Connecticut Form CT 1040NR PY NonresidentPart Year 2021

What is the Connecticut Form CT 1040NR PY Nonresident Part Year

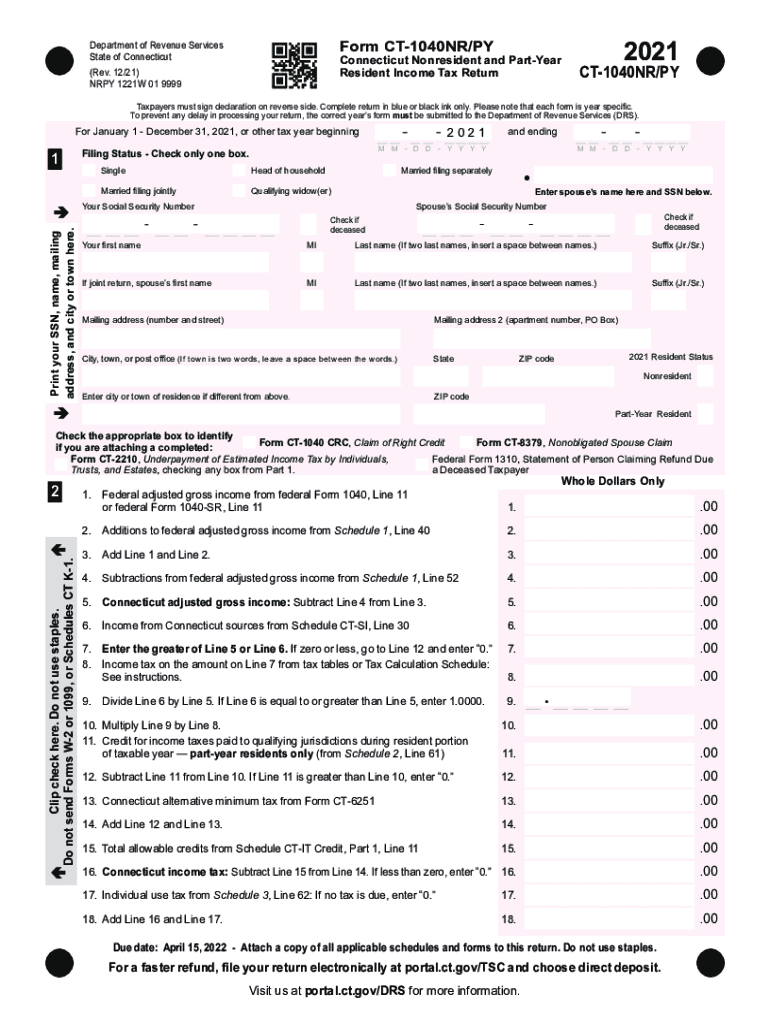

The Connecticut Form CT 1040NR PY is designed for individuals who are nonresidents or part-year residents of Connecticut. This form is essential for reporting income earned within the state during the tax year. Nonresidents are individuals who do not maintain a permanent residence in Connecticut but may have earned income from Connecticut sources. Part-year residents are those who have lived in the state for part of the year, and they must report their income based on the time spent as a resident. Understanding the distinctions between these classifications is crucial for accurate tax reporting.

Steps to Complete the Connecticut Form CT 1040NR PY Nonresident Part Year

Completing the Connecticut Form CT 1040NR PY involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Determine your residency status and the period you were a resident of Connecticut.

- Calculate your total income earned during the year, including any Connecticut-source income.

- Fill out the form by entering your personal information, income details, and any applicable deductions.

- Review the completed form for accuracy and ensure all required fields are filled.

- Sign and date the form before submission.

Legal Use of the Connecticut Form CT 1040NR PY Nonresident Part Year

The Connecticut Form CT 1040NR PY holds legal significance as it is used to report income to the state and determine tax liability. To ensure legal compliance, it is important to accurately report all income and claim any deductions or credits for which you may be eligible. Failure to file this form correctly can result in penalties or legal repercussions. Utilizing a reliable e-signature solution can enhance the legitimacy of your submission by ensuring that your signature is securely captured and verifiable.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Form CT 1040NR PY are critical to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For the 2018 tax year, this means the form must be submitted by April 15, 2019. Taxpayers should also be aware of any extensions that may be available, which can provide additional time to file without incurring penalties.

