Tax Return 2017

What is the Instructions For Alaska Fishery Resource Landing Tax Return

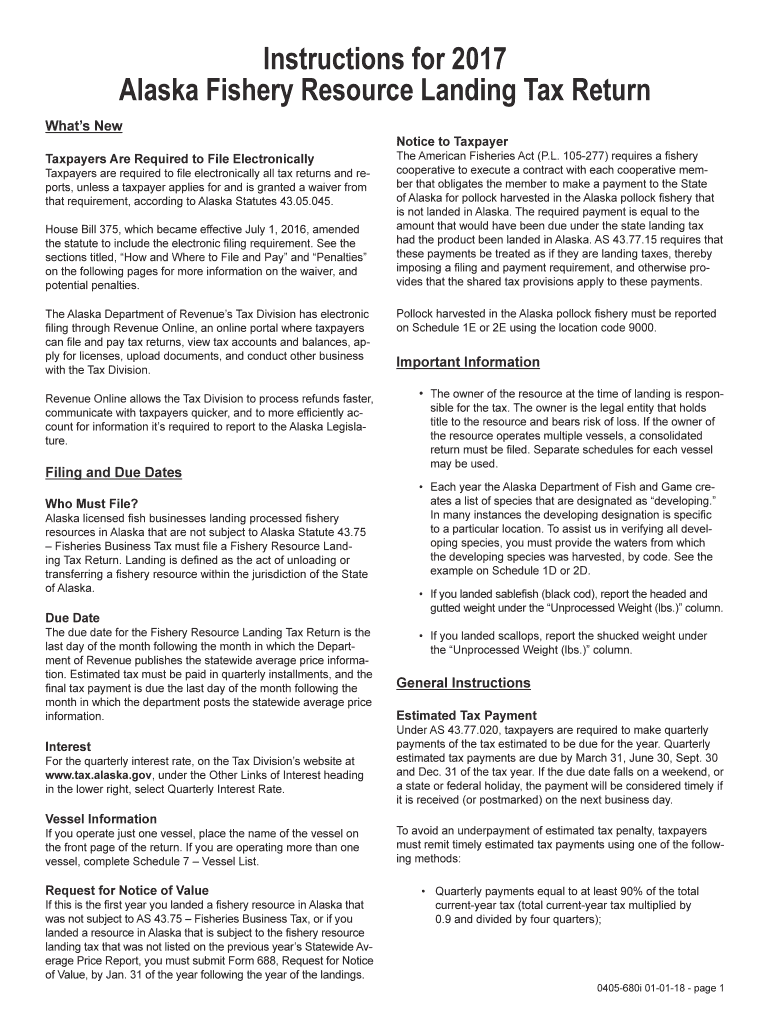

The Instructions For Alaska Fishery Resource Landing Tax Return provide essential guidelines for individuals and businesses engaged in fishing activities in Alaska. This tax return is specifically designed to report fishery resource landings and ensure compliance with state tax regulations. It outlines the necessary information required to accurately report earnings from fishery resources and the applicable tax rates. Understanding these instructions is crucial for maintaining compliance with Alaska's tax laws and avoiding potential penalties.

Steps to complete the Instructions For Alaska Fishery Resource Landing Tax Return

Completing the Instructions For Alaska Fishery Resource Landing Tax Return involves several key steps:

- Gather necessary documentation, including records of fish landings, sales receipts, and any relevant financial statements.

- Review the instructions carefully to understand the specific information required for each section of the tax return.

- Accurately fill out the form, ensuring that all figures are correct and all required fields are completed.

- Double-check the calculations to confirm that the tax owed is accurately represented.

- Submit the completed tax return by the specified deadline, either electronically or via mail.

Legal use of the Instructions For Alaska Fishery Resource Landing Tax Return

The legal use of the Instructions For Alaska Fishery Resource Landing Tax Return is governed by state tax laws. To ensure that the submitted form is legally binding, it is important to adhere to all guidelines provided in the instructions. This includes using the correct format, providing accurate information, and signing the document where required. Compliance with these legal stipulations helps to validate the tax return and protect against potential disputes or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Alaska Fishery Resource Landing Tax Return are critical to avoid penalties. Typically, the tax return must be submitted by a specific date set by the state of Alaska. It is advisable to check the official state tax website or consult with a tax professional for the most current deadlines. Marking these dates on a calendar can help ensure timely submissions and maintain compliance with state regulations.

Required Documents

To complete the Instructions For Alaska Fishery Resource Landing Tax Return, several documents are typically required:

- Records of fish landings, including weights and species.

- Sales receipts or invoices related to fish sales.

- Financial statements that reflect income from fishery resources.

- Any previous tax returns that may provide context for the current filing.

Form Submission Methods (Online / Mail / In-Person)

The Instructions For Alaska Fishery Resource Landing Tax Return can be submitted through various methods, including:

- Online submission via the state tax department's electronic filing system.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can enhance the efficiency of the filing process and ensure that the return is received by the deadline.

Quick guide on how to complete instructions for 2017 alaska fishery resource landing tax return

Complete Instructions For Alaska Fishery Resource Landing Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a stellar eco-friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents swiftly without holdups. Manage Instructions For Alaska Fishery Resource Landing Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Instructions For Alaska Fishery Resource Landing Tax Return with ease

- Locate Instructions For Alaska Fishery Resource Landing Tax Return and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal authority as a standard wet ink signature.

- Review all information and click on the Done button to retain your changes.

- Choose how you want to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choosing. Adjust and eSign Instructions For Alaska Fishery Resource Landing Tax Return and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for 2017 alaska fishery resource landing tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for 2017 alaska fishery resource landing tax return

How to generate an eSignature for the Instructions For 2017 Alaska Fishery Resource Landing Tax Return in the online mode

How to create an electronic signature for your Instructions For 2017 Alaska Fishery Resource Landing Tax Return in Google Chrome

How to make an eSignature for signing the Instructions For 2017 Alaska Fishery Resource Landing Tax Return in Gmail

How to create an eSignature for the Instructions For 2017 Alaska Fishery Resource Landing Tax Return from your smart phone

How to make an eSignature for the Instructions For 2017 Alaska Fishery Resource Landing Tax Return on iOS devices

How to generate an eSignature for the Instructions For 2017 Alaska Fishery Resource Landing Tax Return on Android devices

People also ask

-

What are the key features of the airSlate SignNow platform for submitting the Instructions For Alaska Fishery Resource Landing Tax Return?

The airSlate SignNow platform offers essential features like document templates, eSignature capabilities, and workflow automation, making it ideal for the Instructions For Alaska Fishery Resource Landing Tax Return. Users can easily create, send, and track their tax documents securely and efficiently.

-

How does airSlate SignNow simplify the process of filling out the Instructions For Alaska Fishery Resource Landing Tax Return?

airSlate SignNow streamlines the Instructions For Alaska Fishery Resource Landing Tax Return process by providing intuitive editing tools and pre-built templates. This helps users avoid common errors and ensures all necessary fields are completed accurately, saving time and reducing stress.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Alaska Fishery Resource Landing Tax Return?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those specifically for submitting the Instructions For Alaska Fishery Resource Landing Tax Return. Users can choose from flexible plans that provide a cost-effective solution without compromising on features or capabilities.

-

Can I integrate airSlate SignNow with other tools for the Instructions For Alaska Fishery Resource Landing Tax Return?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Microsoft Office, and CRM systems, facilitating easy data transfer when handling the Instructions For Alaska Fishery Resource Landing Tax Return. This enhances productivity by allowing users to work within their preferred ecosystem.

-

What benefits does airSlate SignNow provide for small businesses filing the Instructions For Alaska Fishery Resource Landing Tax Return?

For small businesses, airSlate SignNow provides a user-friendly and cost-effective approach to manage the Instructions For Alaska Fishery Resource Landing Tax Return. With its easy navigation and robust features, it eliminates complexity and helps businesses comply with tax requirements efficiently.

-

How secure is airSlate SignNow when handling the Instructions For Alaska Fishery Resource Landing Tax Return?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and secure cloud storage to protect sensitive information, ensuring that your Instructions For Alaska Fishery Resource Landing Tax Return is safe from unauthorized access.

-

Can I get support while using airSlate SignNow for the Instructions For Alaska Fishery Resource Landing Tax Return?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions or issues related to the Instructions For Alaska Fishery Resource Landing Tax Return. Their team is available via chat, email, or phone to provide timely help.

Get more for Instructions For Alaska Fishery Resource Landing Tax Return

Find out other Instructions For Alaska Fishery Resource Landing Tax Return

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document