ST 455 6% 5% the South Carolina Department of Revenue Sctax 2010

What is the ST 455 6% 5% The South Carolina Department Of Revenue Sctax

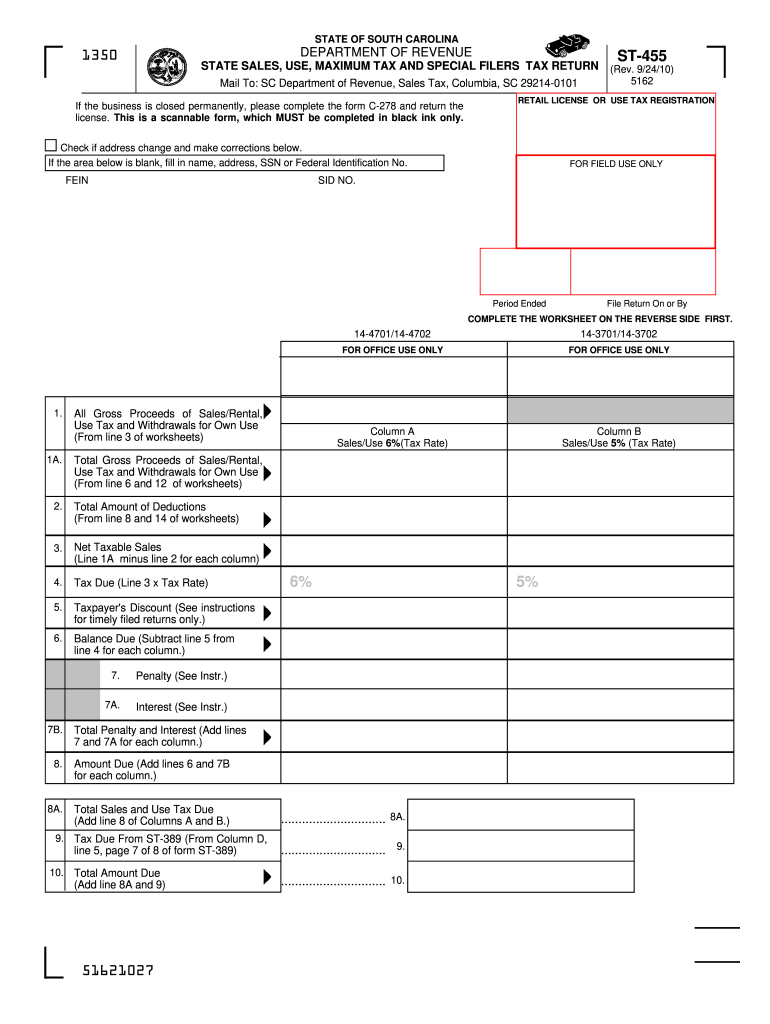

The ST 455 6% 5% form is a tax document issued by the South Carolina Department of Revenue. It is primarily used for reporting certain sales and use tax transactions. This form is essential for businesses operating in South Carolina, as it helps ensure compliance with state tax regulations. The ST 455 form is specifically designed to capture detailed information about taxable sales, exemptions, and the applicable tax rates, which may include a six percent and five percent tax rate depending on the nature of the transaction.

Steps to complete the ST 455 6% 5% The South Carolina Department Of Revenue Sctax

Completing the ST 455 form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial records, including sales receipts and previous tax filings. Next, fill in the required fields, which typically include your business information, total sales, and any applicable exemptions. It's important to double-check the tax rates applied to ensure they align with current state regulations. Once completed, review the form for any errors before signing it. Finally, submit the form through the appropriate method, which can be online, by mail, or in person.