Required Documents

To complete the Connecticut Form CT 1040NR PY, several documents are necessary:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting other income such as freelance work or interest.

- Records of any deductions or credits you plan to claim.

- Proof of residency status, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Connecticut Form CT 1040NR PY can be submitted through various methods. Taxpayers have the option to file online through the Connecticut Department of Revenue Services website, which provides a secure platform for electronic submissions. Alternatively, forms can be mailed to the appropriate address listed on the form. In-person submissions may also be possible at designated state offices. It is important to choose a submission method that aligns with your preferences and ensures timely processing.

Quick guide on how to complete connecticut form ct 1040nr py nonresidentpart year

Complete Connecticut Form CT 1040NR PY NonresidentPart Year effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and electronically sign your documents rapidly without delays. Manage Connecticut Form CT 1040NR PY NonresidentPart Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Connecticut Form CT 1040NR PY NonresidentPart Year with ease

- Find Connecticut Form CT 1040NR PY NonresidentPart Year and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to store your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Connecticut Form CT 1040NR PY NonresidentPart Year to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut form ct 1040nr py nonresidentpart year

Create this form in 5 minutes!

People also ask

-

What is the 2018 Connecticut Form Tax?

The 2018 Connecticut Form Tax refers to the state tax forms that residents and businesses in Connecticut must file for the tax year 2018. This form captures various income details and deductions applicable under Connecticut tax law. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with filing the 2018 Connecticut Form Tax?

airSlate SignNow provides an easy-to-use platform that allows you to eSign and send necessary documents for the 2018 Connecticut Form Tax quickly. Our solution streamlines the process, enabling you to keep your documents organized and securely signed. This means you can focus more on your tax strategy rather than on paperwork.

-

What are the pricing options for using airSlate SignNow for my 2018 Connecticut Form Tax needs?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling the 2018 Connecticut Form Tax and beyond. Our plans are competitive, providing an affordable solution for eSigning documents without compromising on features. You can choose from monthly or annual subscriptions to fit your budget.

-

Are there any additional features in airSlate SignNow that assist with the 2018 Connecticut Form Tax?

Yes, airSlate SignNow comes with several features designed to simplify your workflow for the 2018 Connecticut Form Tax. These include customizable templates, real-time tracking of document status, and cloud storage integration. These features enhance efficiency while ensuring compliance and proper documentation.

-

Is airSlate SignNow secure for eSigning documents related to the 2018 Connecticut Form Tax?

Absolutely! airSlate SignNow prioritizes security, offering bank-level encryption for all documents, including those related to the 2018 Connecticut Form Tax. Our platform ensures that your sensitive tax information remains protected throughout the signing process. You can eSign with confidence knowing that your data is secure.

-

Can airSlate SignNow integrate with other software for managing the 2018 Connecticut Form Tax?

Yes, airSlate SignNow seamlessly integrates with various software applications essential for managing the 2018 Connecticut Form Tax. This integration includes accounting software, document management systems, and CRM platforms, enabling a cohesive workflow. These integrations ensure that all your tax-related documents are organized and accessible.

-

What are the benefits of using airSlate SignNow for the 2018 Connecticut Form Tax?

Using airSlate SignNow for the 2018 Connecticut Form Tax offers numerous benefits, including increased efficiency, time savings, and a more organized document workflow. The platform allows for quick eSigning and document delivery, which can expedite the tax filing process. Ultimately, it reduces paperwork and enhances your tax management experience.

Get more for Connecticut Form CT 1040NR PY NonresidentPart Year

- Assignment of mortgage by individual mortgage holder new hampshire form

- Nh notice form

- Assignment of mortgage by corporate mortgage holder new hampshire form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property new hampshire form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497318694 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property new hampshire form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential new hampshire form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property new hampshire form

Find out other Connecticut Form CT 1040NR PY NonresidentPart Year

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple