Ct 1040nrpy Form 2021

What is the Ct 1040nrpy Form

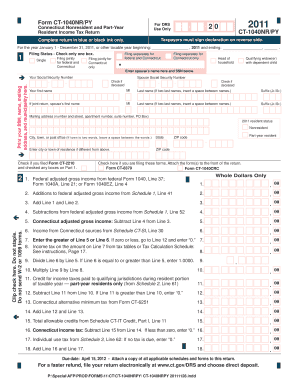

The Ct 1040nrpy Form is a tax document specifically designed for non-resident individuals who earn income in Connecticut. This form is essential for reporting income and calculating any taxes owed to the state. It is important for those who do not meet the residency requirements but have financial ties to Connecticut, ensuring compliance with state tax laws.

How to use the Ct 1040nrpy Form

Using the Ct 1040nrpy Form involves several key steps. First, gather all necessary financial documents, including W-2s and 1099s, that detail your income. Next, accurately fill out the form, ensuring that all income sources are reported. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority. Utilizing digital tools can simplify this process, allowing for easier completion and submission.

Steps to complete the Ct 1040nrpy Form

Completing the Ct 1040nrpy Form requires careful attention to detail. Follow these steps:

- Collect all relevant income documentation.

- Fill out personal information, including your name and address.

- Report all sources of income accurately.

- Calculate your taxable income and any deductions.

- Determine the tax amount owed or any refund due.

- Sign and date the form before submission.

Legal use of the Ct 1040nrpy Form

The legal use of the Ct 1040nrpy Form is critical for ensuring compliance with Connecticut tax laws. Filing this form accurately protects individuals from potential penalties and legal issues. It is recognized by the state as a valid method for reporting income and fulfilling tax obligations, provided that all information is truthful and complete.

Filing Deadlines / Important Dates

Timely filing of the Ct 1040nrpy Form is essential to avoid penalties. Typically, the deadline aligns with the federal tax filing date, which is April fifteenth. However, it is advisable to check for any specific state extensions or changes that may apply. Being aware of these deadlines helps ensure compliance and avoids unnecessary complications.

Required Documents

To complete the Ct 1040nrpy Form, several documents are necessary. These include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits you plan to claim.

- Identification information, such as Social Security numbers.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1040nrpy Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing the completed form to the designated state tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete ct 1040nrpy form

Finish Ct 1040nrpy Form effortlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to generate, amend, and electronically sign your documents swiftly without interruptions. Handle Ct 1040nrpy Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to alter and electronically sign Ct 1040nrpy Form with ease

- Locate Ct 1040nrpy Form and click Get Form to begin.

- Use the features we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and electronically sign Ct 1040nrpy Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040nrpy form

Create this form in 5 minutes!

How to create an eSignature for the ct 1040nrpy form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct 1040nrpy Form?

The Ct 1040nrpy Form is a tax form used by non-resident individuals who earn income in Connecticut. This form allows you to report your income and calculate the appropriate state taxes. Understanding how to complete the Ct 1040nrpy Form is essential for compliance and can save you from potential fines.

-

How does airSlate SignNow help with filling out the Ct 1040nrpy Form?

airSlate SignNow provides a user-friendly platform to electronically sign and send your Ct 1040nrpy Form. With templates and customizable fields, you can quickly fill out this tax form without the hassle of printing. The streamlined process ensures accuracy and efficiency for your tax submissions.

-

Is there a cost associated with using airSlate SignNow for the Ct 1040nrpy Form?

Using airSlate SignNow offers various pricing plans that cater to different business needs. While there is a subscription fee, the platform provides a cost-effective solution for managing important documents like the Ct 1040nrpy Form. Sign up for a trial to explore the features without commitment.

-

What features does airSlate SignNow offer for the Ct 1040nrpy Form?

airSlate SignNow includes features such as reusable templates, digital signatures, and collaboration tools specifically for documents like the Ct 1040nrpy Form. These tools enhance productivity and simplify the document management process, ensuring that you can complete your tax form with ease.

-

Can I integrate airSlate SignNow with other software for the Ct 1040nrpy Form?

Yes, airSlate SignNow seamlessly integrates with a variety of popular software solutions such as Google Drive, Dropbox, and various CRMs. This integration allows you to manage your Ct 1040nrpy Form alongside your other business documents efficiently. Streamlining your workflow helps save time and improve organization.

-

What are the benefits of using airSlate SignNow for tax forms like Ct 1040nrpy?

The primary benefit of using airSlate SignNow for your Ct 1040nrpy Form is the enhanced efficiency it provides through electronic signing and document management. Additionally, the ability to securely store and access your tax documents online adds to your peace of mind. Save time and ensure accuracy with a digital solution designed for modern business needs.

-

How secure is airSlate SignNow when handling the Ct 1040nrpy Form?

airSlate SignNow employs state-of-the-art security measures, including encryption and secure cloud storage, to protect your documents like the Ct 1040nrpy Form. Your sensitive information is kept safe from unauthorized access, allowing you to focus on completing your tax obligations. Trust in our secure platform for your document management needs.

Get more for Ct 1040nrpy Form

- Utero license form

- Raymond james transfer on death form

- Form 9 transboundary movement

- South carolina certificate of religious exemption from form

- How fill up mva certification of insurance to operate vehicle form

- Muscogee creek nation clothing application 2014 form

- 2013 instructions for form 8801 internal revenue service irs

- The apma hipaa privacy manual 2013 revision sickfootcom form

Find out other Ct 1040nrpy Form

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later