Legal use of the ST 455 6% 5% The South Carolina Department Of Revenue Sctax

The legal use of the ST 455 form is crucial for maintaining compliance with South Carolina tax laws. This form serves as an official record of sales and use tax obligations, which can be audited by the Department of Revenue. Businesses must ensure that all information reported on the ST 455 is accurate and truthful to avoid penalties. Additionally, utilizing this form correctly helps businesses claim any eligible exemptions, thereby reducing their overall tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the ST 455 form are critical for businesses to adhere to in order to avoid late fees or penalties. Typically, the South Carolina Department of Revenue sets specific quarterly or annual deadlines for submitting this form. It is advisable for businesses to mark these dates on their calendars and prepare their documentation in advance to ensure timely filing. Keeping track of these deadlines helps maintain good standing with state tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The ST 455 form can be submitted through various methods, providing flexibility for businesses. Online submission is often the most efficient option, allowing for quick processing and confirmation of receipt. Alternatively, businesses may choose to mail the completed form to the South Carolina Department of Revenue, ensuring it is sent well before the deadline. In-person submission is also an option for those who prefer direct interaction with tax officials. Each method has its own advantages, and businesses should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the ST 455 form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the South Carolina Department of Revenue. Businesses are encouraged to stay informed about their filing obligations and to address any discrepancies promptly. Understanding the consequences of non-compliance can motivate timely and accurate submissions, ultimately protecting the business from financial repercussions.

Quick guide on how to complete st 455 6 5 the south carolina department of revenue sctax

Your assistance manual on how to prepare your ST 455 6% 5% The South Carolina Department Of Revenue Sctax

If you’re curious about how to generate and transmit your ST 455 6% 5% The South Carolina Department Of Revenue Sctax, below are a few brief guidelines on how to streamline tax declaration.

To begin, you only need to set up your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and revert to change responses if necessary. Simplify your tax oversight with sophisticated PDF editing, eSigning, and effortless sharing.

Follow the instructions below to finalize your ST 455 6% 5% The South Carolina Department Of Revenue Sctax within moments:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to open your ST 455 6% 5% The South Carolina Department Of Revenue Sctax in our editor.

- Complete the required fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please note that submitting on paper may lead to increased return errors and delayed refunds. Certainly, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct st 455 6 5 the south carolina department of revenue sctax

FAQs

-

A committee of 5 is to formed out of 6 gents and 4 ladies. In how many ways can this be done when each committee may have at the most two ladies?

At most 2 ladies means either no lady, 1 lady or 2 lady.Case 1: 0 lady, 5 members from 6 gents can be selected in 6C5 = 6 ways.Case 2: 1 lady, 1 lady can be selected from 4 ladies in 4 ways. Corresponding to each lady selected, rest 4 members can be selected from 6 gents in 6C4 = 12 ways. So, total ways in Case 2 is 48.Case 3: 2 lady, 2 lady can be selected from 4 ladies in 4C2 = 6 ways. Corresponding to two ladies selected, rest 3 members can be selected from 6 gents in 6C3 = 20 ways. So, total ways in Case 3 is 120.Now each case is independent. So, total number of ways is 120 + 48 + 6 = 174.Answer : 174

-

How do I solve this question? A committee of 5 men and 3 women is to be formed out of 7 men and 6 women. If two particular women are not to be together in the committee, what is the number of committees formed?

Total Available Persons = 7 Men and 6 WomenA committee of 5 Men and 3 Women is to be formed.So, I need to select 5 men out of 7 and it can be done in [math]^7c_5[/math] ways3 women out of 6 can be selected in [math]^6c_3 [/math]waysNow, without any constraints, the number of ways the committee can be selected is:[math]^7c_5 \times ^6c_3 = 21 \times 20 = 420[/math] waysBut, the question says two particular women should not be there in the committee together. So, to find that, we need to look at the question in another way.Number of ways in which two particular women aren't there together in the committee is same as total number of ways minus the number of ways those two women are definitely there together.Number of ways in which the two women are definitely there can be calculated as:[math]^7c_5 \times ^4c_1 = 21 \times 4 = 84[/math]Note: As the two women are definitely there, so I just need to select one more woman from the remaining 4.Thus, number of ways to select such that two particular women are never there together is [math](420 - 84) = \fbox {336 (Answer)}[/math]

-

I am a working software professional in the Bay Area and looking to switch jobs. I can't openly write in my LinkedIn profile about the same. How do I approach recruiters/companies? Is there an easier way than filling out 4 - 5 page forms in the career website of the company?

