State Sales and Use Tax Return South Carolina Department of 2019-2026

What is the State Sales And Use Tax Return?

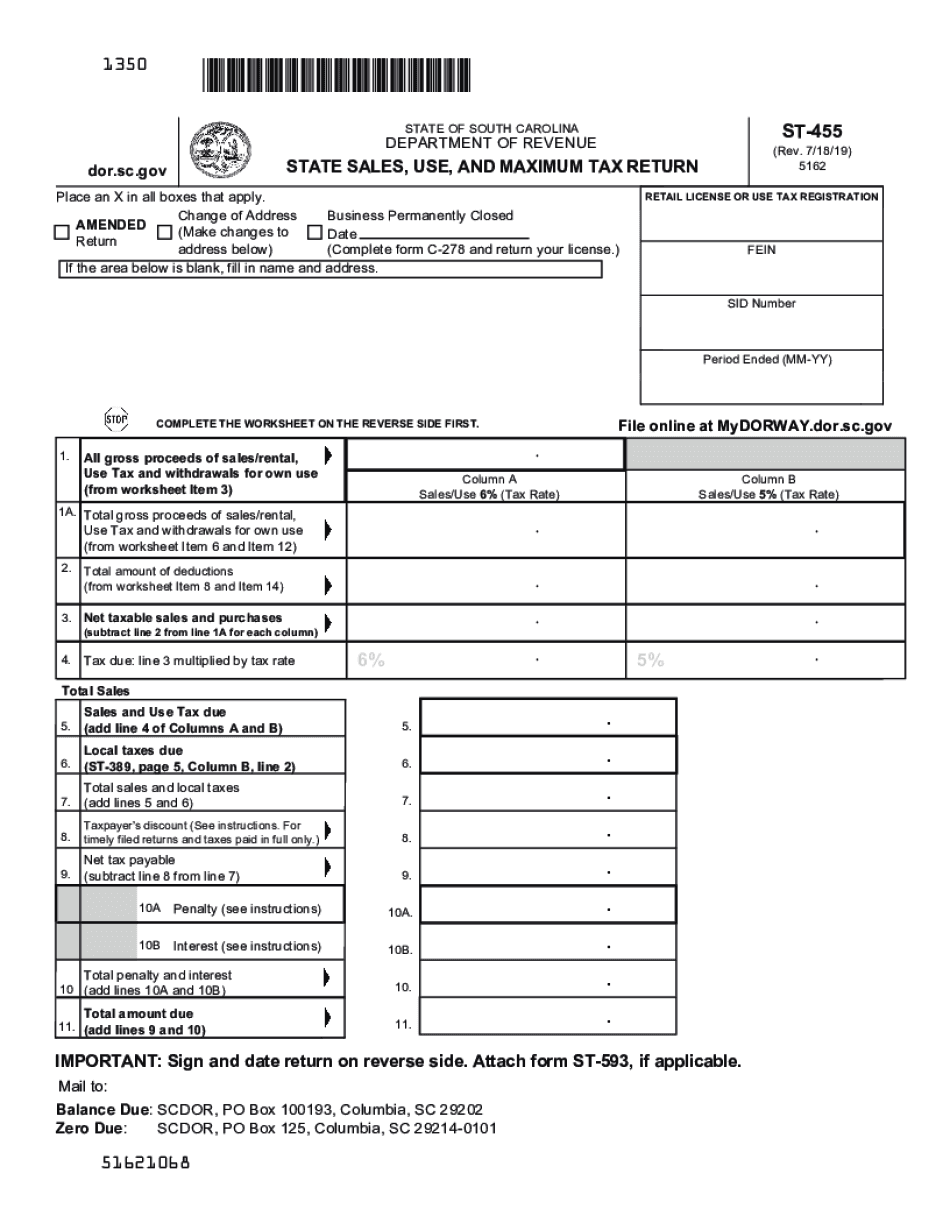

The State Sales and Use Tax Return, commonly referred to as the ST-455 form, is a document required by the South Carolina Department of Revenue for businesses to report and remit sales and use taxes. This form is essential for ensuring compliance with state tax laws, allowing businesses to accurately declare the sales tax collected from customers and any use tax owed on purchases made without sales tax. The ST-455 form is typically used by various entities, including retailers, wholesalers, and service providers, to maintain transparency in their tax obligations.

Steps to Complete the State Sales And Use Tax Return

Completing the ST-455 form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary financial records, including sales receipts and purchase invoices.

- Calculate the total sales made during the reporting period, including taxable and non-taxable sales.

- Determine the total amount of sales tax collected from customers.

- Calculate any use tax owed on items purchased without sales tax.

- Fill out the ST-455 form with the gathered information, ensuring all fields are accurately completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any payment due to the South Carolina Department of Revenue.

Key Elements of the State Sales And Use Tax Return

The ST-455 form includes several critical elements that businesses must complete to ensure proper reporting. Key sections of the form typically include:

- Total Sales: The total gross sales for the reporting period.

- Sales Tax Collected: The total amount of sales tax collected from customers.

- Use Tax: Any use tax owed on taxable purchases made without sales tax.

- Exemptions: Details of any exempt sales that may reduce the total tax liability.

- Signature: The signature of the authorized person certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Timely filing of the ST-455 form is crucial to avoid penalties. The South Carolina Department of Revenue typically sets specific deadlines based on the reporting period. Businesses should be aware of the following important dates:

- Monthly filers: Due on the 20th of the month following the reporting period.

- Quarterly filers: Due on the 20th of the month following the end of the quarter.

- Annual filers: Due on January 20 of the year following the reporting period.

Legal Use of the State Sales And Use Tax Return

The ST-455 form serves as a legal document for reporting sales and use taxes in South Carolina. Proper completion and submission of this form are essential for compliance with state tax laws. It is important for businesses to understand that failure to file the ST-455 form accurately and on time can result in penalties, interest, and potential legal consequences. The form also plays a vital role in maintaining accurate tax records, which can be beneficial during audits or reviews by the tax authorities.

Form Submission Methods

Businesses have multiple options for submitting the ST-455 form to the South Carolina Department of Revenue. These methods include:

- Online Submission: Many businesses opt to file electronically through the Department of Revenue's online portal, which can streamline the process and provide immediate confirmation of submission.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Businesses may also choose to submit the form in person at local Department of Revenue offices, ensuring direct handling of their submission.

Quick guide on how to complete state sales and use tax return south carolina department of

Complete State Sales And Use Tax Return South Carolina Department Of effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without hindrances. Manage State Sales And Use Tax Return South Carolina Department Of on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign State Sales And Use Tax Return South Carolina Department Of without any hassle

- Locate State Sales And Use Tax Return South Carolina Department Of and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign State Sales And Use Tax Return South Carolina Department Of and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state sales and use tax return south carolina department of

Create this form in 5 minutes!

How to create an eSignature for the state sales and use tax return south carolina department of

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is SC ST 455 and how does it relate to airSlate SignNow?

SC ST 455 is a classification for various electronic signature solutions. AirSlate SignNow offers a user-friendly interface that aligns with SC ST 455 requirements, ensuring compliance and ease of use for businesses seeking efficient document signing.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow provides various pricing tiers to accommodate any business size. Plans cater to different needs while ensuring compliance with SC ST 455 standards, allowing users to choose a solution that fits both their budget and functional requirements.

-

What features does airSlate SignNow offer to support SC ST 455 compliance?

AirSlate SignNow includes features like customizable templates, document tracking, and secure cloud storage, all designed to support SC ST 455 compliance. These capabilities help businesses streamline their document workflows while adhering to relevant legal standards.

-

How can airSlate SignNow improve business efficiency?

By utilizing airSlate SignNow, businesses can signNowly enhance their efficiency by automating the document signing process. The platform is designed to meet SC ST 455 benchmarks, allowing for faster turnaround times and improved productivity across teams.

-

Does airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, enhancing its functionality. These integrations help businesses comply with SC ST 455 while connecting necessary tools for a streamlined experience.

-

What are the benefits of using airSlate SignNow over traditional signing methods?

Using airSlate SignNow over traditional signing methods benefits businesses by reducing paper waste and turnaround time. This digital solution aligns with SC ST 455, ensuring that documents are securely signed and easily accessible.

-

Is airSlate SignNow suitable for small businesses?

Absolutely, airSlate SignNow is designed to be cost-effective and user-friendly for small businesses. The platform's compliance with SC ST 455 makes it a reliable choice for small enterprises looking to simplify their document workflows.

Get more for State Sales And Use Tax Return South Carolina Department Of

Find out other State Sales And Use Tax Return South Carolina Department Of

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online