I'd say that you should just seek out the jobs that interest you and apply for them. Many don't have such onerous application forms. Some even allow you to apply through LinkedIn. And if you target a small set of companies that really interest you, then it's worth the extra effort to customize each application. Many recruiters and hiring managers, myself included, give more weight to candidates who seem specifically interested in an opportunity, as compared to those who seem to be taking a shotgun approach to the job seeking process.

Create this form in 5 minutes!

How to create an eSignature for the st 455 6 5 the south carolina department of revenue sctax

How to make an electronic signature for the St 455 6 5 The South Carolina Department Of Revenue Sctax in the online mode

How to make an eSignature for your St 455 6 5 The South Carolina Department Of Revenue Sctax in Google Chrome

How to make an eSignature for putting it on the St 455 6 5 The South Carolina Department Of Revenue Sctax in Gmail

How to create an electronic signature for the St 455 6 5 The South Carolina Department Of Revenue Sctax straight from your smartphone

How to generate an electronic signature for the St 455 6 5 The South Carolina Department Of Revenue Sctax on iOS devices

How to create an eSignature for the St 455 6 5 The South Carolina Department Of Revenue Sctax on Android

People also ask

-

What is the ST 455 6% 5% The South Carolina Department Of Revenue Sctax?

The ST 455 6% 5% The South Carolina Department Of Revenue Sctax is a tax form used by businesses in South Carolina to report and remit sales tax. Understanding this form is crucial for compliance with state tax regulations. airSlate SignNow can simplify the process of handling such documents, enabling businesses to eSign and store them securely.

-

How does airSlate SignNow support the ST 455 6% 5% The South Carolina Department Of Revenue Sctax handling?

airSlate SignNow provides tools for businesses to easily create, send, and eSign documents like the ST 455 6% 5% The South Carolina Department Of Revenue Sctax. The platform ensures that all necessary information is correctly captured and securely stored, which helps eliminate errors in tax submissions.

-

What are the pricing options for using airSlate SignNow with ST 455 6% 5% The South Carolina Department Of Revenue Sctax?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Depending on the features you need for handling the ST 455 6% 5% The South Carolina Department Of Revenue Sctax, you can choose a plan that fits your budget while providing essential tools for document management and eSigning.

-

What features does airSlate SignNow offer that can aid with the ST 455 6% 5% The South Carolina Department Of Revenue Sctax?

Key features of airSlate SignNow include customizable templates, secure eSignature options, and automated workflow capabilities. These tools streamline the process of handling the ST 455 6% 5% The South Carolina Department Of Revenue Sctax, making it easier for businesses to manage their tax documentation efficiently.

-

What benefits do businesses gain by using airSlate SignNow with ST 455 6% 5% The South Carolina Department Of Revenue Sctax?

By using airSlate SignNow for the ST 455 6% 5% The South Carolina Department Of Revenue Sctax, businesses can reduce paper usage, speed up the signing process, and ensure compliance with state regulations. This transformative approach can save time and resources, enhancing overall productivity.

-

How can airSlate SignNow integrate with other tools for managing the ST 455 6% 5% The South Carolina Department Of Revenue Sctax?

airSlate SignNow easily integrates with various third-party software solutions, such as accounting and CRM systems. This allows businesses to manage the ST 455 6% 5% The South Carolina Department Of Revenue Sctax in conjunction with their existing workflows, streamlining operations and data management.

-

Is airSlate SignNow secure for handling sensitive documents like the ST 455 6% 5% The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow employs industry-standard encryption and security measures to protect sensitive documents, including the ST 455 6% 5% The South Carolina Department Of Revenue Sctax. Users can confidently eSign and manage their tax forms knowing that their data is safeguarded against unauthorized access.

Get more for ST 455 6% 5% The South Carolina Department Of Revenue Sctax

Find out other ST 455 6% 5% The South Carolina Department Of Revenue Sctax

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile